Combined capital city clearance rate expected to reach highest point since May 2017

Contact

Combined capital city clearance rate expected to reach highest point since May 2017

The final weekly clearance rate for the combined capital cities is expected to hold above 70 per cent for the first time in more than two years, according to the latest data.

The nation's capital has led the preliminary clearance rates for the week ending August 18, coming in ahead of the two major markets.

CoreLogic's weekly market wrap revealed Canberra returned a preliminary clearance rate of 81.8 per cent from 24 auctions, while Sydney was next with 81.7 per cent from 444 auctions.

Three other capital cities recorded preliminary rates of above 70 per cent, contributing to a combined capital city rate of 76.6 per cent.

CoreLogic expects the revised figure to stay above 70 per cent for the first time since May 2017.

CoreLogic research analyst Kevin Brogan told WILLIAMS MEDIA while the results "felt significant", it would be interesting to see whether the clearance rates could keep up with a potential spring surge in listings.

"If you look at the clearance rates across the last couple of months, they've consistently been at that higher level, but it's not immediately apparent from the data if there is sufficient demand to maintain these clearance rates if an extra 500 properties a week hit the auction market," he said.

"There's no doubt the addition of that supply will exercise downward pressure on clearance rates."

Sydney

Sydney's auction market experienced an increase in volume and clearance rate from the previous week, returning a preliminary rate 81.7 per cent from 444 auctions, in comparison with 81.2 per cent from 367 auctions for the week ending August 11.

Real Estate Institute of NSW President Leanne Pilkington believed there was enough momentum in the market to carry over into Spring.

"With many auctions selling above reserve, agents are confident that buyer demand will see an increased level of properties coming onto the market in the spring selling season," she said.

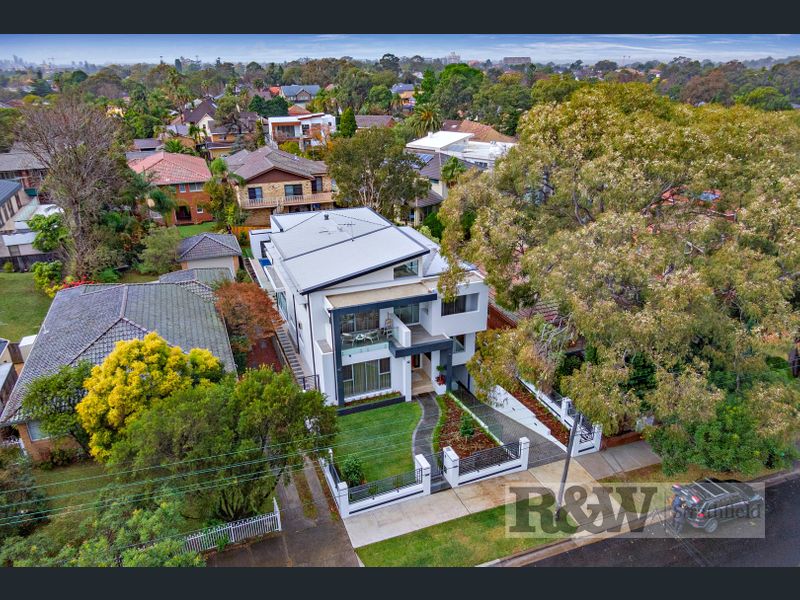

10 Chalmers Road, Strathfield, NSW was sold for $6 million through Richardson and Wrench's Lawrence Chong and Chris Virgona. As seen on The Home Page.

Melbourne

Melbourne was host to 588 auctions for the week ending August 18, returning a preliminary clearance rate of 78.3 per cent.

The previous week saw 500 homes taken to auction across the city, returning a final clearance rate of 72.3 per cent.

Over the same week last year, a clearance rate of 54.0 per cent was recorded across 860 auctions.

Real Estate Institute of Victoria CEO Gil King said the city's auction market was evenly spread across Inner and Middle Melbourne.

"The number of auctions held evenly matched for Inner and Middle Melbourne last week, both holding 166 auctions each, with an average clearance rate of 80 per cent," he said.

"The top three suburbs all cleared their listings, Kew with 11, Doncaster East sold nine and Mount Waverly with eight.

“Last week, a record auction price for 2019 in Victoria took place in 19 Sargood Street in Toorak, which sold for $7,050,000.”

Brisbane

Brisbane saw higher auction volumes week-on-week while Adelaide, Canberra, Perth and Tasmania all saw fewer homes taken to auction.

Apollo Auctions had an average attendance of 20.4 people, with 2.3 registered bidders.

Auctioneer Justin Nickerson said a clearance rate of 53.8 per cent was a continuation of the improvement experienced so far in the back half of the year.

"Registered bidders were again out in force with an average of 2.3 of which over 60 per cent participated in the auction," he said.

"The warm weather also played it’s part, with crowd numbers again strong across the majority of auctions returning an average of in excess of 20 people per auction."

Among the big sales to occur away from auction was 10/170 Bowen Terrace, New Farm, which sold for more than $6 million to an international buyer.

Selling agent Sarah Hackett of Place Bulimba said the home multiple offers and had more than 13,000 views online before going under contract after six weeks.

Similar to this:

Auction clearance rates continue to climb in major markets over June quarter

Start of winter brings lower volumes as clearance rates continue to creep up