CoreLogic Quarterly Economic Review: November quarter data reveals contributors to post-pandemic property recovery

Contact

CoreLogic Quarterly Economic Review: November quarter data reveals contributors to post-pandemic property recovery

Today CoreLogic releases its latest Quarterly Economic Review which unpacks the recent recovery trend in housing market values observed in the months to November 2020.

Nationally, housing market values did not see the large decline anticipated at the start of the COVID-19 pandemic. Housing values fell just 1.9% between March and September before moving into a recovery trend, increasing 0.4% nationally through October and 0.8% in November.

Eliza Owen, CoreLogic’s Head of Research Australia, says “Relative to previous housing market downturns, the current decline through to November seems relatively mild, with dwelling values just 0.7% below the pre-COVID levels. There are numerous factors which have contributed to the prevention of a larger downturn in dwelling values including the institutional, coordinated response to the pandemic, which have seen low borrowing costs, added incentives for first home buyers and the extension of mortgage repayment deferrals limiting forced sales.”

Despite an initial slump in housing finance through the beginning of the year due to the COVID-19 pandemic, the year to October saw a remarkable 14.5% lift in the volume of finance secured for the purchase of property, according to ABS lending indicators.

Ms Owen says “The post-COVID mortgage lending boost was driven by owner-occupiers including changeover buyers such as upsizers and downsizers, as well as buyers getting into the property market for the first time.

“Money lent to first home buyers saw the fastest growth rate at 35.1% in the year to October, accounting for 22.1% of lending, up from 18.8% in the year prior. Meanwhile, investor mortgage lending increased less than 1% in the same period. There are several factors that contributed to this growth in first home buyer activity, including generational trends, monetary and fiscal incentives and lower dwelling values and competition,” says Ms Owen.

Commentary by Eliza Owen on the key findings by State and Territory:

