Residential construction costs outpace inflation - CoreLogic

Contact

Residential construction costs outpace inflation - CoreLogic

New South Wales continues to record the highest residential costs increase, up 4.5% on an annual basis, while Western Australia has the lowest rate at 2.9%, according to the latest CoreLogic CHIP Report.

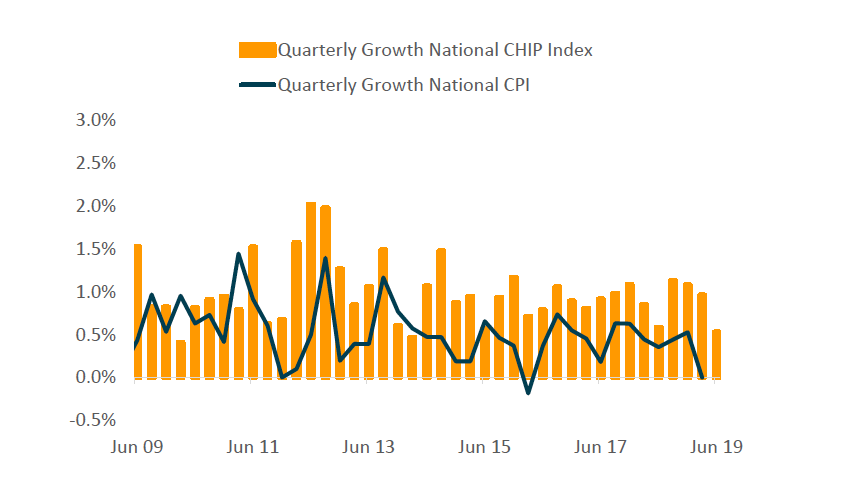

The latest CoreLogic CHIP Report shows that at a national level, residential construction costs were up 0.5% over the June quarter and 3.8% higher over the year, continuing a trend where the cost of building residential projects continues to outpace inflation.

The NSW Chip Index showed residential construction costs were up 0.6% over the June 2019 quarter, the slowest growth rate since June 2018 and down from the 1.0% reading recorded for the March 2019 quarter.

New South Wales has also continued to record the highest residential costs increase, up 4.5% on an annual basis, while Western Australia has the lowest rate at 2.9%.

CoreLogic commercial research analyst James Shang said, “Although construction costs are rising at a faster pace than inflation, the trend is pointing towards an easing in the growth rate, attributable to a slowdown in activity for residential construction projects.”

At a glance:

- The latest CoreLogic CHIP Report, which uses data from the Cordell Construction database, shows at a national level, residential construction costs were up 0.5% over the June quarter and 3.8% higher over the year, continuing a trend where the cost of building residential projects continues to outpace inflation.

- New South Wales has also continued to record the highest residential costs increase, up 4.5% on an annual basis, while Western Australia has the lowest rate at 2.9%.

- Victoria is also moving through a historic peak in unit construction and is experiencing some challenges due to an oversupply in specific sectors of the market. The number of new unit projects reported as commencing in 2019 is less than half that recorded in the preceding 12 months.

According to Cordell construction data, NSW is tracking strongly for new applications and projects commencing construction in the commercial development market, driven by infrastructure investment and community projects funded mainly by the State Government and the private sector.

NSW unit construction peaked in 2018; despite a material supply overhang within the unit sector, with a material slump in high rise dwelling approvals. The number of new approved unit and apartment projects for May is approximately 75% of the three-year median while the total value of unit projects reported as commenced construction is 63% lower on a rolling 12-month basis.

The latest indicators to the end of June showed 62% of Sydney off the plan apartments were settling with a valuation lower than the contract price which could present headwinds for developers seeking finance for new projects.

Additionally, data from the Australian Bureau of Statistics show that residential building approvals peaked in 2018 and thereafter, continued to trend downwards.

Mr Shang said, “As this trend unfolded, a mini infrastructure boom come into play, creating a knock-on effect which saw greater demand for material and labour which created further upwards pressure on building costs.”

Since the second half of 2018, the number of projects moving into the construction phase has contracted sharply.

Source: CoreLogic.

Mr Shang added, “The heavy decline in projects moving to construction translates to a fall in demand for building supplies and labour, which has resulted in a slowdown in the rate of increase in construction costs for two consecutive quarters.

“We are seeing the first signs that the divergence between the rate of increase in residential building costs inflation starting to decelerate.

“We have seen several other policy announcements that are likely to support improvement in housing market activity. Namely, the Reserve Bank slashing of the cash rate by fifty basis points, taking the official cash rate to a record low of 1.0%," he said.

"In addition, APRA confirmed its decision to remove the 7% serviceability floor on mortgage lending, switching to a 2.5% buffer on mortgage rates, and legislation was passed for tax cuts targeting low-income earners, which will see $7.6 billion in tax refunds paid out to low-income earners.

"While these measures are likely to provide some stimulus to the housing sector, the headwinds of tight credit conditions, lower business confidence and a slowdown in the economic momentum nationally are likely to dampen the construction sector over the second half of this year," Mr Shang said.

