Unpredictable vacancy rates the only constant for residential rental market - REINSW

Contact

Unpredictable vacancy rates the only constant for residential rental market - REINSW

The REINSW Vacancy Rate Survey results for February 2021 show that the residential rental market across New South Wales remains unpredictable.

The REINSW Vacancy Rate Survey results for February 2021 show that the residential rental market across New South Wales remains unpredictable.

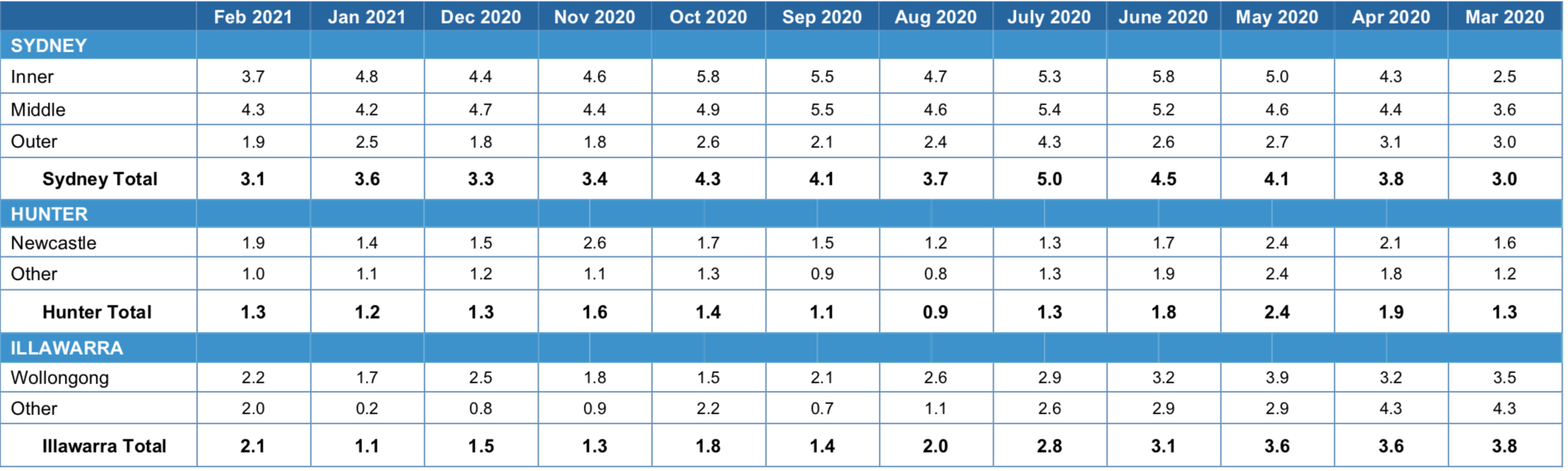

Vacancies for Sydney overall tightened last month and now sit at 3.1% (-0.5%).

“Sydney’s Inner Ring dropped to 3.7%, a decrease of 1.1% for the month,” REINSW CEO Tim McKibbin said. “Similarly, the Outer Ring dropped by 0.6% to 1.9%. Bucking the trend, the Middle Ring remained relatively stable, experiencing only a slight 0.1% rise to 4.3%.

“Some of this downward movement may be due to families making decisions to move ahead of the start of the new school year and university students converging on the city for another year of study.

However, if the last 12 months have taught us anything, it’s that the residential rental market remains unpredictable, moving up and down month after month.”

Outside Sydney, vacancy rates remained stable in the Hunter region, increasing by only 0.1% to be 1.3%. Vacancies in the Illawarra region also increased – rising to 2.1% (+1.0%).

Vacancy rates across much of the rest of regional New South Wales continue to remain extremely tight.

“Rates in the Albury, Central West, Murrumbidgee, New England, Northern Rivers and South East areas all dropped in February,” Mr McKibbin said. “Feedback from our members in these areas indicates that stock is extremely tight, as tenants continue to exit the Sydney residential rental market to secure a property that suits both their budget and desired lifestyle.”

The Central Coast, Coffs Harbour and Riverina areas remained stable in February, while Mid North Coast, Orana and South Coast each experienced a slight uptick in the availability of rental accommodation.

View the full REINSW Vacancy Rate Survey Results here.

Similar to this:

Sydney property values reach new record high - CoreLogic

REIA reports a rise in housing and rental prices across most of Australia

John McGrath – Synchronised growth in home values nationwide