Housing values remain stable in April

Contact

Housing values remain stable in April

CoreLogic's latest report shows most regions had an increase in home values with the national monthly pace slowing but still growing.

Despite a sharp drop in market acitivity, alongside severe weaking in consumer sentiment, the CoreLogic Home Value Index results, released today, show housing values are staying reasonably steady in April.

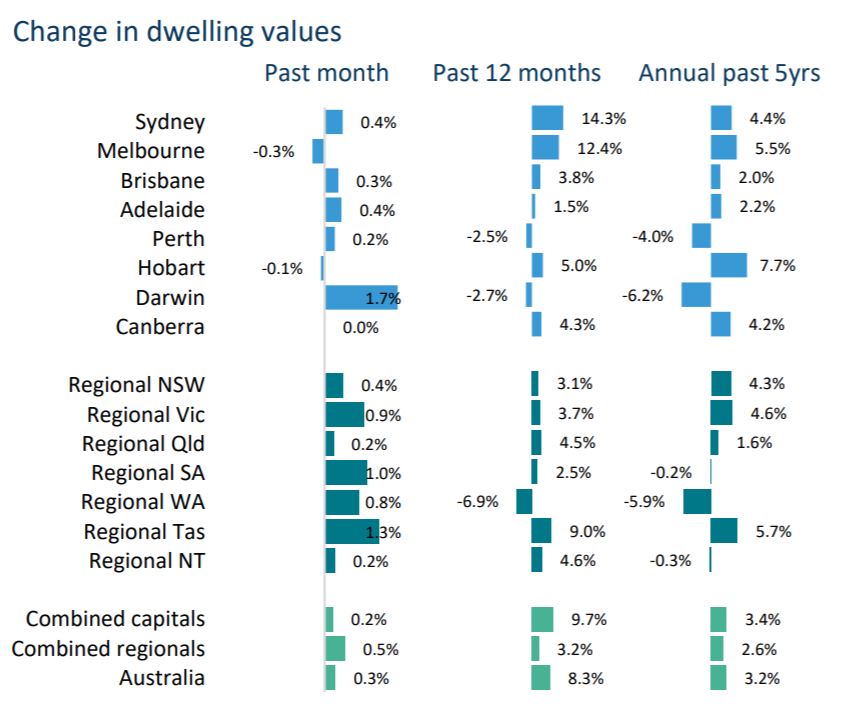

Although most regions recorded a rise in home values through April, the national monthly pace of growth more than halved, dropping from 0.7 per cent in March to 0.3 per cent.

The April result was the smallest month on month movement since June last year, when the national index was down 0.2 per cent.

Source: CoreLogic

“Although housing values were generally slightly positive over the month, the trend has clearly weakened since mid-to-late March, when social distancing policies were implemented and consumer sentiment started to plummet," said CoreLogic head of research Tim Lawless.

The capital city markets generally showed a weaker performance relative to the regional markets, with the combined capital cities index up 0.2 per cent in April compared with a 0.5 per cent rise across the combined regional markets.

The sharpest reversal in growth conditions can be seen in Melbourne, where values nudged into negative territory through April, down 0.3 per cent.

Sydney values remained positive, rising 0.4 per cent over the month.

To provide some context, the six months prior to March saw both cities averaging a monthly growth rate around 1.7 per cent.

According to Mr Lawless, Australia’s largest cities have a higher level of downside risk.

“Sydney and Melbourne arguably show a higher risk profile relative to other markets due to their large exposure to overseas migration as a source of housing demand, along with greater exposure to the downturn in foreign students, stretched housing affordability and already low rental yields that are likely to reduce further on the back of rising vacancy rates

and lower rents," said Mr Lawless.

Hobart was the only other major region to record a decline in home values over the month, down 0.1 per cent.

“Hobart has the most exposure of any capital city, at least proportionally, to the industry sectors most heavily impacted by COVID-19 in terms of employment, with 12.7 per cent of the workforce employed within accommodation & food services, and arts & recreation services sectors," said Mr Lawless.