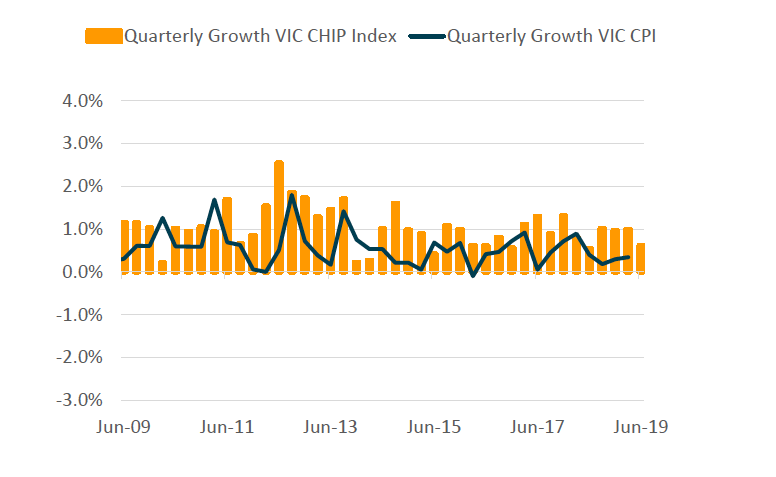

Victoria CHIP Index recorded a 0.6% rise over the June quarter, with the quarterly growth rate unchanged from the previous quarter.

Similar to NSW, Victoria has also experienced record levels of construction in infrastructure projects, however, the quarterly growth in residential construction costs across Victoria appears to be levelling out and edging closer to matching the CPI growth rate.

Victoria is also moving through a historic peak in unit construction and is experiencing some challenges due to an oversupply in specific sectors of the market. The number of new unit projects reported as commencing in 2019 is less than half that recorded in the preceding 12 months.

Source: CoreLogic.

In Melbourne, 46% of off the plan units are settling with a valuation lower than the contract price causing lenders to remain cautious of the lending/settlement risk that exists within this sector.

Residential construction project tracking by Cordell indicates over 5,000 projects with a total estimated value over $60 billion possibly getting off the ground in 2019 and 2020, this activity along with a surge in commercial and community development projects currently underway are likely to put upward pressure on building costs.

According to the CHIP index, residential construction costs for Qld rose by 0.5% over the June quarter of 2019. This increase is the lowest growth rate recorded since June 2010. The most recent figures for Queensland’s CPI report an increase of just 0.09% compared to the previous period.

The impact of a contracting natural resource sector is evident with the number and value of commercial property construction projects in Qld continuing to trend lower in 2019.

Mining and construction are the two largest contributors to the Queensland economy. The downturn in the mining industry has resulted in a large fall in mining projects with both the number of new projects approved and commencing construction 60% lower on a rolling 12-month basis.

Major project tracking by Cordell indicates overseas investors are planning the construction of large scale tourist resorts in North Queensland and an increase in residential housing construction planned for 2020 which should provide a welcome boost for the state’s economy, and potentially place some upwards pressure on residential construction costs.

The nominal quarterly growth in the CHIP index for WA was 0.4%, well down from the recent high of 1.0% in September 2018. The annual growth rate in construction costs dropped from 3.2% to 2.9% while the most recent CPI rate for Western Australia reports that the state’s CPI fell by 0.1%.

The construction sector remains subdued across the state, with low activity recorded for residential and mining projects in terms of both volume and value. On a rolling 12-month basis, the number of mining projects commencing construction is 75% lower than the previous period.

There are early signs of a lift in jobs growth and the most recent reporting on construction projects for WA shows a lift in the number of approved mining sector projects and a surge in the value of projects commencing construction.

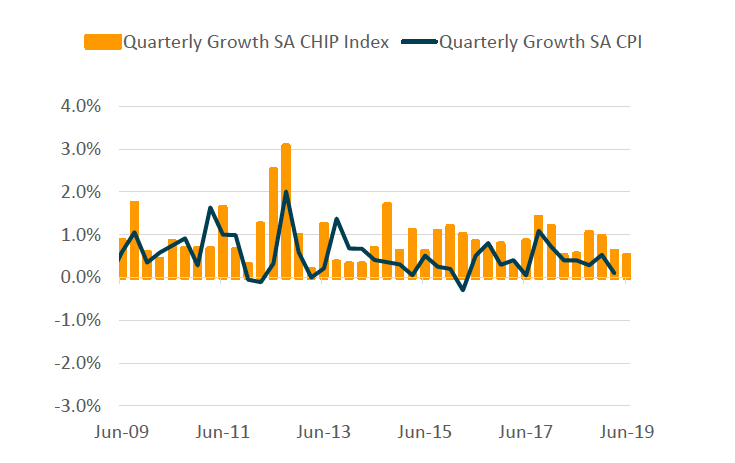

South Australia continues to report the lowest CHIP Index at 265.8. Quarterly growth in the CHIP Index was 0.5%, down slightly from 0.6% in the previous quarter.

Source: CoreLogic.

Quarterly growth in the SA CHIP has continued to trend lower since September 2018 with activity across the construction sector currently below average, with the number of project applications approved and projects commencing construction tracking 25% below the previous period on a rolling 12-month basis.

While the Southern Australian construction industry has been subdued, reported increases in community and civil engineering projects, as well as the approval to expand the Carrapateena Block Cave mine at an estimated cost of $1.3bn, will provide a boost to the state and potentially place some upward pressure on residential construction costs.

Source: CoreLogic.

Click here for more information on the report.

Similar to this:

Residential building construction to slip after $68.7 billion "all-time high"

ArchiStar.ai survey offers property developer industry snapshot