John McGrath – End-of-Year Wrap: Pandemic delivers widespread property wealth

Contact

John McGrath – End-of-Year Wrap: Pandemic delivers widespread property wealth

John McGrath founder and executive director of McGrath Estate Agents looks back at 2021 and what the property market did during this unexpectedly tumultuous year.

We started 2021 with hope and optimism, thinking newly-approved vaccines around the world would convert the COVID-19 pandemic into a manageable health issue that we could live with.

But issues around the roll-out, supply delays and rare side effects associated with both AstraZeneca and Pfizer vaccines made us nervous, and then along came Delta to delay the global recovery by a good six months.

What did the property market do during this unexpectedly tumultuous second year of the pandemic? It went up. Again. And by double digits in every area bar the regional Northern Territory.

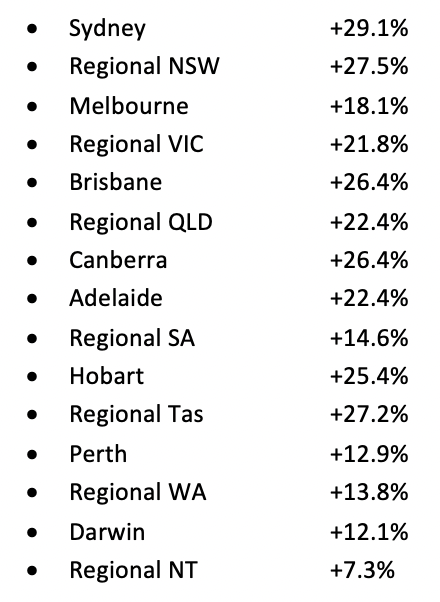

Here is the latest data from CoreLogic capturing house price growth from January 1 to November 30. The great thing is the surge in real estate wealth for homeowners everywhere – not just the cities.

Median house prices Jan 1 - Nov 30, 2021

Source: CoreLogic Hedonic Home Value Index, published December 1, 2021

As discussed in our McGrath Report 2022, home loans remain incredibly cheap and people are continuing to upgrade their homes whilst investors are returning to the market in droves.

More people are also continuing to depart the major East Coast cities for a new work-from-home lifestyle in the regions, where genuine housing affordability has made their lives so much easier.

This strong population trend has led to a record increase in house prices in Australia’s 25 largest non-capital city regions, according to a new CoreLogic report. In fact, 24 of them had double-digit growth.

Sales records over the 12 months to October 31, 2021 show the greatest growth in house prices occurred in the Southern Highlands and Shoalhaven region in NSW at 35.9%.

Next in line was the Richmond – Tweed region in northern NSW, which incorporates the ever-popular Byron Bay, with 32.8%. Queensland’s Sunshine Coast had similar growth at 32.3%.

Beachside is the common denominator with these locations, as well as their proximity to capital cities which provides easy commutability for work and visiting family and friends.

We now have the extraordinary situation of a few select regional locations being more expensive than the capital cities. The median house price in Byron Bay is $1.7 million compared to just over $1.3 million in Sydney.

Noosa’s median is $1.2 million compared to the mid-$700,000s in Brisbane.

Some experts note that the exodus from cities may result in the regions losing their affordability advantage. This may be the case in a small number of highly desirable coastal areas but there are plenty of affordable beach towns still available, along with snow areas, wine country and the bush.

The important thing is that being able to work from home is opening up Australia’s regions in a way we haven’t seen in decades. As local populations rise, more money gets spent locally and more services (and jobs) will naturally follow.

This is great for our country. We have one of the most concentrated populations in the world with more than 6 in 10 of us living in just 8 capital cities. It would be great to see more of the population dispersed so our national wealth can be shared more evenly between city and country.

Being able to work from home is actually providing an unexpected solution (for some workers) to the affordability problem we have in our big cities. It’s a very real social issue that a cohort of young people can’t afford to buy a home for themselves within reasonable proximity of their work.

There are many solutions to this problem but most require political will. Being able to work from home puts the choice to live outside the expensive capitals in the hands of individuals.

COVID-19 has reinforced the good fortune that we all have living in such a huge and somewhat remote country. Being able to remote work from anywhere is allowing more of us to enjoy everything our country has to offer. That’s a great silver lining for us.

The human race is an amazing collective of talent and inspiration. I know that together, we will help each other move through the tail end of this challenge and on to new and exciting beginnings.

Stay safe and I wish you and your friends and family a fantastic Christmas and holiday season.

The views expressed in this article are an opinion only and readers should rely on their independent advice in relation to such matters.

For more information including articles, checklists, guides and more visit McGrath’s Insights Centre.

Similar to this:

John McGrath – Is the market cooling?