Despite the weakening in housing market conditions, some cities have outperformed the six-month average pace of change. Perth (+0.2 per cent), Adelaide (+0.4 per cent) and Darwin

(+1.7 per cent) outperformed their six month average pace of growth in April, demonstrating some resilience to weaker conditions.

Hedonic Home Value Index

Other indicators of housing market conditions have not been so resilient.

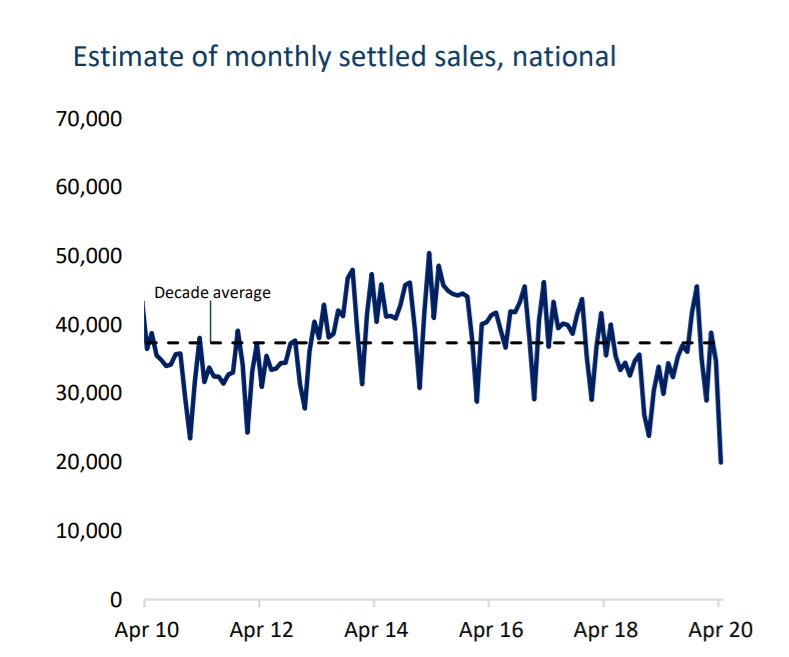

CoreLogic estimates of settled sales plunged by around 40 per cent in April as buyers retreated to the sidelines and listing numbers dried up.

“The most recent months are harder to provide an accurate estimate of sales activity due to the lag in receiving the full complement of sales records from each state government, as

well as the impact from Easter, however the substantial drop in sales activity is supported by a similar fall in the number of mortgage related valuation events across CoreLogic valuation platforms, which account for around 85 per cent of lender valuation instructions,” said Mr Lawless.

Activity across CoreLogic’s ‘RP Data’ platform, where the large majority of Australian real estate agents undertake their research to prepare a property for sale, was down by around 60 per cent prior to Easter, providing a firm signal that industry activity has been hit hard by the drop in active buyers and sellers as well as policies preventing open homes and onsite auctions.

