Worldwide yield potential as residential rental values outperform capital values

Contact

Worldwide yield potential as residential rental values outperform capital values

Savills World Cities Prime Residential Rental Index finds residential rental values fared better than capital values over 2019 in Los Angeles and Moscow

At an annual increase of 1.2 per cent from 0.4 per cent in 2018, residential rental values fared better than capital values.

Compare this to a 0.1 per cent increase for capital values over the same period, according to the Savills World Cities Prime Residential Rental Index.

However, as with capital values, rental growth slowed in the second half of the year, with a 0.3 per cent increase, compared to 0.8 per cent in the first half.

“In the first half of 2019, average annual rental values in the index outperformed capital values for this first time since 2008 and this continued in the second half of the year," said Sophie Chick, head of Savills World Research.

"As prime residential capital value growth is forecast to remain at modest levels, the search for income will be increasingly important for global investors and the prime residential sector in key global cities can provide appealing yield potential.

"Average yields increased in 2019, after being on a downward trend since December 2014, as rental growth outpaced price growth, standing at an average of 3.2 per cent across the index as a whole, compared to 3.0 per cent the previous year."

United States

Ms Chick said Los Angeles remains the highest yielding city in the Savills Index, at 5.5 per cent.

"Yields have been pushed upward due to a shift from buying to renting, particularly among younger age groups.

"The city also saw the highest increase in rents over 2019 with a 6.1 per cent increase."

US cities generally saw capital values fall throughout 2019 as a result of tax changes and oversupply in some key markets, yet the rental markets have performed well, both in terms of yields and rental growth.

Europe

In Europe, Moscow is the second highest yielding city, at 5 per cent, and the top performer for rental growth over the year, with a 3.8 per cent increase.

The prime rental sector has seen high levels of activity, primary driven from corporate tenants.

Unlike the largely domestic sales market, the rental market has a high share of international interest.

Both Berlin and Paris outperformed their European counterparts in terms of capital growth at 8.8 per cent and 6.4 per cent respectively.

Rental values in Berlin, however, experienced a -0.6 per cent fall in the second half of the year, despite a 2.8 per cent rise for the year.

The uncertainty around rental caps has had an impact on investor sentiment in the city.

Similarly prime rents in Paris have remained flat following the introduction of rent controls in July 2019.

Asia Pacific

Cities in Asia Pacific are largely lower yielding, with the bottom ten cities for average yields all located in this region.

Bangkok, Kuala Lumpur and Tokyo buck this trend when it comes to yields however their rental growth is more of a mixed picture.

The Japanese capital has seen strong growth over the past few years however rents fell marginally in the second half of the year (-0.1per cent) as some stock starts to look overpriced.

Kuala Lumpur saw one of the largest falls over the year (-4.1per cent) along with Dubai at -5.0 per cent.

Both markets are facing oversupply and, therefore, renters have a lot of choice, and negotiating power.

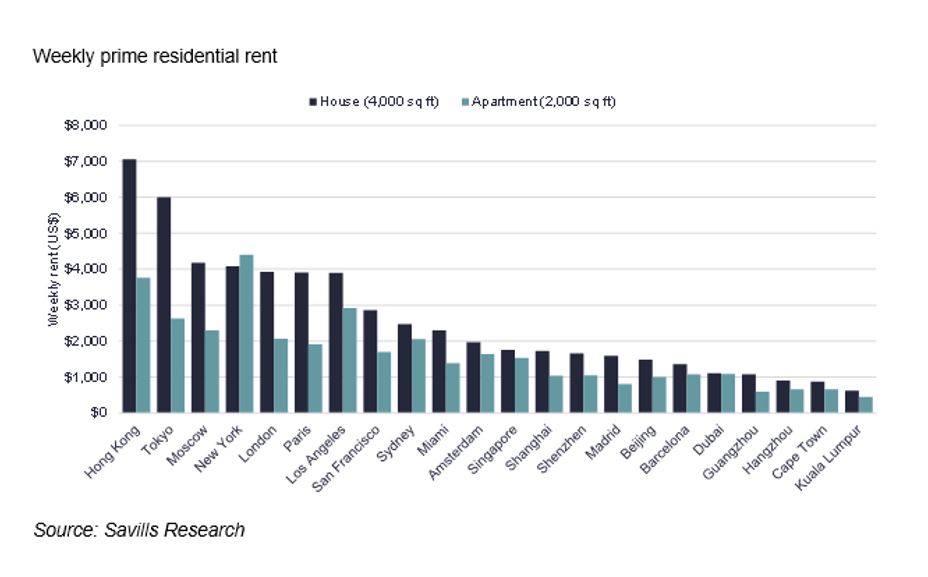

When it comes to weekly rents for a prime house, Hong Kong remains top of the price league at just over $7,000 per week.

However, when it comes to the apartment market, it is tipped by New York, the only city in the index where the average weekly rent for an apartment is higher than a house.

This reflects the high-quality supply of apartments at the top end of the market and their prime locations.

According to Paul Craig, CEO, Savills Australia and New Zealand, housing values in every Australian state capital rose in January, demonstrating price recovery as a direct response to the RBA’s easier monetary conditions and lower interest rates.

“Melbourne and Sydney lead the Residential price reflation, with Perth showing signs of coming out of its 5.5 year slump," said Mr Craig.

“Sydney and Melbourne are still leading the recovery and perhaps highlight current interest rate settings are creating a 2-speed Residential economy that could be exacerbating a Resi price bubble again.

“According to CoreLogic Brisbane, Adelaide, Hobart and Canberra are posting new record highs, while Sydney needs to recover another 5.4 per cent and Melbourne 1.2 per cent.”

Chris Orr, Director, Residential at Savills Australia said Prime housing in Sydney is currently benefiting from an increased number of wealthy migrants from the Asia Pacific region.

“With the local issues in some parts of the region encouraging migration, coupled with the limited ability to purchase for non-residents, the Prime markets are seeing a renaissance similar to pre-GFC levels for leasing inquiry when priced appropriately," said Mr Orr.

“While this hasn’t increased rental prices as you would expect, it has helped stabilise this end of the market where it had typically been a tough proposition to find tenants for Prime leases over the past couple of years.

“With the increased number of apartments being delivered in Sydney over that past couple of years there has been a dip in capital values in this segment, while rents have been steady for the period and aren’t currently increasing, we are seeing capital values now return close to 2017 peak levels which is further reducing the yield on Prime Assets."

Similar to this:

Tempted by favourable investment conditions in Europe and the UK?

Highest rental yields are in Blackwater, according to CoreLogic report