Auction bidding now at its strongest level since February 2022

Contact

Auction bidding now at its strongest level since February 2022

According to Nerida Conisbee, Ray White Chief Economist, there are a lot of ways you can look at demand for property.

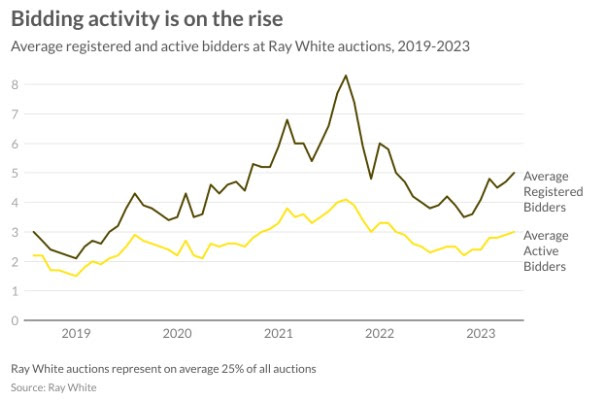

Early on in the upturn there was a lot of talk about the return of price growth being a “dead cat bounce”. That is, there were some predicting that there would be a short uptick in prices before they came crashing down. Based on our auction data, particularly bidding activity, we could see that conditions really started to turn at the end of last year and the momentum in price growth was not a “dead cat bounce” but an earlier than expected return to growth.

There are a lot of ways you can look at demand for property. You can look at housing finance, population growth and even online clicks. Bidding at auction however gives us a real time measure of activity. If someone actually bids on a property, you can be reasonably assured that they are in the market and ready to buy.

Last year, average active bidders nationally hit a low of 2.2 in November 2022. This was the lowest level since April 2020, the first full month of the pandemic. At a more localised level, the trough occurred much earlier in Sydney where it hit a low in June 2022. Sydney average active bidding is now back to where it was in November 2021.

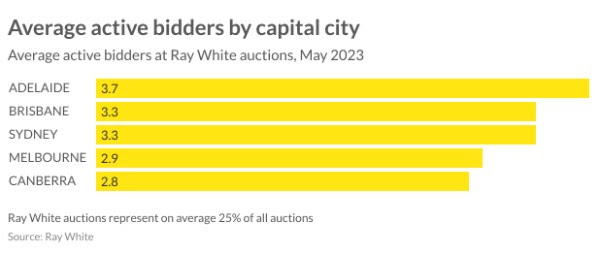

The city with the most active bidding is Adelaide. Adelaide barely had a downturn last year and house prices are now back to their 2022 peaks. In May, average active bidding hit 3.7. All cities however are continuing to show a steady increase in bidding activity.

This month, it will be interesting to see if the latest interest rate rise will slow the market. Auction numbers are slowly on the increase, as is the number of listing authorities (properties signed to Ray White but not yet advertised). It may be that more stock on market calms pricing and bidding activity.