Modest recovery not enough for fleeing investors

Contact

Modest recovery not enough for fleeing investors

The first six months of 2019 has seen overall transactions for this year down 1.9% on 2018, and down 0.5% in cumulative value. Across the state, house prices increased 4.2% over the six months whilst units were up 6.6% and land rose 7.5%.

The market has somewhat rebounded from pre-election jitters, according to Real Estate Institute of Tasmanian figures for the June Quarter.

Although the figures indicate the recovery was modest, it did see transactions for this quarter increase by 7.7% to 2843 sales, and the gross value of sales reach $1.054 billion. Both figures were down marginally on the June 2018 Quarterly results.

REIT President Tony Collidge said, "Whilst there was clearly an improvement in activity within the market place following the federal election, it is evident that our market is transitioning to a more balanced environment."

At a glance:

- The market has somewhat rebounded from pre-election jitters, according to Real Estate Institute of Tasmanian figures for the June Quarter.

- The first six months of 2019 has seen overall transactions for this year down 1.9% on 2018, and down 0.5% in cumulative value. Across the state, house prices increased 4.2% over the six months whilst units were up 6.6% and land rose 7.5%.

- The biggest shock has been the continued withdrawal of investors from our market (down 10.9%). In 2018, 2504 investors purchased rental properties across the state. In the first half of 2019, the number was 979.

Mr Collidge also said that while a reduction in interest rates improved affordability, it doesn’t appear to have significantly impacted sales numbers.

"I believe that the strong price and rental growth of yesterday’s market is now behind us and that a much more modest level of momentum in our market will occur."

The first six months of 2019 has seen overall transactions for this year down 1.9% on 2018, and down 0.5% in cumulative value. Across the state, house prices increased 4.2% over the six months whilst units were up 6.6% and land rose 7.5%.

The markets varied across the three major population zones with activity remaining very strong on the North West Coast with house sales up 6.4%; Launceston easing down just 0.6%, and Hobart slowing more rapidly down 3.5%.

The biggest shock has been the continued withdrawal of investors from our market (down 10.9%). In 2018, 2504 investors purchased rental properties across the state. In the first half of 2019, the number was 979.

Source: REIT

The results showed that mainland purchaser numbers are also down significantly (12.6%) on last year. Traditionally mainland buyers account for between 20-25% of total sales, with foreign buyers less than 1%. More than half of the mainland buyers are buying property to reside here. This year, mainland buyers are down by 12.6%.

Other highlights of the June 2019 Quarter included Hobart's recorded 534 house sales at a median price of $520,000. Whilst the median price was up 2.8% on last year the number of sales continues to decrease (down 7.8%). Additionally, Launceston recorded 332 sales at a median price of $335,000 with both sales numbers down 7.5% and prices -1.2%. The North West Coast market saw a 15% increase in transactions and a 0.4% increase in prices (median $279,000).

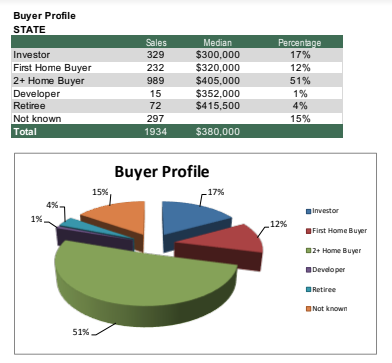

Further, first home buyer numbers have retracted (down 5%) from the previous quarter but return to the traditional level of the past couple of years (12% of all house sales). Investors were at 17%, up 1% on March Quarter but well down on their historical average of 20-25%.

Investors remain strongest in Launceston where they account for 28% of all sales. Hobart and the North West were 18% each. Like investors, interstate buyers were well down on their traditional 20-25% market share at just 18% of all sales.

Source: REIT

The results also highlighted the average selling time for property crept out to 34 days an increase of two days over the quarter. And Sandy Bay pipped Acton Park for Tasmania’s most expensive suburb achieving a median price of $939,000 from 32 sales.

Queenstown and Roseberry provide some of the most affordable living in Australia with median prices below $100,000 for their 35 sales. Devonport sold the highest number of properties with 56 sales. Launceston remained the highest selling Municipality with 397 sales, followed by Clarence and Glenorchy.

"REIT data captured over the quarter showed a strong improvement in activity in April; a robust May and softening in sales numbers in June. What has become evident from these results is that the unavailability of stock in Hobart and Launceston, in particular, has almost brought the market to a standstill," Mr Collidge said.

He added that the withdrawal of investors is a major concern and will only impact the broader economy as we struggle to cater for the housing needs within our communities.

"The inability of Government or Municipal Councils to make proactive decisions on urban development and infrastructure needs will have dire consequences into the future.

"Unfortunately, the lack of strategic foresight and a common sense to planning could see both investors and developers looking to leave the state in pursuit of opportunities elsewhere," he said.

"This is something Tasmania can’t afford! We need to develop diverse accommodation not only to meet current needs but those of the future. By increasing housing supply, we can create an environment which is more conducive to affordability and meeting buyer needs," Mr Collidge said.

For more REIT industry reports click here.

Similar to this:

Tasmanian sellers 'need to readjust expectations', says REIT

We need brave and strong leadership to tackle these issues" says REIT President

"People are hurting" says Tony Collidge, REIT, on strong growth in the Tasmanian housing market