Monthly market report for Victoria: The Agency

Contact

Monthly market report for Victoria: The Agency

Statistics, results and outlooks for The Agency in the Victorian real estate market, according to General Manager and Chief Auctioneer Peter Kakos and Senior Portfolio Partner, Ree Chettri

Welcome to this month's market wrap for The Agency Victoria.

COVID-19 is in the minds of all in the real estate sector in Victoria as the metropolitan area have been operating under Stage 4 restrictions and regional areas in Stage 3 since the beginning of August.

We talked to Peter Kakos, General Manager and Chief Auctioneer of Victoria for The Agency about whats happening in the Victorian residential market

Sales

Mr Kakos said it is a hard time to report on in regards to sales results.

"There is no manual to get through this, no precedence, just a will to ensure each and every one focuses on the light at the end of the tunnel," said Mr Kakos.

"The general state is that stock levels are incredibly low, but July was one of the busiest Julys we have ever had.

"We have transacted just over $29,000,000 in the last 30 days.

At a Glance:

- July was one of the busiest sales months on record for The Agency

- Suggestions are that Victorian real estate is in line with New Zealand who saw listing numbers sky rocket

- Supply and demand are still driving the market despite supply being very light

"Most people who would be holidaying and away are in town and they have been buying property.

"During the first round of COVID it was busy and we were motoring towards a busy Spring, then we got hit with the second wave."

283/83 Whiteman Street, Southbank is for sale through agents Michael Paproth and Emily Adams of The Agency Photo: The Agency

Mr Kakos said that evidence is showing, once lockdown and restrictions are lifted the pent up demand for properties is going to be exceptional.

"When you combine that with the pent-up availability of property from lockdown coming to market and the record -low-interest rates, it will be 3 - 4 months worth of listings put into 2 and will be a race to the line for Christmas," said Mr Kakos

"Data from New Zealand, after their lock down, showed that listing numbers sky rocketed and all suggestions are that it will be the same here."

Peter Kakos said pent up demand in Victoria for property is on the same track as New Zealand.

Mr Kakos said supply and demand are still driving the market despite supply being very light on at this time.

"If we look at how the year started, so beautifully, then COVID hit," said Mr Kakos.

"We got over the first wave and the market picked up with very strong results during a normally quiet time.

"Then it hit again but there are no real signs of any price drops."

Mr Kakos said there have been great results with the big, luxury properties and the other end of the spectrum with first home buyers.

"Even certain segments of luxury, in and around the $5 million mark there have been strong results which shows there are people in the market who have been unaffected," said Mr Kakos.

Rental market

Ree Chettri, Senior Portfolio Partner said rental prices in Melbourne have dropped in every region since COVID 19 hit Melbourne towards the end of March.

"Apartments are the worst hit," said Ms Chettri.

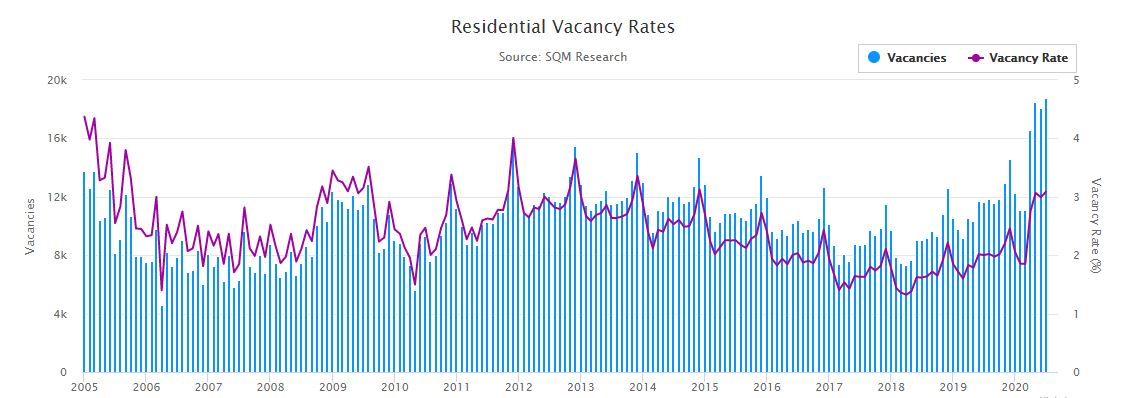

"Vacancy rates are high however, it hasn’t hit the roof.

271B Belmore Road, Balwyn North is leased for $1000 per week. Photo: The Agency

"The recent lockdown in Melbourne has resulted in job losses due to closures of businesses across the city; aimed at reducing the spread of the disease, border closures both interstate and internationally and inspections on hold except for online until the restrictions are lifted.

At a Glance:

- Vacancy rate for Melbourne in July was 3.1 per cent with 18,746 vacancies

- Property gross rental yield for Melbourne in July was houses 2.7 per cent and units 3.6 per cent

- Weekly median rents in July for houses $528 and for units $403

Melbourne July 2020 vacancy rates. Source: SQM Research

"These factors have taken another hit on the rental market."

Ms Chettri said there are still enquiries coming in for rental properties, but tenant applications have reduced significantly.

Source: SQM Research

"The restrictions back in April-May were already a hard hit with tenants applying for rental discounts because of hardship," said Ms Chettri.

"Looking around for cheaper properties to rent since the rental prices were discounted by the landlords so that their property doesn’t sit vacant for months.

"Tenants now are tempted to move to a bigger property since working from home is encouraged by the government and the employer and with reduced rents, they can afford a bigger place for the same price.

30 Nelson Place, South Melbourne leased for $1500 per week. Photo: The Agency

"Hence, well presented homes in the vicinity of $650-$850 are doing very well in the rental market.

"On that note, high end rental properties between $1000-$1500 per week are still leasing very well.

"There is a niche market for these properties and there is always movement in that market."

Similar to this:

Quarterly rental report shows fall in vacancy rates: The Agency

Seven key policy options to reinvigorate the rental market

All state and territory governments' rental support summarised