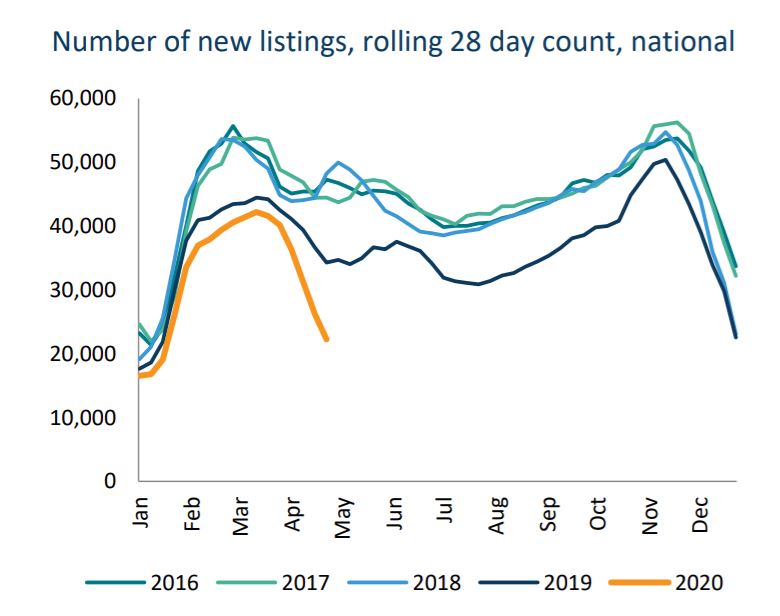

The decline in real estate agent activity is also showing up in the number of new listings being added to the market which was tracking 35 per cent lower at the end of April relative to the same time a year ago and 43 per cent below the five year average.

Source: CoreLogic

According to Lawless, lower advertised supply levels may have a silver lining for housing values.

“The reduction in advertised stock levels at a time of low demand is another factor that should help to insulate housing values from a more material downturn," said Mr Lawless.

Mr Lawless states the drop in housing turnover has implications for a wide variety of industries that are either directly or indirectly reliant on property sales.

“Real estate agents will be among the most impacted by the decline in transactions," said Mr Lawless.

"A significant reduction in housing activity will also have an impact on the banking and finance sector, due to reduced mortgage-related activity, less valuation work and conveyancing.

"There will also be fewer building and pest inspections and a drop in removalist services,” he said.

“While construction of dwellings is still progressing amid COVID-19, the building sector is facing challenges to productivity as sites are adapted to ensure the health and safety of workers.

"A slowdown in approvals will have a lagged impact on available projects for construction companies down the line.”

Source: CoreLogic

Additionally, state governments will experience a budgetary hole from less stamp duty as transactions decline, and some retail items such as home furnishings, appliances and white goods may see a decline, with sales likely to suffer until housing market activity starts to recover.

However retail trade data suggests losses in this space may be partially offset by increases in hardware, building and gardening supplies, as people that can afford to, use the current slowdown for home improvement.

The most expensive housing markets are slowing the fastest.

The CoreLogic stratified hedonic index shows the top quartile of the housing market has weakened the most substantially.

Quarterly gains across the top quartile reduced from 6.6 per cent late last year to 2.4 per cent over the three months ending April.

In the context of rapidly weakening economic conditions and the broader COVID-19 related disruption, the April housing market result looks remarkably resilient.

“The Australian version of this global health and economic crisis is only a month-and-a-half old, and it looks inevitable that there will be some downwards pressure on housing values over the coming months," said Mr Lawless.

"The magnitude of housing value falls depends on a broad range of factors with most hingeing on the timing and extent of social distancing policies being lifted.

“The good news is that Australia has managed to flatten the spread of the virus more effectively and efficiently than expected and we are already seeing a subtle easing of social

distancing policies in some states.

"An early return of economic activity should support a lift in consumer spirits which in turn should see housing market activity sparking back to life.”

Plenty of downside risk remains for housing values, however, there are a variety of factors that will help to insulate home values from a material downturn.

A key factor is the leniency provided to distressed borrowers affected by COVID-19 by Australian banks.

Eligible borrowers can take advantage of payment holidays over a six month window, by which time the economy will hopefully be in better shape.

This policy is central to limiting the flow of distressed properties onto the market, which could have otherwise been a source of more significant downwards pressure on home values.

Lawless noted, that the high rate of unemployment is likely to be most impactful on areas of the workforce that have lower rates of home ownership.

The potential for stronger labour market conditions amongst workers that have a higher rate of home ownership is another factor that should help to keep the number of distressed properties to a minimum.

There is also the unprecedented level of stimulus to consider, which will help to keep businesses afloat and workers in a paying job.

A sharp reduction in advertised supply levels is another factor helping to safeguard home values amidst a fall in buyer demand.

“No doubt the coming month will provide more clarity about the direction of housing markets," said Mr Lawless.

"One of the most important indicators to follow will be measures of consumer sentiment. If consumer spirits start to bounce back to more normal levels, this is when we should start

to see housing activity lift from their current low levels.”

Similar to this:

Home values growing at a fast pace