Opulence and high end properties are still in favour: Market wrap

Contact

Opulence and high end properties are still in favour: Market wrap

Agents are finding strong demand for luxury properties despite restrictions due to COVID-19.

The opulence of 652 London Road, Chandler was the attraction for a young Brisbane family who were looking for their dream 'forever' home.

They had been looking for six months and after the Chandler home was passed-in at auction on June 14, they offered a price in excess of its last sale price of $3,850,000 in 2018.

After the auction, agent Joseph Lordi received multiple post-auction offers with 42 individual inspections from qualified buyers.

652 London Road, Chandler sold through agent Joseph Lordi of McGrath Estate Agents. Photo: McGrath.

"It's a one of a kind house," said Mr Lordi.

"We ran a five week auction campaign, but it was passed in.

"We were in negotiation for a couple of weeks with a number of qualified buyers."

Mr Lordi said there were more than 140,000 online views of the listing which included local, national and international interest.

On top of that there were more than half-a-million views on social media where the norm is 50,000 – 80,000.

"The property is across 2.5 acres and is built on the highest point of London Road," said Mr Lordi.

In Melbourne where restrictions have been re-introduced, choice properties are still on the radar of motivated buyers.

8 McGregor Street, Middle Park has sold after 2 weeks of negotiation with agent Adrian Wood of The Agency. Photo: The Agency.

The Agency has recently sold 8 McGregor Street, Middle Park for an undisclosed price.

"We put the property on the market just as the first lock-down took place, so were able to do one on one inspections," said The Agency's Adrian Wood.

"We had an auction and got not a bad offer, but not enough, as we felt it was worth more.

"The property is the best of its type I've seen."

Mr Wood said the eventual buyer was a local man who is currently an ex-pat and negotiatons took place over two weeks.

Auctions

Justin Nickerson of Apollo Auctions said Queensland showed its strongest overall clearance rate since February.

"This has mainly been fuelled by a strong buyer pool, which despite the challenges faced by interstate and overseas buyers have remained consistent in both their quantity and quality," said Mr Nickerson.

"Attendances also are back in force with crowds again enjoying attending on-site auctions, with almost 30 people on average in attendance at each auction."

Mr Nickerson said he experienced a clearance rate of 72.7 per cent for the week.

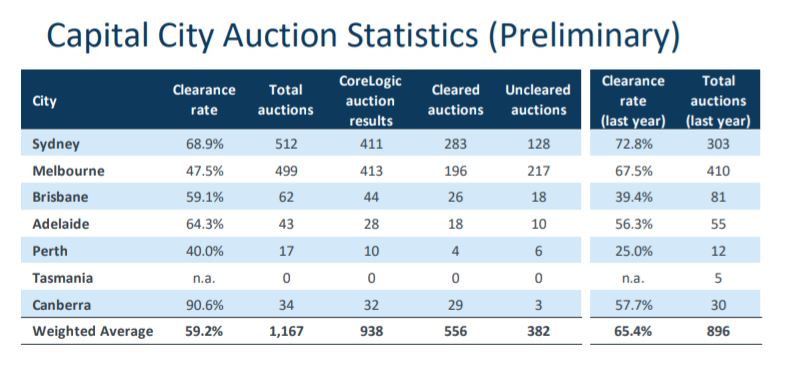

CoreLogic reported 1,167 homes scheduled for auction across the combined capital cities this week, down from 1,269 over the previous week, although higher than

this time last year (896).

Source: CoreLogic

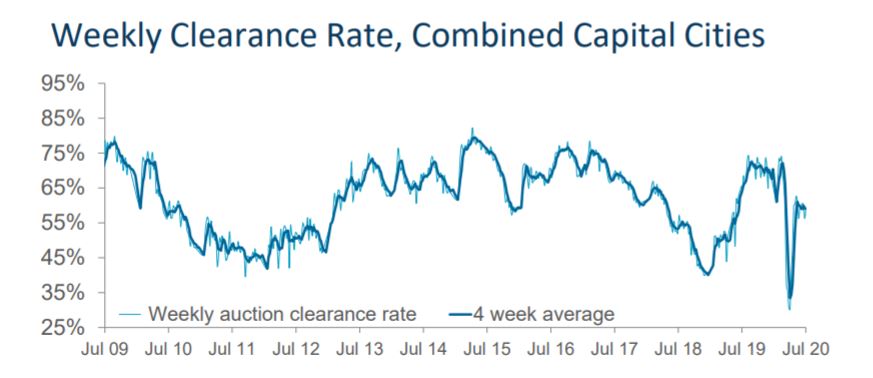

Of the 938 results that have been reported so far, 59.2 per cent were successful, up from last week’s final clearance rate of 56.2 per cent, and lower than this time last year (65.4 per cent).

In Sydney, 512 homes were scheduled for auction this week, down from 566 over the previous week, although higher than one year ago when 303 homes were taken to auction across the city.

Of the 411 auction results collected so far, 68.9 per cent were successful, although this will revise lower as the remaining results are collected.

In comparison, the previous week reported a final clearance rate of 61.8 per cent, while a clearance rate of 72.8 per cent was recorded this time last year.

There were 499 auctions scheduled in Melbourne this week, similar to the previous week when 506 homes were taken to auction, and higher than the same week last year (410).

Preliminary results show that of the 413 results collected so far, 47.5 per cent were successful, while 43.6 per cent were reported as withdrawn (compared with 15.1 per cent of Sydney auctions).

Source: CoreLogic

As mentioned the previous week, the withdrawn numbers are not overly surprising given that Melbourne is currently in lockdown.

The previous week saw a final clearance rate of 51.2 per cent, while this time last year, 67.5 per cent of Melbourne auctions reported a successful result.

With restrictions in place across Melbourne for another four weeks, we are likely to see more auctions being withdrawn from the market than normal, which will drag the clearance rate

lower.

Excluding withdrawn auctions from the clearance rate calculation, and focussing purely on those auctions that proceeded shows a much higher 84 per cent ‘adjusted’ preliminary clearance rate, with the majority of these (55 per cent) selling prior to the auction rather than under the hammer or post event.

Similar to this:

All eyes on Melbourne as auctions continue: Market Wrap

Strong sales at auctions as prices above reserves achieved: Market Wrap