Indicators are showing a strong market for 2020 in New Zealand

Contact

Indicators are showing a strong market for 2020 in New Zealand

CoreLogic NZ Market Pulse takes a look at some of the key property investment metrics and which parts of the country look the most attractive.

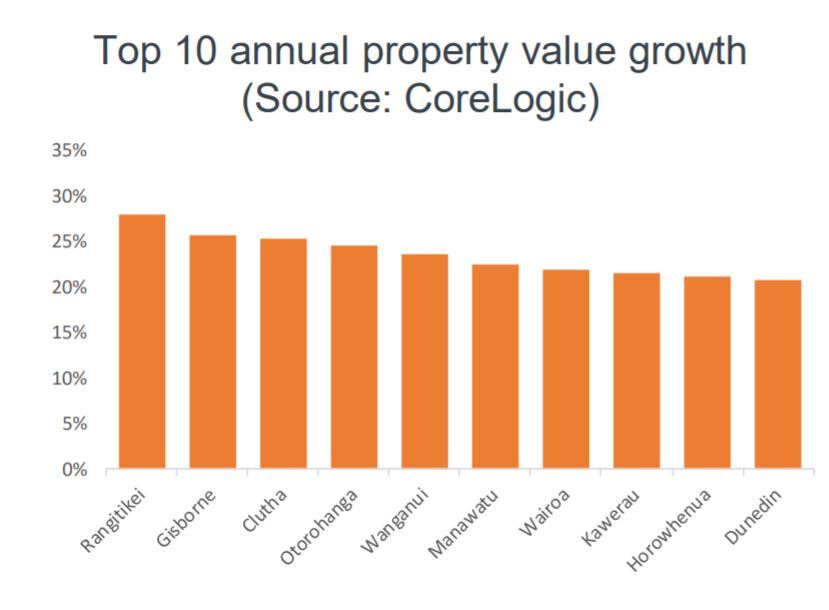

Results from CoreLogic's NZ Market Pulse report finds each of the top 10 areas of New Zealand has delivered at least 25 per cent in the past 12 months, with Rangitikei, Clutha, and Gisborne sitting at 30 per cent or more.

By combining gross rental yields with the change in property values over the past year (i.e. capital gains), we can look at total investment returns – and unsurprisingly the recent results are strong.

With momentum now building again across most of the NZ property market, 2020 looks set to deliver another year of strong investment returns.

At a Glance:

- Top 10 areas of New Zealand all have yields in excess of 5 percent

- Rents have risen by at least 14 per cent over the past 12 months

- Capital gains has seen a growth of 25 per cent

According to CoreLogic, one of the key property market trends of the past 3-6 months was the return of mortgaged investors, both in terms of number of purchases and their percent of market share.

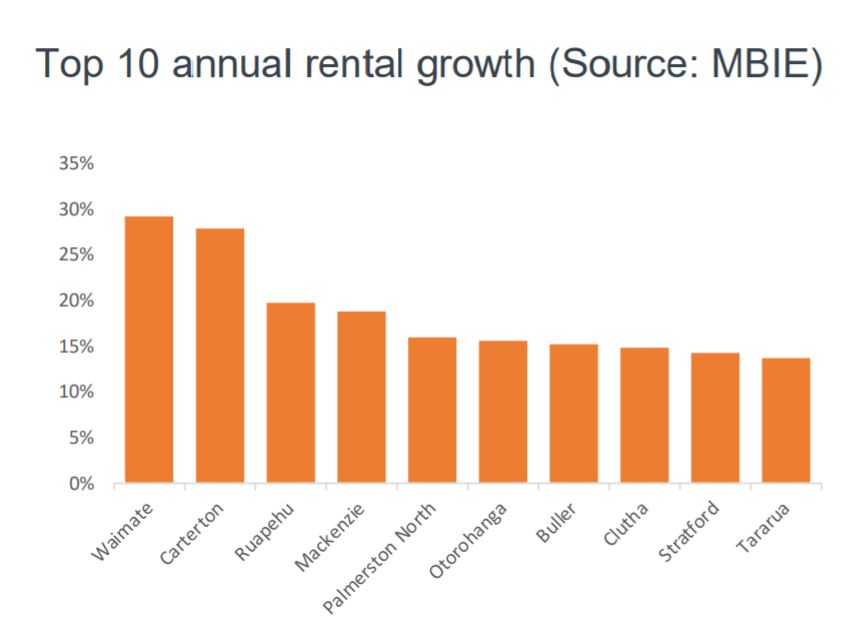

In relation to rents, there have been some eye-catching results across the country, with each of the top 10 having seen rents rise by at least 14 per cent over the past 12 months – good for investors, not so much for tenants.

Contributed: CoreLogic

Having already featured for high gross yields, Waimate, Ruapehu, Buller, and Clutha pop up again for strong rental growth.

For many investors, it’s not just about yields and any growth in rents; capital gains are also a key focus.

The top 10 here is quite different than for the previous two measures, with larger areas like Gisborne, Wanganui, and Dunedin now featuring.

Clutha also makes the top 10 for this measure too, with a rise in average property values over the past year of 25 per cent.

The capital gains component dominates this measure, so the top 10 for value growth are also the top 10 for total returns, with each of these areas delivering at least 25 per cent in the past 12 months.

Contributed: CoreLogic

Looking ahead, rental growth is likely to remain steady across many parts of NZ, and property values still have strong momentum too.

Therefore, the returns to existing landlords are likely to remain solid, and aspiring investors will no doubt be keen to get a piece of the action too.

Sales agent Steen Nielsen from the Remuera office of Ray White, in the eastern suburbs of Auckland, has seen this positive movement in the New Zealand property market.

"The market became stronger in 2019 as more people came into the office and to our auctions where bidding was competitive," said Mr Nielsen.

"The drivers that I see behind the market growing stronger include a growing population in Auckland, both domestic and international immigration, and more buyers than sellers which is driving up the prices of homes.

"Mortgage rates are also historically very low at the moment."

Managing Director of Sotheby's Mark Harris. Photo: Sotheby's NZ

Managing Director of Sotheby's Mark Harris also agreed that they had seen an increase in investment property purchasing, due to interest rates having lowered in the past 12-18 months.

"Capital growth is still being monitored but it is definitely on the way up after a couple of years of stagnation," said Mr Harris.

"(We are seeing) owner occupiers in the mid to high end of the market, investors more so in the secondary market as interest rates remain low and a return to property versus banking or securities exists."

More information on the CoreLogic NZ Market Pulse report

Simlar to this:

World-famous wonders of New Zealand wilderness surround Wyuna Preserve lots for sale

Aaron Davis appointed Harcourts New Zealand National Auction Manager

New Zealand's 'foreign buyer ban' comes into effect, as questions linger about its long-term impacts