CoreLogic Home Value Index shows growth easing in most regions as new listings rise - CoreLogic

Contact

CoreLogic Home Value Index shows growth easing in most regions as new listings rise - CoreLogic

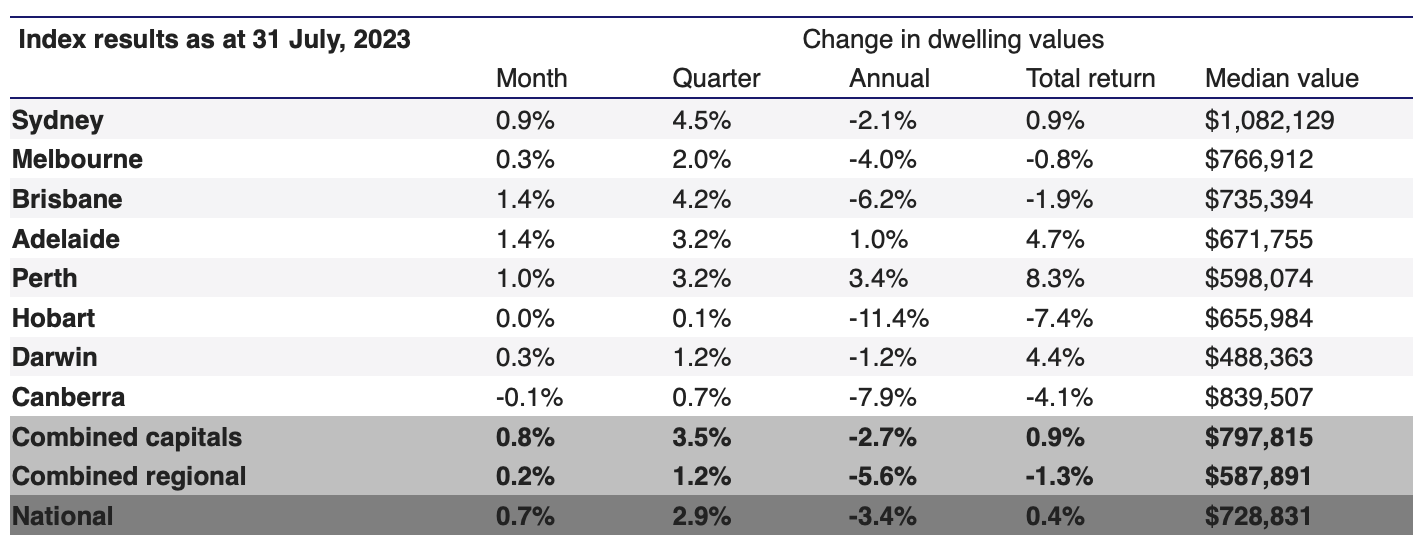

CoreLogic’s national Home Value Index (HVI) rose 0.7% in July marking a fifth consecutive month of housing value recovery. Since finding a floor in February, the national HVI is up 4.1%, following a -9.1% decline from record highs in April 2022.

Nationally, home values remain -5.3% below the April 2022 peak, with only Perth, Adelaide and Regional South Australia recording a new cyclical high in dwelling values through July. While housing values are continuing to record a broad based rise, the rate of growth has lost momentum over the past two months, slowing from 1.2% in May.

CoreLogic Research Director, Tim Lawless, noted the most substantial reduction in growth has occurred in Sydney.

“After leading the upswing, the monthly pace of growth in Sydney housing values has halved from a recent high of 1.8% in May to 0.9% in July. Sydney has also seen a significant rise in the number of fresh listings added to the market, 9.9% higher than the same time last year and 18.0% above the previous five-year average. An increased flow of new listings provides more choice and may be working to reduce some of the urgency felt among prospective buyers,” he said.

Brisbane and Adelaide saw the monthly pace of growth accelerate in July, leading the pace of gains across the capitals with housing values up 1.4% across both cities. Although the trend in new listings has risen in these cities, Mr Lawless said the number remains well below levels from a year ago and the previous five-year average.

Canberra was the only capital city to record a decline in values in July, down -0.1%, while Hobart values were unchanged.

The slowdown in value growth has mostly been driven by an easing in gains across the upper quartile of the market. While growth in the upper quartile of the combined capitals index diminished from 1.8% in May to 0.7% in July, the lower quartile (1.0%) and broad middle of the market (0.9%) remained resilient in July, following a smaller, but more consistent rate of growth over previous months.

“Some resilience in growth across the middle and more affordable end of the market aligns with housing finance data which has shown a stronger bounce back in the value of lending to first home buyers and investors over recent months,” Mr Lawless said.

“These segments tend to be more active across the middle to lower end of the pricing range where competition to purchase a home may be more intense.

“Premium housing markets tend to lead the cycles, so the slowdown in the pace of growth could be a sign of a broader easing in the pace of growth over the coming months.”

Regional values continued to lag behind the capitals with the combined regionals index rising 0.2% in July compared with a 0.8% increase across the combined capitals index. Every rest-of-state region recorded a smaller change in dwelling values through July relative to the capital city, reflecting milder housing demand across regional Australia as demographic patterns normalise.

The largest rise in regional housing values over the three months ending July (based on SA4 regions) has been the Gold Coast (4.0%), the South East region of Tasmania (3.1%), and the Newcastle/Lake Macquarie region (3.0%). On the flipside, the weakest conditions over the rolling quarter were confined to areas of Regional Victoria, with Bendigo (-3.7%) recording the largest decline, followed by Shepparton (-2.3%) and the Warrnambool/South West region (-2.3%).