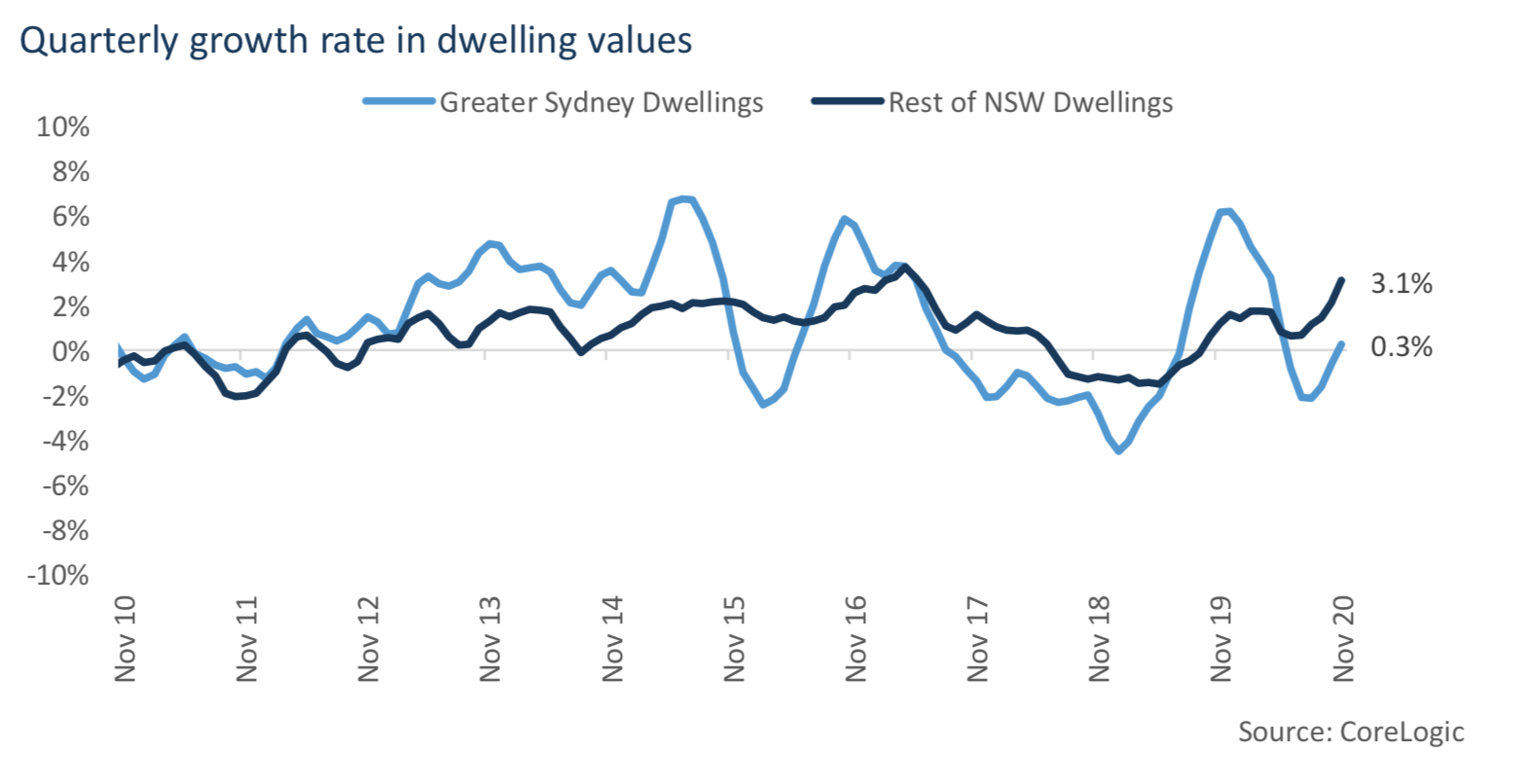

New South Wales:

Both Sydney and regional NSW were back into the upswing phase of the property cycle in the three months to November. Sydney dwelling values were up 0.3%, while regional values were up 3.1%. For regional NSW, this is the highest quarterly growth rate through 2017.

Indicators are showing the regional NSW dwelling market is still on the rise, despite the recession. Every regional market in NSW has seen an increase in dwelling values since March through to November. There were around 18,000 regional dwelling sales in the three months to November, up a remarkable 23.3% on the same period in 2019.

Looking forward to 2021, NSW dwelling markets are generally expected to remain in upswing, but pockets of the market are at risk of further decline. Demand is generally shifting from inner-city stock preferred by investors, to detached housing at the periphery of the metropolitan area, and in regional NSW.

