Less than 10 weeks of listings remaining in WA’s property market

Contact

Less than 10 weeks of listings remaining in WA’s property market

As vaccination has become the national health priority with most of the country living under some form of lockdown, WA has weathered the pandemic well recording a budget surplus of $5.6billion and positive economic activity resulting in a positive but cautious residential property market.

Heading into Spring, WA is in a prime position for residential real estate whether you are a buyer, seller or investor Realmarks Managing Director, John Percudani provides an analysis of the current market conditions supported by the recently released CoreLogic data.

Evaluating CoreLogic's recent property market report*, demand and supply continue to be in tension with supply down by 28% in comparison to the long-term 5 year averages and demand up 60% on long term 5 year averages. Year on year demand is still up 50% and what this is leading to is a clearance rate that is faster than the marketplace norm. This leads to a supply pipeline in WA of less than 10 weeks (about 2 and a half months) of stock in the current residential market.

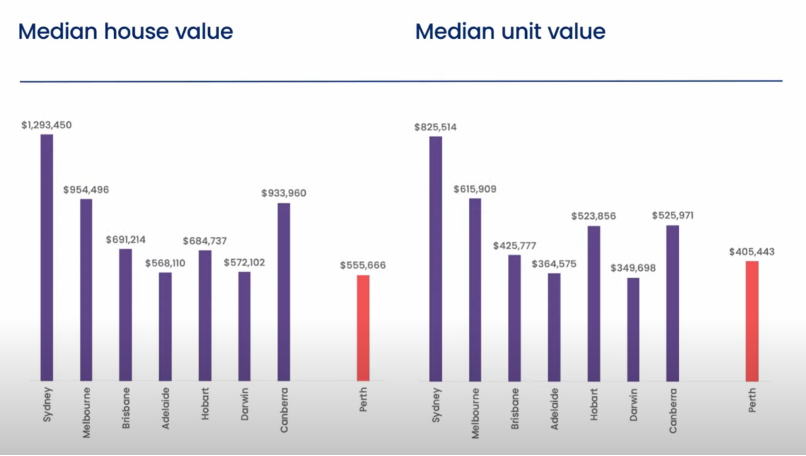

Despite market conditions, Perth housing values remain affordable compared with other national cities where the median house price is $555,000, the lowest of any capital city in Australia.

Because of this, prices continue to rise in WA but not across all markets. The price movement is leading to a challenge in affordability for housing in the market as WA remains attractive by comparison to other parts of Australia.

Rental Market

If we evaluate the rental market, this is a different market altogether as it appears to have reached some degree of stability and a healthy point between supply and demand. In fact, rental prices have appeared to have stabilized across many markets and sectors in WA.

Demand from tenants appear to be looking for the quality of properties with a preference of houses over apartments and a desire for longer-term leases where tenants are looking for more tenancy term security in the house they select.

The WA Economy

The WA economy is in a strong position by comparison to other parts of Australia. This is reinforced by the social conditions that we have in WA and a rise in confidence in relation to vaccination rates and other positive aspects within the state. All these factors are leading to a positive yet cautious sentiment in the marketplace and this is positively affecting the property market.

In addition to this, WA has excellent economic activity in terms of agriculture, mining, and the service sectors. WA has strong economic management by the State Government and the expectation of higher expenditure in the public sector. Employment conditions are steady resulting in a degree of security when people making an investment or purchase remain positive.

Mr Percudani said “The underlying theme of the market at present is the tension between supply and demand. Another question coming up is inflation and with increased expenditure and economic activity, whether inflation will start to rise. This is something to consider particularly if you are making an investment decision.”

Realmarks Evaluation

If you are a buyer, Mr Percudani explained that the challenging market conditions are set to continue well into 2022.

“Our advice to you as a buyer is to be well prepared before you enter into the market. Make sure you have clarity on what your buying capacity is, what your expectations are and when you choose to act, act with confidence and clarity and put your best offer forward.”

The key take away for investors is to act now “there is an opportunity if prices continue to rise, strong tenant demand, good rental situations with long-term security and the flight to quality assets are going to continue, investment properties will remain attractive.

“It may be in your best interest to retain your existing property or consolidate your investment or if you have the ability to enter into the property market as an investor at this time you will be taking advantage of ideal market conditions and getting ahead of the curve” states Mr Percudani.

If you are a seller these are ideal times to bring your property to market.

“If you are considering presenting your property in the market, you need to be considerate towards buyer stresses and therefore you might need to have some flexibility around settlement dates, subject to sale conditions and other elements to accommodate buyers in the current market” said Mr Percudani.

If you are looking to realise your asset as a buyer, these market conditions are in a great position. It's important to leverage favorable market conditions to maximise your price return and the conditions relative to your sale.

“A cautious approach to marketing your property and appointing a structured selling method will ensure you don’t just get a sale, but you get a premium sale which will be advantageous in this market. A sale is assured at this time however the key is having an agent with the skill to ensure you do not risk underselling ” said Mr Percudani.

So whether you are in investor, buyer or a seller, in todays market Realmark’s advice is to ask us and we will certainly give you the best advice in terms of marketing conditions, selling methodologies and other things to make sure you achieve the best result for your property and take advantage of the current climate.

Similar to this:

What’s in the water at Realmark?

Perth’s inner-city suburbs are a bargain compared to Sydney and Melbourne - REIWA