Major correction recorded in National Rental Market

Contact

Major correction recorded in National Rental Market

CBD vacancy rates surge and rents fall in April, according to Louis Christopher of SQM Research

Job losses have caused an exodus of tenants from CBD areas, the drop off of international students and the surge of short term accomodation now being advertised as long term leasing, are all conditions that have led to a major surge in vacancy rates, according to Louis Christopher of SQM Research in his monthly report.

SQM Research has revealed the national residential rental vacancy rate has recorded a large one month jump from 2 per cent in March to 2.6 per cent in April 2020, with the total number of vacancies Australia-wide now at 88,668 vacant residential properties.

At a Glance:

- Sydney's rental vacancy rate has blown out to 13.8 per cent

- Total rental vacancies Australia-wide at 88,668

- Asking rents for houses in capital cities has decreased nationally by 1.3 per cent

"This is one of the largest one month rises ever recorded on our vacancy rates series," said Mr Christopher.

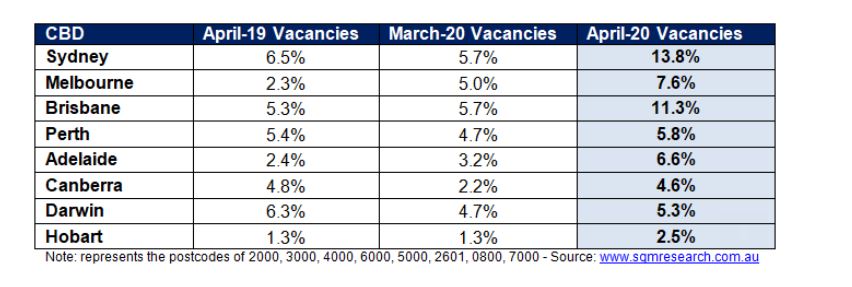

Residential vacancy rates over the past month and in comparison to the same time last year. Source: SQM Research

"All states recorded increases in vacancy rates with the exception of Darwin which recorded a 0.1 per cent decline.

"The year on year comparison also revealed rises when the national rental vacancy rate in April 2019 was 2.3 per cent compared to 2.6 per cent recorded for April 2020, indicating the surge in vacancy rates is beyond seasonal rises.

"Only Perth and Darwin recorded lower vacancy rates compared to this time last year."

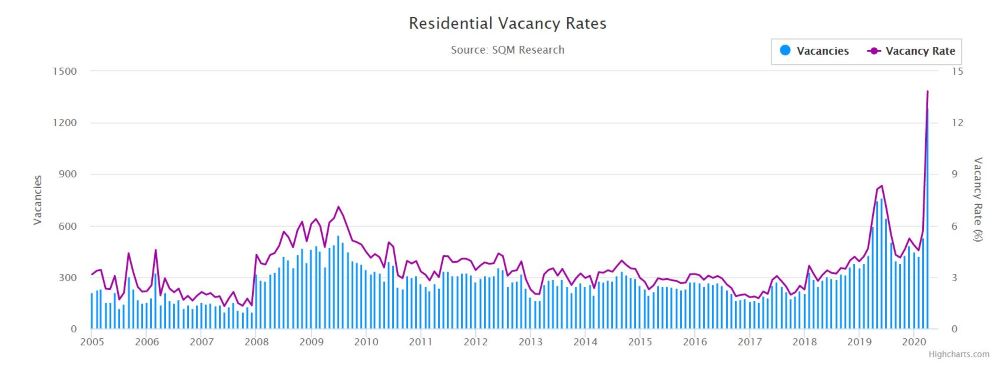

Among the largest rises are the capital city CBD locations, particularly for the Sydney CBD where the vacancy rate has blown out to 13.8 per cent - a record high on SQM’s series.

Residential Vacancy Rates for Sydney showing the huge spike in the last month. Source: SQM Research

"The Melbourne and Brisbane CBD locations have also recorded a huge rise in rental vacancies," said Mr Christopher

"Melbourne Southbank has risen to 13 per cent.

"The CBD itself rose to 7.6 per cent."

Other holiday locations have also suffered with Surfers Paradise recording a vacancy rate of 8.5 per cent and Noosa blowing out to 6.8 per cent.

Suburban areas have faired better though rises have been recorded for most localities around the country.

"The question now begs is how long will we see such high rental vacancies?" said Mr Christopher.

"If it is sustained throughout the course of the year, then we can expect far deeper falls in rents which will be good news for tenants but a disaster for landlords.

"There will also be economic consequences with further sharp falls in building approvals likely; thereby risking a major depression in our residential construction sector as well as the rather obvious risks for housing prices."

Asking rents

Over the month, capital city asking rents decreased 1.3 per cent for houses and remained stable for units for the week ending 12 May 2020 to record asking rents of $537 per week for houses and $428 per week for units.

"National combined rents are now recording a 12 month decrease of 3.1 per cent," said Mr Christopher.

"Sydney, Melbourne and Perth recorded decreases in asking rents for both houses and units over the month.

"Whilst Brisbane, Canberra and Hobart recorded decreases in house asking rents but minor increases in unit asking rents.

"Darwin appears to be the only city that has remained relatively stable for the month with increases recorded in house rents of 2.7 per cent but declines in unit rents of 2 per cent.

"Adelaide bucked the trend and recorded rent increases for both houses and units of 0.1 per cent and 1.4 per cent respectively."

Similar to this:

February saw declining vacancy rates