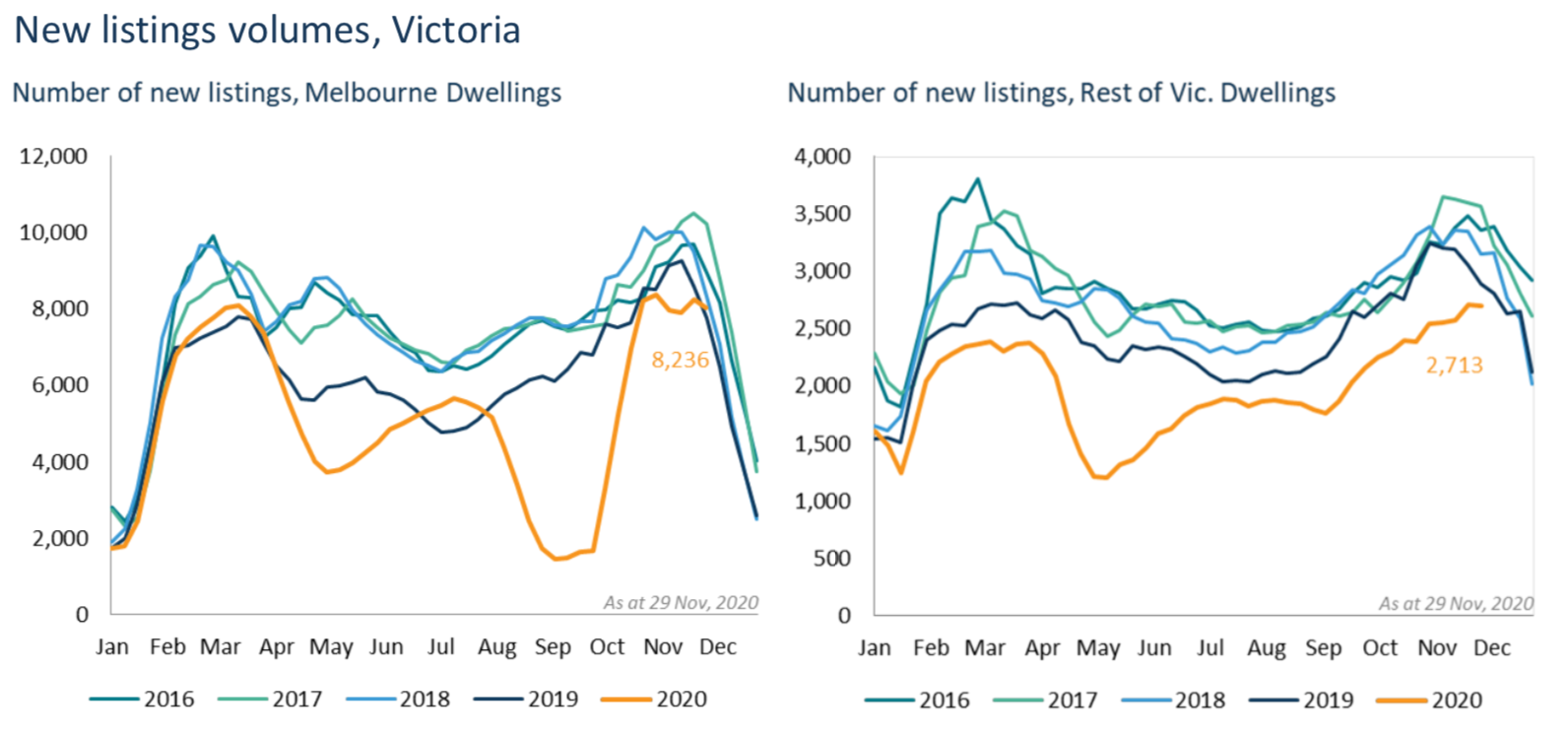

Victoria:

Through to November, there have been signs of an economic and property market uplift in Victoria. This follows a decline in Melbourne dwelling values, which are sitting 5.0% below the record high value reached in March 2020.

New listings across Melbourne rose from 2,756 in the month of September, to over 8,000 in November. Meanwhile, sales activity rose from 1,546 to an estimated 4,301. This means the increase in sales activity has not matched the big increase in stock on the market, which may have a dampening effect on the recovery of the Melbourne market.

The Melbourne rental market has been particularly impacted by the pandemic. This may also end up impacting property values, and CoreLogic data suggests larger dwelling value declines are correlated with declines in rent values.

