National CBRE housing report says market is moving in positive direction

Contact

National CBRE housing report says market is moving in positive direction

CBRE’s 2020 Market Outlook report highlights key forecasts for Australia’s residential sector

The outlook for Australia's residential sector has been captured by CBRE’s Market Outlook report and it includes a national forecast for all capital cities.

The report outlines the positivity of 2020 compared to 2019 for the property market, with strong growth price returning, especially for Sydney and Melbourne.

The report indicates there is the possibility of this leading to an overflow of people moving to more affordable capitals, such as Brisbane in particular.

"With the cost of debt low and lending volumes starting to turn, it is predicted that investors will return," Associate Director, Head of Residential Research, Craig Godber said.

"This should encourage well-placed developers to begin marketing larger projects again."

Price growth is stripping wage inflation in the two biggest capital cities. Source: CBRE

Over the past 10 years the report shows that dwelling prices have outgrown wage inflation in Sydney and Melbourne, but not the other capital cities.

"Affordability is an issue in these two cities only," said Mr Godber.

"Price growth has returned to residential markets and this will continue in 2020."

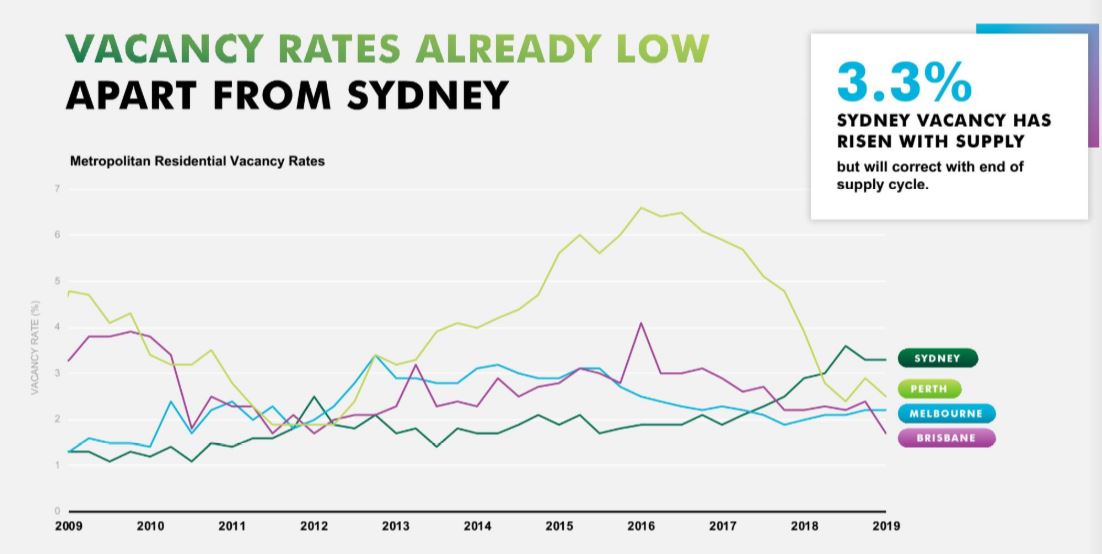

Vacancy rates are already low except for Sydney. Source: CBRE

The report shows that Brisbane now has the lowest level of residential vacancy.

Based on the level of dwelling approvals and construction starts, the CBRE report predicts Brisbane will have the highest risk of being undersupplied by 2021.

This should support stronger price growth in this market.

Read more on the CBRE 2020 Market Report here.

Similar to this:

CBRE appoints high profile recruit

Increased interest in Sydney apartment blocks ahead of potential changes to negative gearing - CBRE

CBRE named best property consultancy in Australia at Property Awards