Growth in house prices predicted for 2022/2023

Contact

Growth in house prices predicted for 2022/2023

A significant downturn in population growth will see any significant recovery in house prices delayed until the 2022/2023 financial year, according to m3property.

The latest market analysis from m3property on the implications of COVID-19 on the residential market in June 2020 has forecast an overall population growth reduction of around 300,000 persons by the end of 2023, in comparison to the pre-COVID-19 forecast from the ABS.

This includes the Federal Government’s estimation of a massive 85 per cent fall in immigration in FY2021, compared to FY2019.

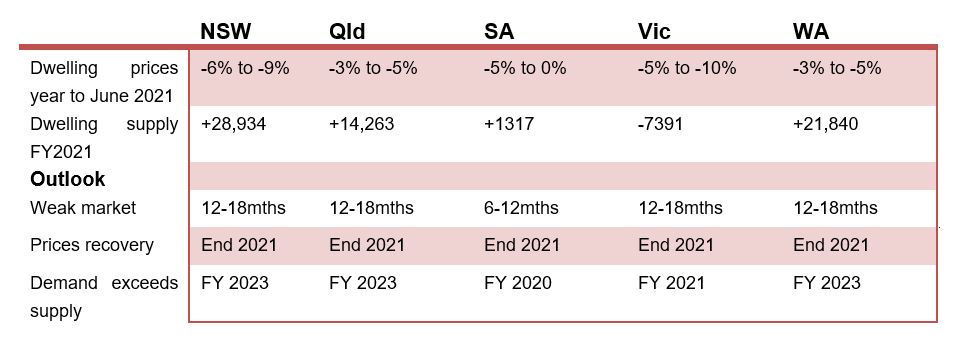

According to m3property's National Director Residential Development, Luana Kenny, the forecast, which assumes no second wave coronavirus event, will also see oversupplied markets in all states except Victoria over the next financial year.

At a Glance:

- A forecast of a population growth reduction of around 300,000 persons by the end of 2023

- Assuming no second wave coronavirus event, will also see oversupplied markets in all states except Victoria over the next financial year.

- Expect market growth between mid and late 2022 to accelerate in FY2023

"Dwelling prices are unlikely to recover while demand is severely weakened by borders being closed to immigration and a reluctance on the part of both investors and owner-occupiers to commit to hefty loans in a very uncertain economic climate," said Ms Kenny.

"While we expect residential prices to continue to decrease between now and the first half of 2021 the extent of any decrease may be tempered, to a degree, by government stimulus measures and an earlier than expected economic recovery.

"As it stands at the moment we expect to see a slow recovery from the latter half of 2021 as the economy deals with a high level of unemployment, however that may be partly offset by improving population growth.

"We expect market growth between mid and late 2022 to accelerate in FY2023."

The analysis forecasts that Victoria, which has experienced the strongest population growth of any state in recent years, would be the only mainland state or territory to continue to experience a dwelling undersupply in the wake of the virtual halt to immigration.

According to m3property’s National Research Director, Jennifer Williams, Victoria will have an undersupply of 7391 dwellings in the 2021 financial year - the anticipated nadir of the COVID-19 impact.

"We expect Victoria to continue to be undersupplied over the next three years with the demand-supply gap likely to start reducing by mid-2021 before widening again from early 2022 when we begin to see population growth returning to pre COVID-19 levels,’’ said Ms Williams.

Ms Williams said demand in NSW was likely to match supply by mid-2021 and start to outstrip supply from early 2022, while Queensland would experience an oversupply of more than 14,000 dwellings during 2021, WA nearly 22,000 and South Australia a low 1317.

Source: m3property

SA to lead the pack on housing recovery

The analysis found the South Australian market appeared to have weathered the COVID-19 storm better than others with a recovery forecast to begin up to six months ahead of other states.

m3property’s Managing Director in South Australia, Kym Dreyer, said it was no surprise the local market had not been hit as hard as its interstate counterparts.

"SA markets have historically been less volatile and, while it has not witnessed the strong gains in values over recent years, it is also unlikely that it will experience strong falls over the forecast period," said Mr Dreyer.

"Adelaide in particular is a much more stable and predictable market than we are seeing in other capitals and the forecasts bear that out with a minimal level of oversupply which will see the market recover that much more quickly."

Mr Dreyer said the the SA Government’s $40,000 increase in the first home buyer grant for new builds along with the existing $15,000 State Government incentive and the Federal Government’s $25,000 HomeBuilder program, would provide the sort of encouragement that would enhance the state’s prospects of an earlier exit from the economic downturn.

Similar to this:

House prices have increased according to latest REMF

Forecasting a drop in housing pricing a wasted exercise: REIA

House price expectations become positive, yet housing affordability remains a big issue