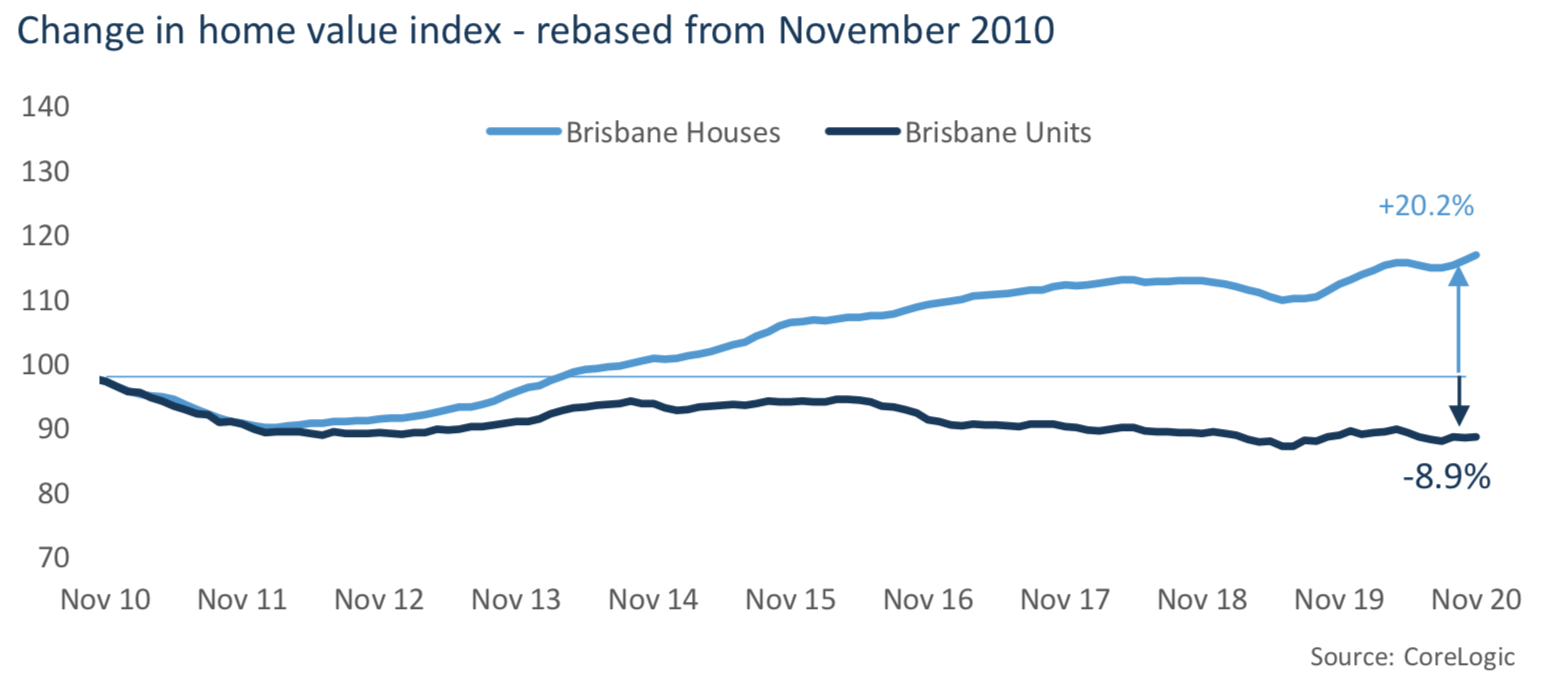

Queensland:

Across Brisbane, dwelling values have risen 0.9% from the onset of the pandemic in March through to November, with dwelling values now at a record high.

Despite the recent uplift in the dwelling market across Brisbane, unit values remain 8.9% lower over the decade.

Most Queensland dwelling markets are in upswing. Grouping Queensland into 19 sub-markets, 17 have seen dwelling value increases since the onset of COVID-19. The Brisbane Inner City and Brisbane West markets were the only dwelling markets to see a fall in values during the period.

