The Agency Group positive about increased returns

Contact

The Agency Group positive about increased returns

The company's model and a sustainable financial framework will continue to provide results, according to Paul Niardone, Managing Director of The Agency Group.

It's been a big year for real estate business, The Agency Group.

For the first time since inception of the company, the Earnings before Interest, Taxes, Depreciation and Amortization (EBITDA) of $2.66 million for FY2020 is in positive territory.

This is an amazing $4.9 million turnaround from FY2019 when EBITDA was running at a loss of $4.25 million.

At a Glance:

- FY20 EBITDA of $2.66 million

- Pre-adoption of AASB 16 leasing standard, FY20 EBITDA of $711,714 - a $4.9 million turnaround from FY19 EBITDA loss of $4.25 million

- FY20 positive cashflow from operations of $334,704, compared to FY19 negative cashflow of $6.4 million

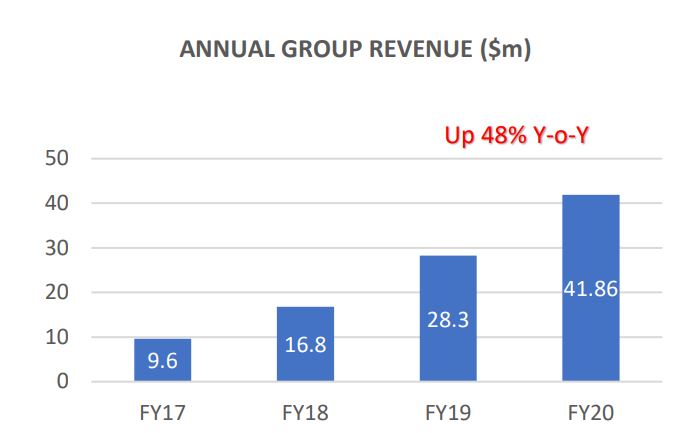

- Annual Group Revenue up 48 per cent y-o-y to $41.86 million

- Cash receipts of $42.53 million, up 42 per cent y-o-y from $30 million

In another milestone for the Group, The Agency reported its first full year positive cashflow from operating activities of $334, 704 for FY20, a $6.76 million turnaround on the previous year’s negative cashflow from operating activities of $6.43 million.

“I am exceedingly proud of all The Agency has achieved in FY2020," said The Agency Group's Managing Director, Paul Niardone.

"To report a maiden EBITDA profit, positive cashflow, a strong gain in revenue and other key metrics is a major achievement and testament to the hard work and dedication of our agents and our staff, especially when considering the impact of COVID-19.

“Our quick response to COVID-19 has placed us in an enviable position, allowing us to rebound strongly in key markets.

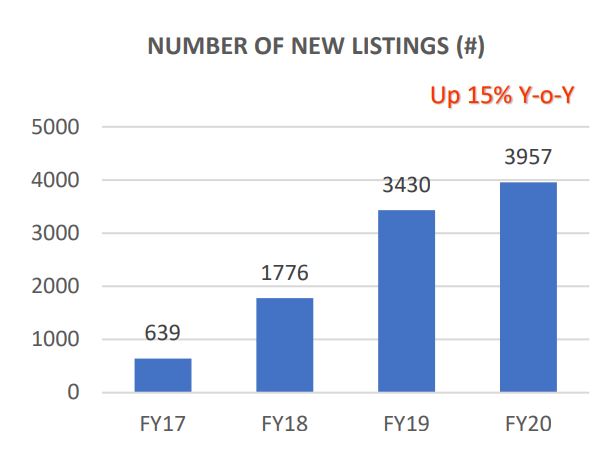

"We have generated a strong sales pipeline which has flown through into the first quarter FY21 with a record 446 listings for July 2020."

Strong operating results were delivered despite the impact of the COVID-19 pandemic and resultant impact from restrictions on the real estate sector nationally during the latter part of the March and for the majority of June Quarter 2020.

Source: The Agency

The Annual Group Revenue of $41.86 million is a 48 per cent increase year-on-year (FY2019 $28.34 million) which underlines the fact the company's model is effective.

