Fifth monthly increase in Home Value Index: CoreLogic

Contact

Fifth monthly increase in Home Value Index: CoreLogic

CoreLogic’s national Home Value Index has recovered from its trough in June this year by 4.7 per cent.

CoreLogic’s national Home Value Index surged 1.7 per cent higher over the month and delivered the fifth consecutive monthly increase, coupled with the largest monthly gain in the national index since 2003.

Since finding its trough in June earlier this year, the national dwelling value index has recovered by 4.7 per cent.

Although values are recovering rapidly, at a national level home values remain 4.1 per cent below their 2017 peak, tracking roughly at the same level as recorded in the January 2017 index results.

At a glance:

- Home values have increased over the month by 1.7 per cent

- National level home values are still 4.1 per cent below the 2017 peak

- Dwelling values have been trending lower since mid-2014

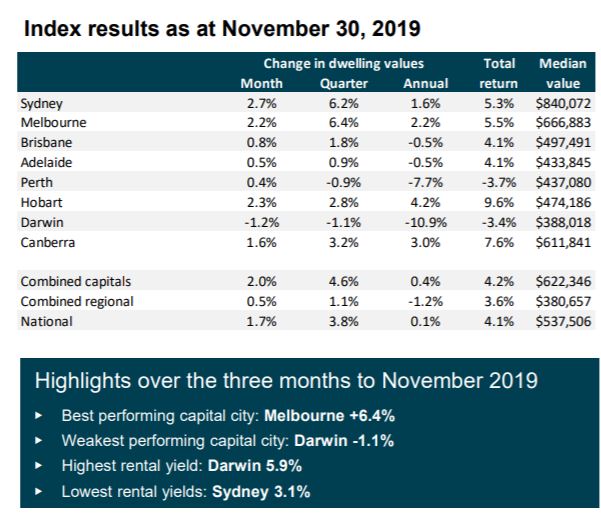

Sydney and Melbourne continued to drive the rapid recovery, with values up by 2.7 per cent and 2.2 per cent respectively over the month.

All remaining capital cities, excluding Darwin, demonstrated a broadening in the geographic scope of this upswing with values rising over the month.

In a significant turn of events for the Perth market, values edged 0.4 per cent higher in November; the first month-on-month rise in dwelling values since the downtrend took a pause in early 2018.

Source: CoreLogic

Dwelling values have been trending lower since mid-2014, down a cumulative 21.3 per cent through to the end of November.

Over the past thirteen years, Perth has seen house values move from being the most expensive across the capital cities to now be the lowest; great news for first home buyers, however Perth home owners have seen a material reduction in their wealth over the past five and a half years.

The November results have seen CoreLogic’s national index nudge back into positive annual growth territory for the first time since April 2018, with dwelling values 0.1 per cent higher over the past twelve months.

Four of Australia’s capital cities moved back into positive annual growth, led by Hobart (+4.2 per cent), Canberra (+3.0 per cent), Melbourne (+2.2 per cent) and Sydney (+1.6 per cent), while the largest declines remain in Darwin (-10.9 per cent) and Perth (-7.7 per cent).

21 Miller St, West Melbourne is for sale by agents Gordon Bardic and Trevor Gange of Jellis Craig. Photo: Luxury ListAccording to Tim Lawless who heads up CoreLogic Research, a variety of factors are supporting the strong gains in housing values.

“The synergy of a 75 basis points rate cut from the Reserve Bank, a loosening in loan serviceability policy from APRA, and the removal of uncertainty around taxation reform following the federal election outcome, are central to this recovery," said Mr Lawless.

“Additionally, we’re seeing advertised stock levels persistently low, creating a sense of urgency in the market as buyer demand picks up.

"There’s also the prospect that interest rates are likely to fall further over the coming months and an improvement in housing affordability following the recent downturn are other factors supporting a lift in values.”

Housing values are generally rising across the regional areas of Australia, but the recovery trend is milder relative to the capital cities.

CoreLogic’s combined capital cities index is 4.6 per cent higher over the past three months with values recovering by 5.7 per cent since bottoming out in June.

The combined regionals index is up a smaller 1.1 per cent over the past three months and values have recovered only 1.1 per cent since finding a floor in August.

Across the broader regional areas of the states, Tasmania is seeing the strongest growth with values up 2.2 per cent over the past three months, followed by Queensland (+1.8 per cent), New South Wales (+1.2 per cent) and Victoria (+1.0 per cent).

Similar to this:

Housing downturn loses some steam with CoreLogic House Value Index down 0.6% in March

'Subtle' home value rises in major markets during June

National dwelling values increase for the first time since October 2017