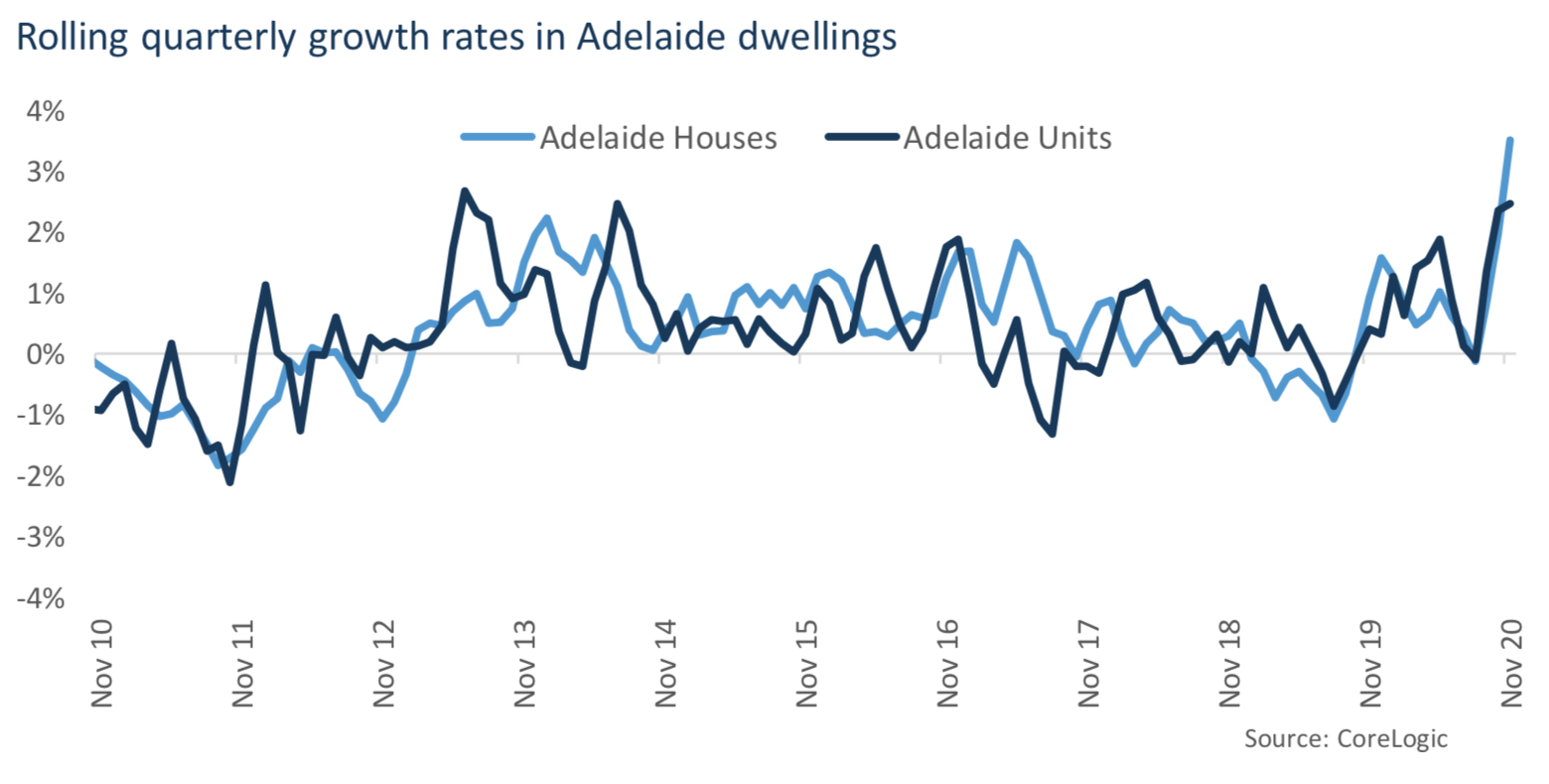

South Australia:

Like many of the smaller capital cities through COVID-19, Adelaide dwelling values avoided price declines. The combined value of the Adelaide dwelling market is 4.1% higher from March through to November, and dwelling values are currently at a record high.

In the three months to November, dwelling value increases were strongest across the North of Adelaide, where typical dwelling values were $378,705.

The rate of change in Adelaide dwelling values has historically been among the least volatile of the capital cities. But with momentum building across the market, quarterly growth rates have reached the highest level in ten years.

Western Australia:

Western Australia, in particular Perth, seems to be returning to an upswing phase of the property cycle, following a long correction in values, and a temporary interruption to the recovery through COVID-19.

In the year to November, house values in Perth increased 0.9%, while unit values increased a more modest 0.1%. For the entire Perth dwelling market, this is the first year-on-year increase in dwelling values in six years.

Perth has also seen the highest annual growth in rent values since the onset of COVID-19, with rent incomes up an incredible 8.2% in the year to November. This is likely to see property investor participation increase over 2021.

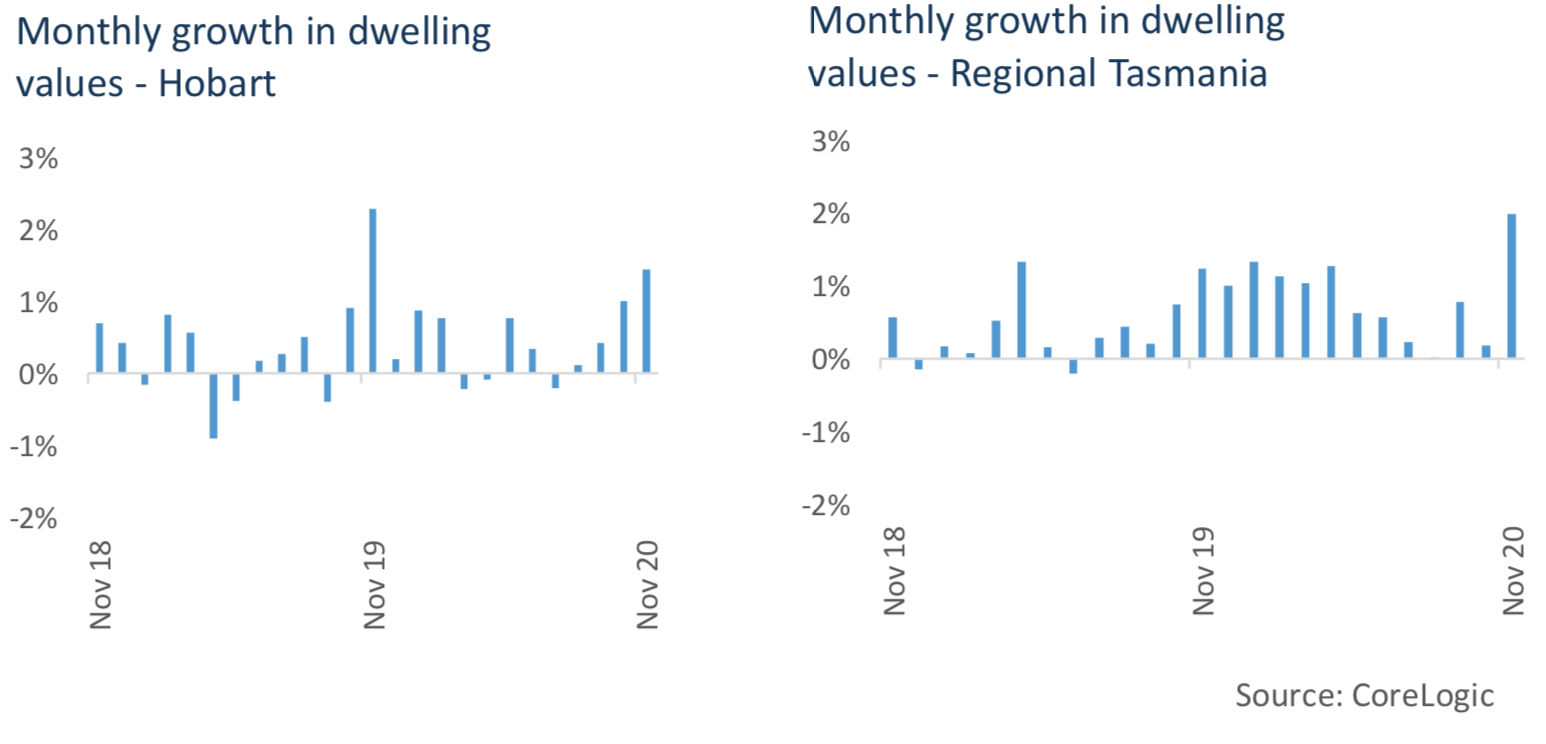

Tasmania:

The continued popularity of the Hobart market has seen median unit values also increase over the year, with Hobart now the fourth most expensive capital city unit market. The median unit value across Hobart was $414,966 at November.

Hobart dwelling values rose 3.9% from the end of March through to November, and regional Tasmanian dwelling values increased 5.8% in the same period, with both dwelling markets sitting at a record high in November.

Regional Tasmania has been supported by a ‘spillover’ of demand from the high-growth city of Hobart, with both dwelling markets sitting at a record high in November.

Gross rent yields for dwellings in Hobart declined a significant 40 basis points over the year to November, but at 4.6%, were still the second highest of the capital cities behind Darwin (6.0%).

Northern Territory:

After a long correction in NT property values, Darwin has seen the highest level of capital growth in dwelling values of the capital city markets from March through to November, increasing 5.8%.

Darwin dwelling values are still 27.4% below the record high in 2014.

Despite significant fluctuations in both rent and purchase prices, gross rent yields have remained remarkably steady since May 2014, fluctuating less than 1 percentage point. Gross rent yields in Darwin dwellings were 6.0% at November, the highest of the capital cities.

