As population grows, house affordability diminishes

Contact

As population grows, house affordability diminishes

Strong population growth to deteriorate affordability in Sydney and Melbourne, according to Riskwise

While the recent property downturn improved asking prices and serviceability, affordability in Sydney and Melbourne remains the big issue due to extremely high population growth.

RiskWise Property Research CEO Doron Peleg said house-to-income ratio and the mortgage serviceability ratio (the ratio between the median household income and the amount required to service a discounted variable loan, based on an 80 per cent LVR) were key measures of serviceability and a major problem in the two capital cities.

He said while price reductions in the order of 11 to 15 per cent in Sydney and Melbourne had significantly improved affordability, houses in NSW remained the most unaffordable in Australia while Victoria was also unaffordable for people on an average income.

At a glance:

- Houses in NSW the most unaffordable in Australia

- Price-to-income ratio as well as mortgage serviceability ratio are still very high

- House prices in Sydney and Melbourne likely to reach new record in next 12 to 24 months

“While housing affordability has improved, the price-to-income ratio as well as mortgage serviceability ratio are still very high,” said Mr Peleg.

“This is largely due to the strong population growth in these major cities that lead to price increases and, as we projected following the May election results, a removal of the uncertainty regarding political changes and the forecast taxation reforms had Labor won.

“In addition, lending restrictions are not quite as severe, and this all means that dwelling prices in Sydney and Melbourne have slowly been increasing in value and are very likely to reach a new record within the next 12 to 24 months.

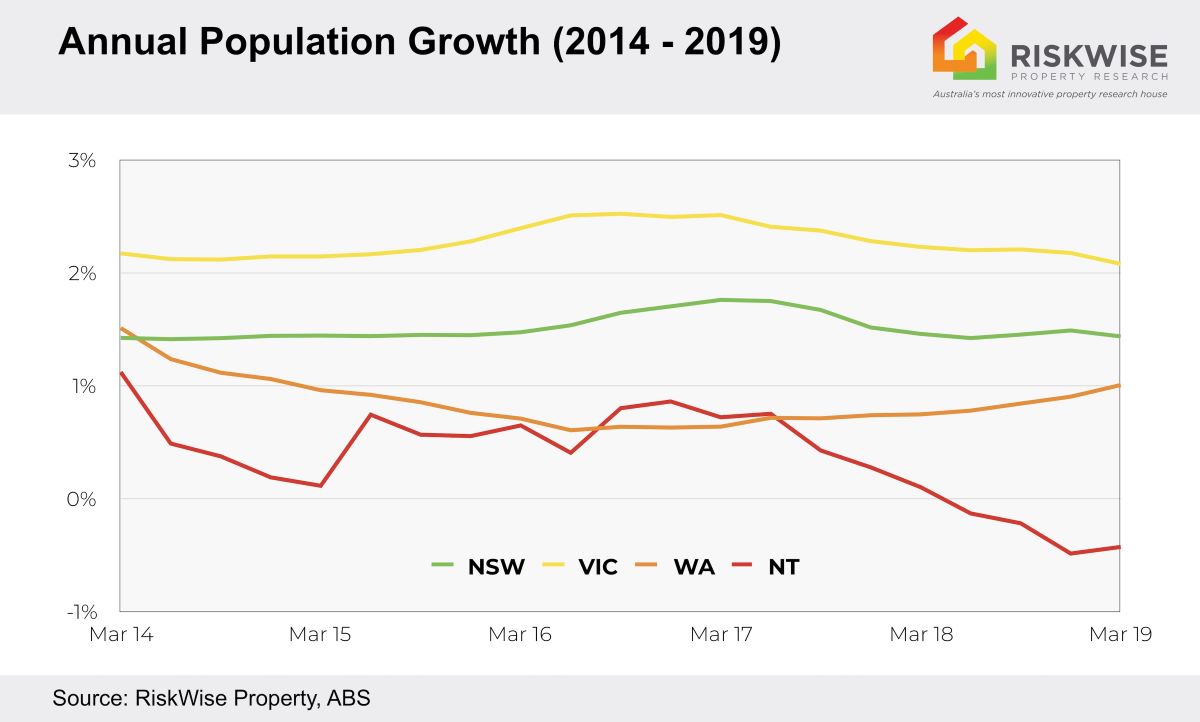

“The key problems we have is imbalances between house and unit supply compared to the very strong population growth in what are effectively global cities. This population growth is largely driven by strong employment opportunities in these multicultural cities that receive external migrants extremely well.”

