Listing numbers fall again as older listings are sitting slightly longer on the market - Ray White Research

Contact

Listing numbers fall again as older listings are sitting slightly longer on the market - Ray White Research

So what is putting downward pressure on listings? Inflation and interest rate uncertainty, but new vendors are also contending with a log jam of old listings. For over a year, listings have sat slightly longer on the market, allowing more to sit on listings sites for longer says William Clark, Ray White Data Analyst.

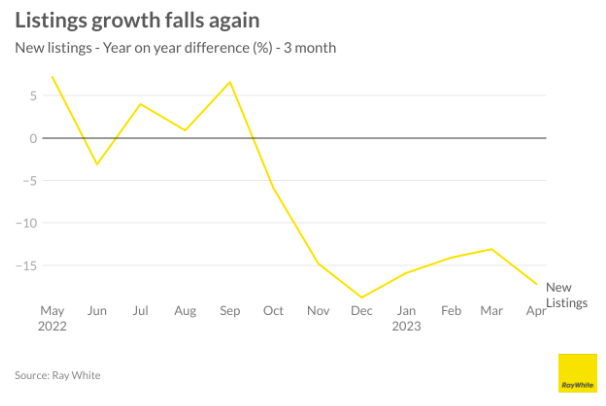

This month sellers across Australia took a wait-and-see approach with respect to price growth, inflation uncertainty and interest rates. We saw inflation fall to a quarterly rate of 1.4 per cent, which translates to a 5.4 per cent annualised rate should inflation stay at the current level. Prices fell slightly across Australia, and this has not been welcome news among Australia’s sellers, with a 17.1 per cent fall in the three months to April against the same period last year.

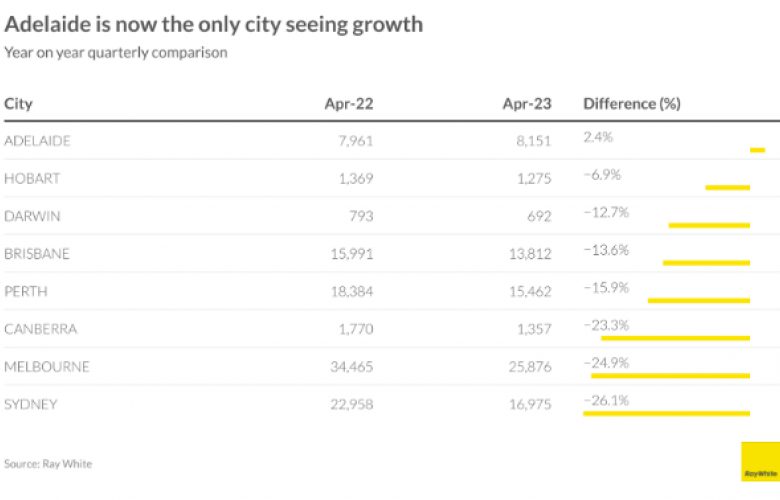

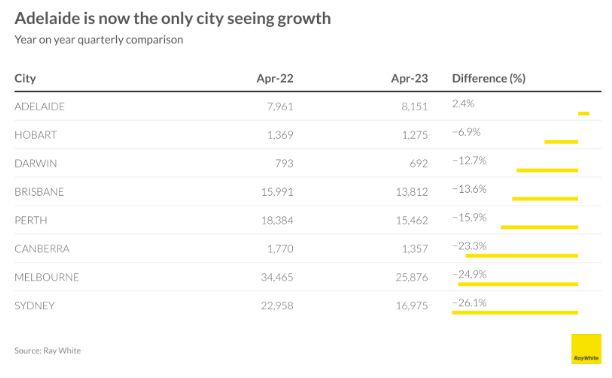

Across the capitals, Sydney, Canberra and Melbourne are still well down on the same month last year. Brisbane, Darwin and Perth again saw more moderate losses in listings, with Hobart now also seeing losses. Adelaide remains as the only city seeing an increase to listings at this time last year.

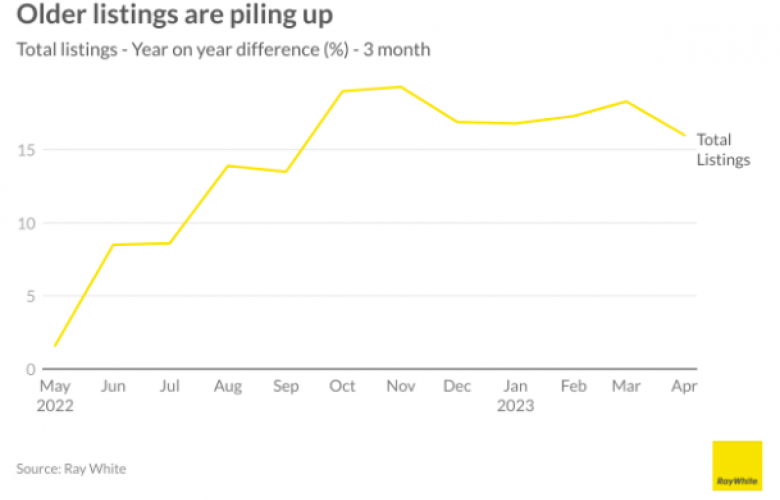

So what is putting downward pressure on listings? Inflation and interest rate uncertainty, but new vendors are also contending with a log jam of old listings. For over a year, listings have sat slightly longer on the market, allowing more to sit on listings sites for longer. Below is a tally of this, and we see the opposite trend for older listings, with an increase year-on-year.

By William Clark, Ray White Data Analyst.

Related Reading:

Price growth takes a breather, but not everywhere says Ray White Chief Economist

CoreLogic Home Value Index: Further evidence Australia’s housing downturn is over says CoreLogic