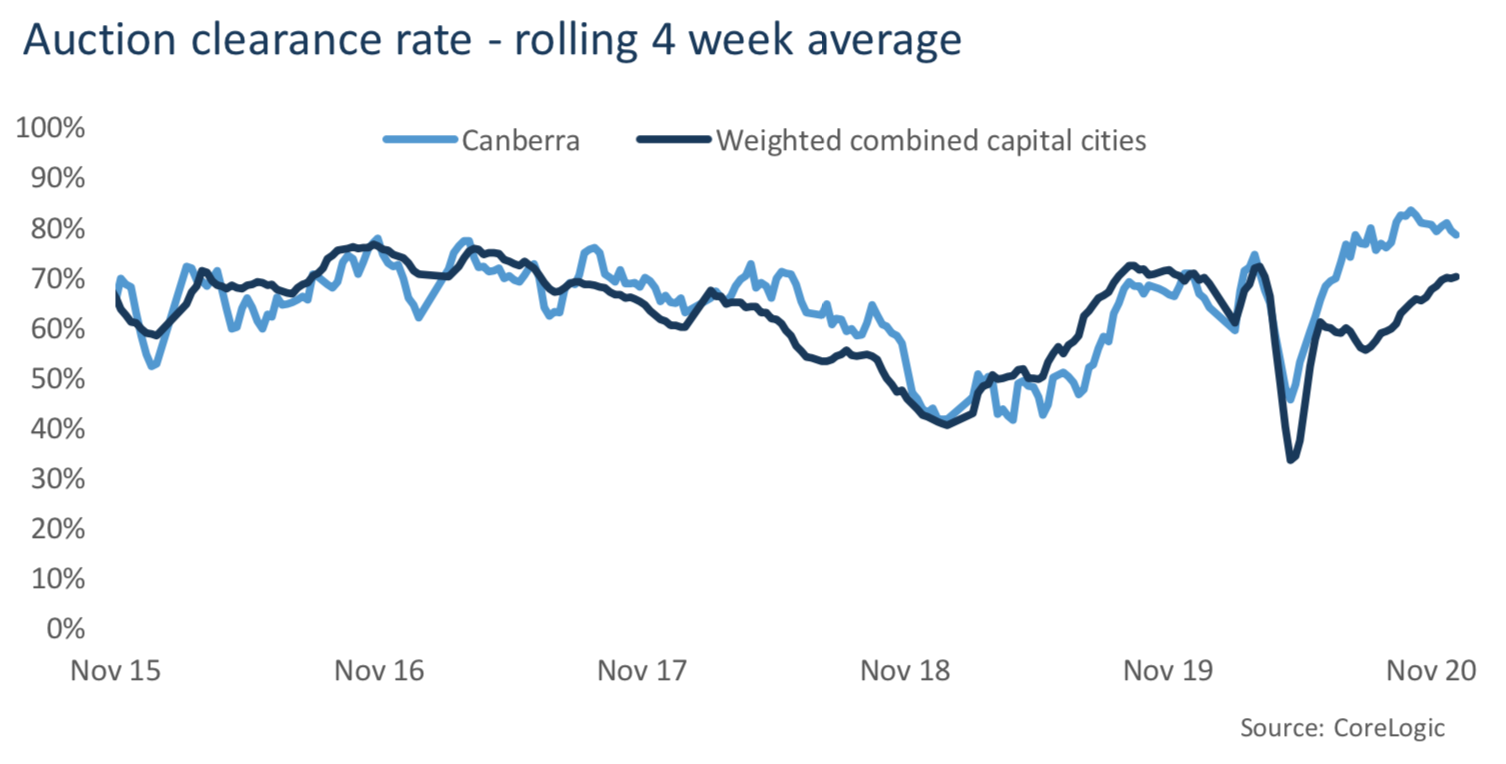

Australian Capital Territory:

Dwelling values across the ACT rose 3.3% in the three months to November, taking values 5.2% higher since the onset of stage two restrictions in March.

The combined ACT dwelling market has hit a fresh, record high value every month since September 2019.

Typical ACT dwelling values are the third most expensive of the capital city markets behind Sydney and Melbourne, but the third most ‘affordable’ behind Darwin and Perth, due to high local incomes in the Capital.

Continued price increases will lead to a deterioration of affordability across Australia’s Capital.

To download the full report or for more information about CoreLogic, visit www.corelogic.com.au.

Similar to this:

Rentals near the city getting cheaper: CoreLogic

John McGrath – End-of-Year Wrap: Prices Up in 2020 Despite Pandemic