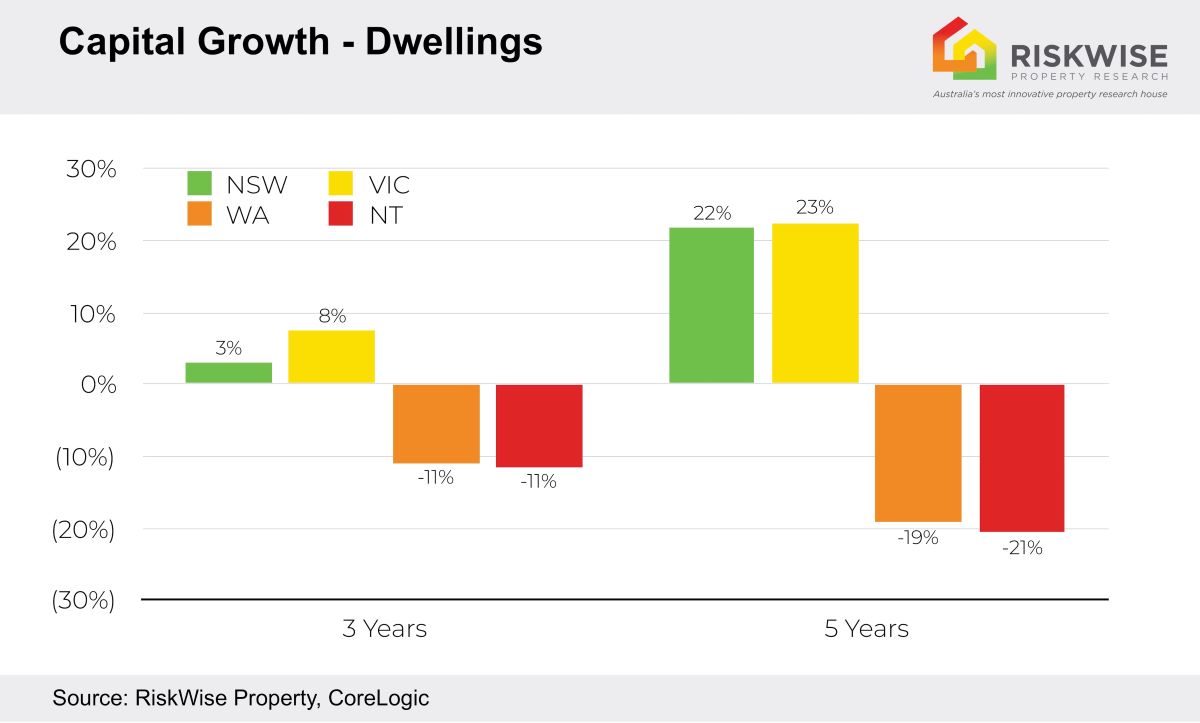

Mr Peleg said the connection between employment, population and property prices had been clearly demonstrated. Price growth in NSW and VIC were positive in the past three years, although there was a major downturn in the market and a massive unit oversupply in many areas in NSW and Victoria.

On the other hand, Perth and Darwin were hit hard by the end of the mining boom with population decreases as job seekers left these states in search of employment.

This, in turn, affected house prices which have either stagnated or fallen further.

Mr Peleg said the population growth, job creation, improving economy and good infrastructure that Sydney and Melbourne were experiencing would draw even more people to these cities and, therefore, increase demand for property, with population forecasters expecting both to hit the eight million mark by 2050.

He said in the current environment of already high prices it would be way more difficult to compete with property investors, and it would be harder for first home buyers to put a deposit together and secure finance. In addition, generally, investor activity significantly increased when there were low interest rates and low out-of-pocket expenses.

“We expect to see investors increase their activity in the market as it is currently well below peak and this will put further pressure on dwelling prices and housing affordability,” Mr Peleg said.

“These imbalances in the market cannot be resolved without a strategic solution and co-ordinated plan by all levels of government.

“While it’s true that part of the solution lies in developing the middle rings of these cities with family-suitable accommodation close to transport hubs and schools, that is only a short to medium-term response that will eventually stop working when demand once again overtakes supply.

Mr Peleg said it comes down to undersupply of suitable dwellings that force the price up and make them completely unaffordable.

“The gap between the household income people need to buy an inner-city unit of just 105sqm in Sydney and Melbourne that is suitable for families and their actual income is so huge a household with the median income would really struggle to afford one," said Mr Peleg.

“We simply go back to square one of undersupply of family-suitable properties, lower interest rates, increased investor activity and then first home buyers who will be left behind with the creation of two classes - ‘the-haves and the have-nots’.

Mr Peleg said the 2018 Building Up & Moving Out report, which details a ‘national plan of settlement’ focusing on population, employment, the economy of cities and regions, socially and environmentally sustainable development and connectivity between the cities and the regions with an emphasis on housing affordability, was a step in the right direction.

The report states rapid population growth, insufficient and slow land supply, onerous planning regulations and taxation policies (supporting housing as investment rather than as a place to live) are key causes of housing unaffordability.

It recommends the Australian Government develop a framework for the development of cities and regions outside the major metropolitan centres, undertake the development of transport networks which allow for fast transit between cities and regions, ensure urban and regional infrastructure is developed and the appointment of a Minister for Cities and National Settlement.

“By reducing the population of major cities and encouraging people into regional areas, you affect supply and demand of housing and, therefore, affordability. If there is less demand, it follows that prices should drop,” he said.

“The solution is to encourage development of larger regional areas and ensure they are well serviced by infrastructure and jobs to attract people away from the traditional employment hubs.”

Visit www.riskwiseproperty.com.au

Similar to this:

Housing affordability improves while rental affordability declines: report

House price expectations become positive, yet housing affordability remains a big issue

Housing choice and affordability key to Victorian Government's 20-minute neighbourhoods