Mortgage Choice data shows fixed rate demand lowest in eight years

Contact

Mortgage Choice data shows fixed rate demand lowest in eight years

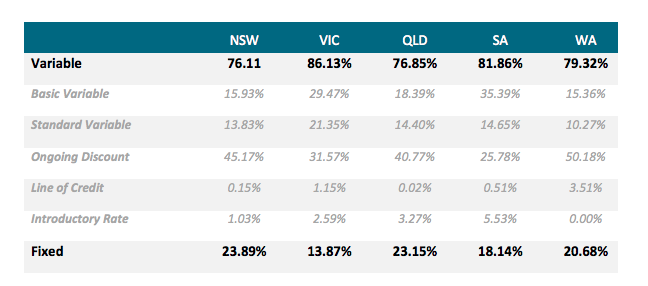

June approval data revealed that variable rate demand was highest in Victoria, where 86% of borrowers opted for this type of product. This was followed by South Australia (82%), Western Australia (79%), Queensland (77%) and NSW (76%).

Demand for fixed-rate home loans fell in June, accounting for 21 per cent of all home loans written, according to new data from Mortgage Choice.

Mortgage Choice Chief Executive Officer Susan Mitchell said, “This drop in demand for fixed loans is hardly surprising when you consider the spate of variable interest rate reductions that followed the two consecutive cash rate cuts from the Reserve Bank. A snapshot of approval data from last week suggests borrower preference for variable loans is growing.

“If we look at the split of variable-rate and fixed-rate home loans at the end of last week, we can see a clear shift towards variable rate loans. In fact, this type of loan product accounted for 86.5% of home loan applications submitted by our broker network, and only 13.5% of customers chose to fix.

"What is truly shocking about this data is that demand for fixed-rate loans has not been this low in almost eight years,” said Ms Mitchell.

Source: Mortgage Choice.

The June approval data revealed that variable rate demand was highest in Victoria, where 86% of borrowers opted for this type of product. This was followed by South Australia (82%), Western Australia (79%) and Queensland (77%).

Borrowers in New South Wales were the least likely to apply for a variable rate home loan with 76% choosing this type of product.

Ms Mitchell said both the weekly and monthly data indicate that borrowers know there are great deals to be had. The high level of demand for variable rate loans with an ongoing discount reveals that many customers are receiving a discount on packaged home loans beyond what lenders are offering.

"This increase in demand is a combination of our brokers negotiating a better rate with lenders and customers actively asking for a better rate.

“With such great deals to be had, it would be a shame for any borrower to be complacent when it came to the interest rate they’re paying on their loan. For most of us, our home loan is our most significant debt, so you are really doing yourself a disservice by being afraid to haggle," she said.

“That being said, I think it’s important for borrowers who may be considering a fixed rate to know that we have seen a significant reduction in fixed rates offered by the lenders on our panel, which suggests that the outlook is for rates to remain lower for longer.

“If you are seeking home loan repayment certainty going forward, there are great deals on the market, with fixed rates as low as 3.09% p.a.1 , high-quality borrowers will be in a great position to negotiate," Ms Mitchell said.

Similar to this:

Housing finance figures show cautious optimism, Mortgage Choice

New data shows 'unsurprising' growth in demand for fixed home loans