Properties for auction tracked at 1,522 for this week

Contact

Properties for auction tracked at 1,522 for this week

CoreLogic says auction numbers have risen, but expects a significant proportion to be withdrawn.

Despite ongoing COVID-19 restrictions regarding on-site auctions and inspections, the number of homes scheduled to go to auction is set to rise across the combined capital cities with 1,552 currently being tracked by CoreLogic.

While this is up from last week when only 634 auctions were scheduled over the Easter period slowdown, it’s expected there will be a significant proportion of these withdrawn from the market or converted to private treaty sale method as CoreLogic have noted over the last few weeks.

At a Glance:

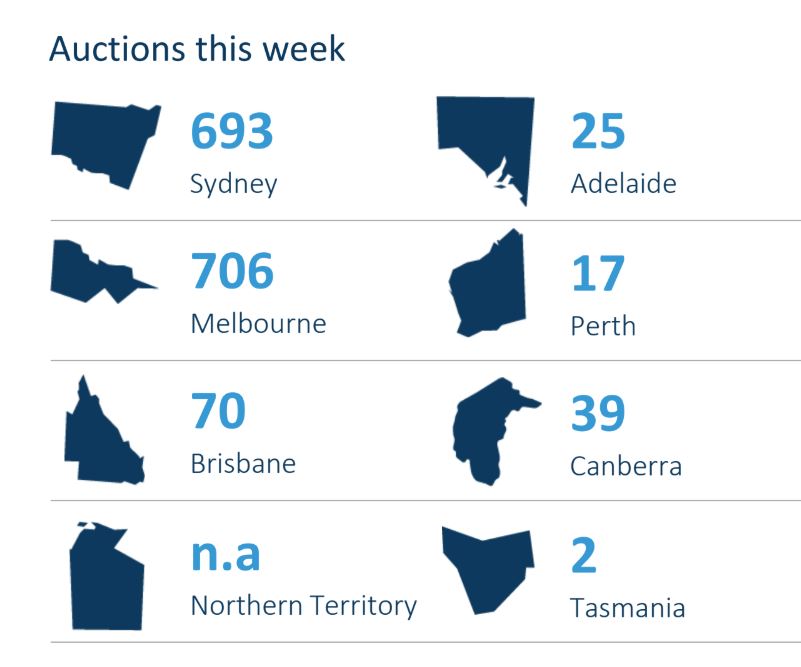

- Total of 1,552 homes to be auctioned this week

- Melbourne expected to have the highest volume of auctions at 706 properties

- Sydney has the second highest number of auctions at 693

Melbourne is expected to see the most significant rise in volumes this week, with 706 properties scheduled for auction, up from the 88 auctions last week.

In Sydney, 693 homes are set to go to auction this week, increasing on the 413 scheduled last week.

Outside of Sydney and Melbourne, Brisbane and Perth also have a higher number of auctions scheduled over the week, while there are fewer scheduled in Adelaide, Canberra and

Tasmania.

Source: CoreLogic

Last week, over the Easter period slowdown a total of 634 homes were scheduled to go to auction across the combined capital cities.

The lower volumes last week returned a final auction clearance rate of 30.6 per cent; surpassing the week prior as the lowest on record for CoreLogic.

Of the 174 properties reported as being sold across the capital cities, 61% sold prior to the scheduled auction date and of the 569 results collected more than half were withdrawn (56 per cent).

There were only 88 Melbourne homes scheduled for auction last week, returning a final auction clearance rate of 20 per cent and a withdrawal rate of 64.7 per cent.

Of the 17 homes that did sell across Melbourne, 52.9 per cent sold prior to the auction date.

Sydney had the highest volume of auctions of all the capital city auction markets last week, with 413 homes scheduled for auction, returning a final auction clearance rate of 32.1 per cent and a rate of withdrawal of 54.2 per cent.

McGrath Estate Agents has noticed a dynamic shift between agents and their clients, both vendors and buyers, as they transact properties in the current climate.

“Our agents are working very closely with their clients as they continue to transact effectively and in many cases very quickly," said McGrath CEO Geoff Lucas.

"The dynamics have changed as the social distancing required by Covid-19 health and safety measures have brought a more personalised service to the industry.

"While we are benefitting from bringing forward the advanced technology we have in place, we have ultimately reverted to good old fashioned one-on-one buyer appointments and I believe this will have a long-term positive impact on the real estate industry.

“We are seeing the benefit of agents who have developed a strong relationship with their clients, now being used as a trusted advisor on movements within the market and areas in which they specialise."

34 Edwards Road, Wahroonga sold in 16 days for $1.95 million through agent Alex Mintorn of McGrath Wahroonga. Photo: McGrath

Despite the Easter holiday when the market generally takes a breather, McGrath recorded some outstanding sales throughout its network.

Alex Mintorn of McGrath Wahroonga said 24 Edwards Road, Wahroonga sold in 16 days.

“These properties attracted a very large level of enquiry," said Mr Mintorn.

"Buyers are not delaying when they find the property that suits them, and they move quickly.

"Upgraders and empty nesters are active and many are relocating to other areas of Sydney.”

19 Kiama Street, Padstow went under the hammer and sold for $1,190,000 through agent David Loaney of LJ Hooker Padstow. Photo: LJ Hooker

Andrew Cooley of Cooley Auctions said 19 Kiama Street, Padstow had 9 registered bidders.

The auction finished $40,000 over the reserve after 74 bids.

"The team at LJ Hooker Padstow also put 4 other properties under contract ahead of last weekend’s auctions as well, so all in all a great day for the team," said Mr Cooley.

Of the 117 sold results collected, 65 per cent sold prior to auction.

Across the smaller cities, volumes were lower week on week across all markets.

Canberra returned the highest final clearance rate of 43.9 per cent and a withdrawal rate of 51.2 per cent.

Similar to this:

CoreLogic data preview says property prices fell in May