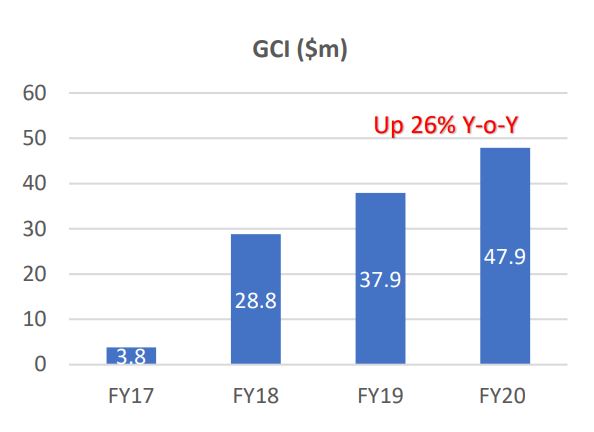

The increase in revenue was primarily due to a 26 per cent increase year-on-year in Combined Gross Commission Income to $47.9 million (FY19: $38 million).

This figure was bolstered by 3,153 sales (up from 2,419 sales for FY19) and $2.9 billion worth of property sold across the combined group for the FY2020 (FY19: $2.5 billion).

Source: The Agency

Property management continues to grow with The Agency reporting a record total of 4,838 Properties Under Management as at 30 June 2020, up 12 percent on the prior corresponding period, generating ~$9 million revenue annually.

The company also witnessed growth in its Mortgage Solutions Australia (MSA) business with home loan approvals for FY2020 up 11 per cent year-on-year from $124.2 million to $137.4 million.

As at 30th June, The Agency was comprised of a combined 283 sales agents (East Coast: 142, West Coast: 141), with average Gross Commission Income (GCI) increasing by over 20 per cent over the past twelve months.

The Agency’s model of allowing agents to focus on sales and providing support is being demonstrated by the year-on-year increase in GCI.

The Agency will be looking to boost agent numbers in the coming quarters.

Based on the company’s existing platform and cost structure, which is largely fixed, any future recruitment will directly contribute to EBITDA performance.

Source: The Agency

Financial Review

The net assets of the Group have increased from 30 June 2019 by $2.51 million to $11.54 million at 30 June 2020 (2019: $9.03 million).

The Group incurred a net loss before tax for the year of $10.36 million (2019: $9.26 million loss), primarily impacted by depreciation and amortisation (over $6 million) and impairment of goodwill ($5.3 million).

The Board has taken a conservative view on the review of its goodwill on historical acquisitions and believed it was appropriate to impair by $5.3 million for FY2020, in light of market uncertainty as a result of COVID-19.

As at 30 June 2020, the Group's cash and cash equivalents increased from 30 June 2019 by $126,843 to $2.724 million at 30 June 2020 (2019: $2.60 million).

There remain significant intangible assets off the balance sheet, these include the rent roll and the Mortgage Book.

These assets contribute an annuity income to the business in excess of $10 million per annum.

Total estimated market asset value of rent roll and loan book is in excess of $27.0 million.

Government incentives and related grants have been received during the last quarter of the year and were used to also support employee sales agents in Perth.

These have been included in operational cashflows.

Rebound from COVID-19

The Agency implemented a range of initiatives in the third quarter 2020 to deal with the fallout from COVID19 including a seamless transition of its workforce to remote working using the Company’s “remote ready” cloud-based platform.

With the restrictions on open houses and in-person auctions, the company quickly employed innovative solutions including digital viewings and auctions.

The company reduced working hours of all staff (including management and board) temporarily in line with reduced workloads as well as a small number of redundancies.

As a result, the company retained the vast majority of its staff and successfully moved all staff back to full working hours and full salaries in June 2020.

Pleasingly, The Agency rebounded in June across key metrics as COVID-19 restrictions on open houses and in-person auctions eased in major markets.

Results delivered in June are now flowing through with a strong sales pipeline into Q3 CY2020.

Future Developments, Prospects and Business Strategies

The Group remains focussed on maintaining a sustainable financial framework and continues to identify and implement efficiencies into its business.

The Agency is also active in pursuing a range of strategic partnerships and JV opportunities it believes will drive agent recruitment and sales revenue in the coming reporting periods.

Similar to this:

Monthly market report for Victoria: The Agency

Quarterly rental report shows fall in vacancy rates: The Agency