Proof is in the pudding - Why small management portfolios fail

Contact

Proof is in the pudding - Why small management portfolios fail

With the new financial year underway, it is interesting to analyse why the performance of small rent rolls continue to fail in line with previous financial years.

With the new financial year underway, it is interesting to analyse why the performance of small rent rolls continue to fail in line with previous financial years.

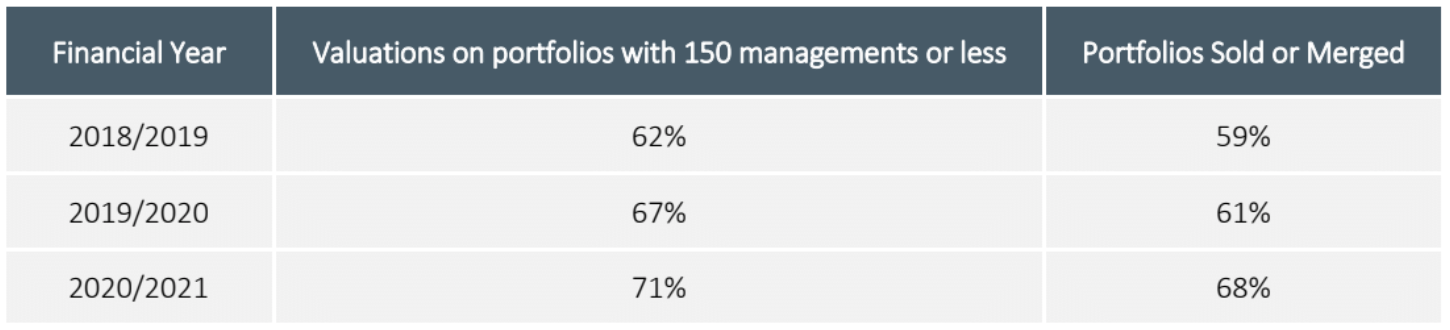

When comparing the rent roll valuations we completed over the past three financial years, it shows a consistent pattern:

These numbers provide clear and anecdotal support to the well-founded opinion that, in most cases but not all, small portfolios are unsustainable.

Most clients with small portfolios who undertake the valuation and ultimately sell their portfolio all have similar issues. The common threads are;

- They are sales orientated businesses with property management seen as an offshoot to their core business.

- Many have quite poor management systems and processes specific to tenant and landlord communication.

- Low to average management fees and ancillary fee collection.

- Highly stressed business owners with limited direct involvement in the day-to-day management of the portfolio.

- Take an active interest in property management only when required.

- Often are under financial duress.

- Have a limited understanding of how to address the natural churn inside the portfolio.

- Business operating costs are too high.

The industry is in a state of fluctuating fortunes right now. While property sale conditions have been rampant across much of the country, in many cases this has been at the expense of property management portfolios. Many clients have reported higher numbers of managed properties being sold by landlords to capitalise on market conditions, and others are reporting a high number of owners relocating.

With slower growth of investor activity, it means many portfolios are experiencing negative growth or at best neutral growth.

This downward spiral is more prevalent for portfolios under 150 managements. In many cases, the financial viability of small portfolios is coming to a close – and fast.

We expect to see a high number of small portfolios diminish in the market over the next twelve months at an accelerated pace with an increasing number of businesses consolidating.

Sustainability for management portfolios is now between 250 – 300 managements at a minimum.

The views expressed in this article are an opinion only and readers should rely on their independent advice in relation to such matters.

Similar to this: