Perth house price growth to lead the nation in 2021 CBRE

Contact

Perth house price growth to lead the nation in 2021 CBRE

CBRE 2021 Australia Real Estate Market Outlook Report predicts Perth residential market to be the nation’s front runner, with house prices expected to grow between 9%-12% and unit prices to lift 5%-7% in 2021. CBRE Head of Residential Research Craig Godber said Western Australia economic backdrop was supporting the robust growth forecasts.

CBRE 2021 Australia Real Estate Market Outlook Report predicts Perth residential market to be the nation’s front runner, with house prices expected to grow between 9%-12% and unit prices to lift 5%-7% in 2021. CBRE Head of Residential Research Craig Godber said Western Australia economic backdrop was supporting the robust growth forecasts.

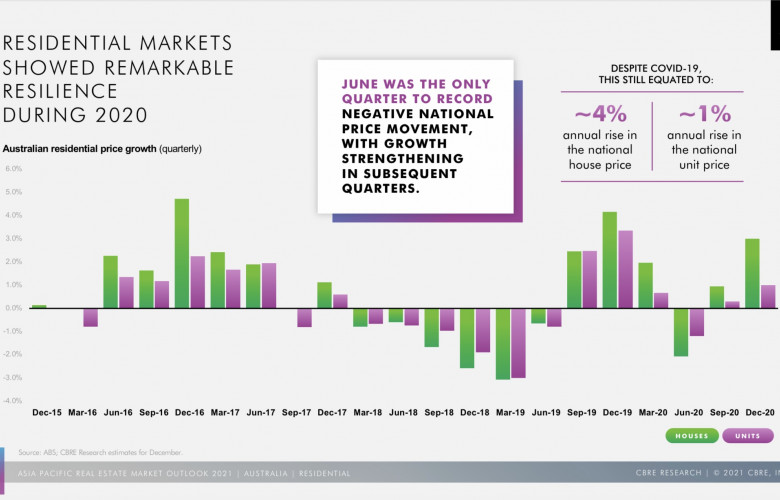

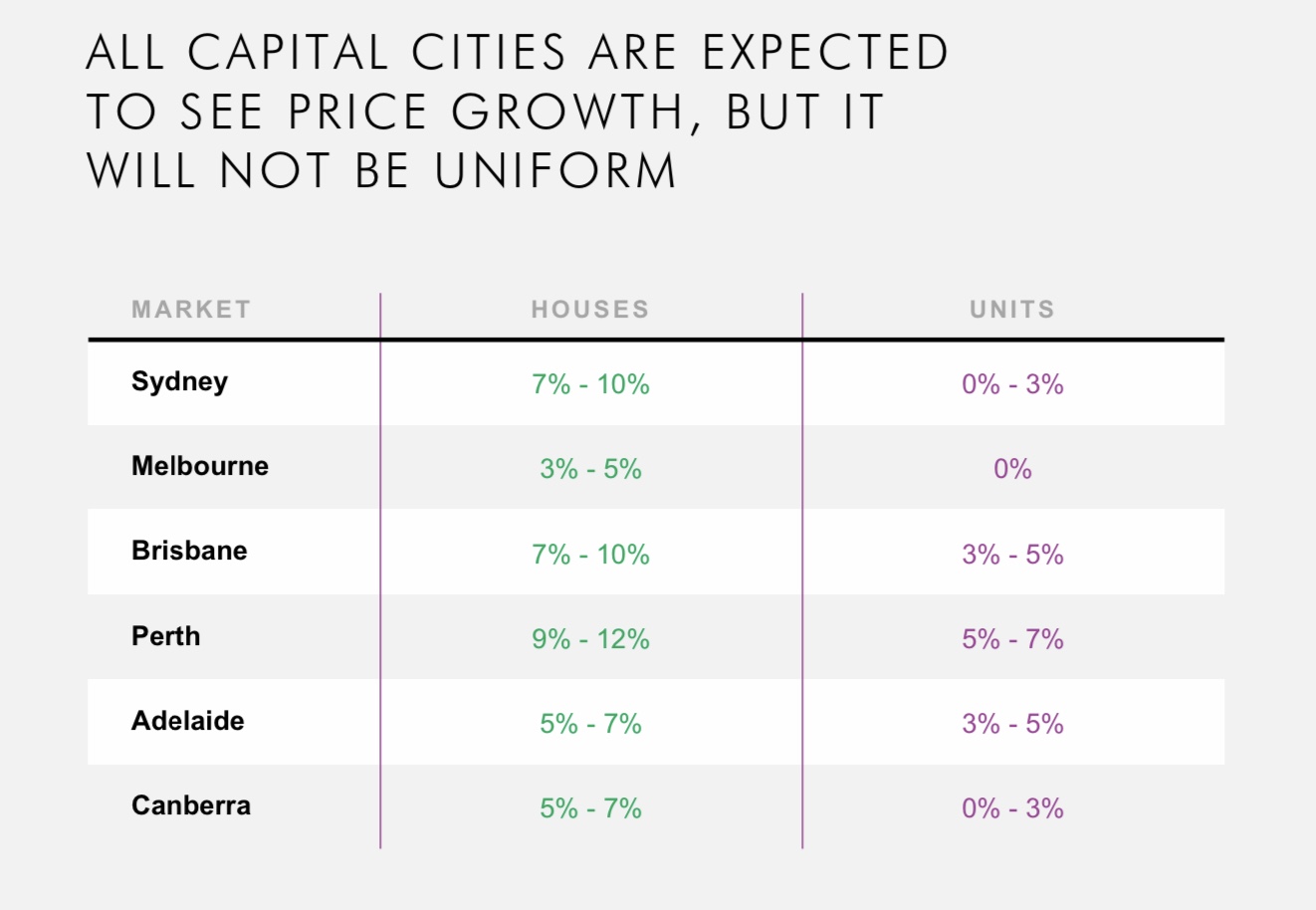

Perth’s residential market is on track to record double digit growth for the first time in 11 years – leading the nation’s housing recovery in 2021.

CBRE’s 2021 Australia Real Estate Market Outlook Report predicts Perth’s residential market to be the nation’s front runner, with house prices expected to grow between 9%-12% and unit prices to lift 5%-7% in 2021.

CBRE’s Head of Residential Research, Craig Godber, said Western Australia’s economic backdrop was supporting the robust growth forecasts.

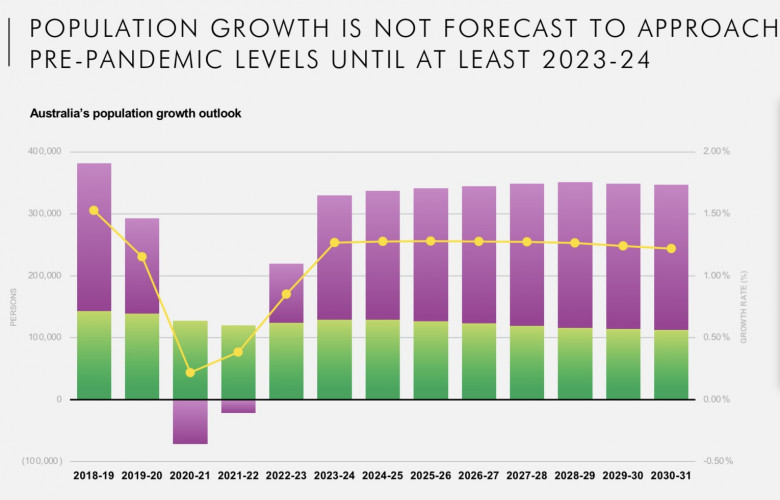

“A return to positive interstate migration, accompanied by a solid resources sector outlook, is helping propel Perth’s housing market recovery ahead of the nation. Federal Government incentives such as Homebuilder and additional State support packages are boosting the construction sector and further contributing to growing confidence in the market,” Mr Godber explained.

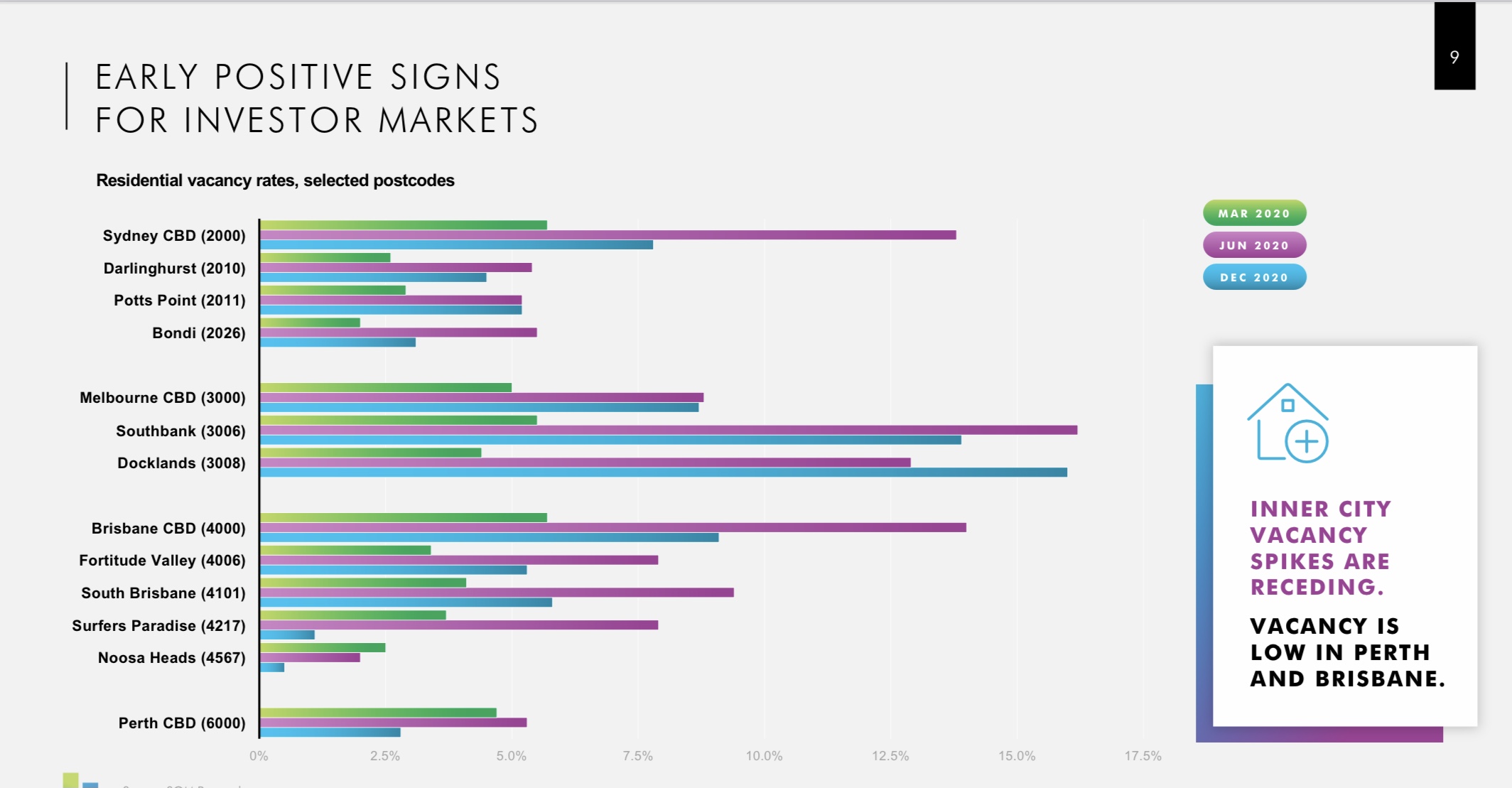

“Supply also remains tight, with vacancy already sub-1% which is leading to strong rental growth and providing attractive opportunities for investment in 2021.”

Sydney is expected to see house price growth of between 7%-10%, while units will experience a 0%-3% rise. Similarly, 7%-10% growth is forecast for Brisbane’s housing market and units are on track to record a 3%-5% value uplift.

The report predicts 5%-7% growth for both Adelaide and Canberra’s housing markets, with the former expecting a 3%-5% rise in unit prices and the latter tracking an uplift of 0%-3% for units.

A longer recovery is expected for Melbourne, with house prices expected to lift 3%-5% in 2021 and no increases for unit values.

Mr Godber said regional residential markets would be another standout performer in 2021, underlining the shift in demand for more affordable lifestyles.

“A significant preference shift has occurred – with the ability to work from home and lifestyle choices driving a shift towards regional markets and the smaller capitals,” Mr Godber said.

The report shows regional value growth outpaced metropolitan values in all states, except Western Australia, during 2020.

To request a copy of the CBRE Market Outlook 2021 please email Craig Godber Head of Research CBRE via the contact forms below.