Sharpest fall to the shallowest bottom - HIA economist on rise in housing affordability

Contact

Sharpest fall to the shallowest bottom - HIA economist on rise in housing affordability

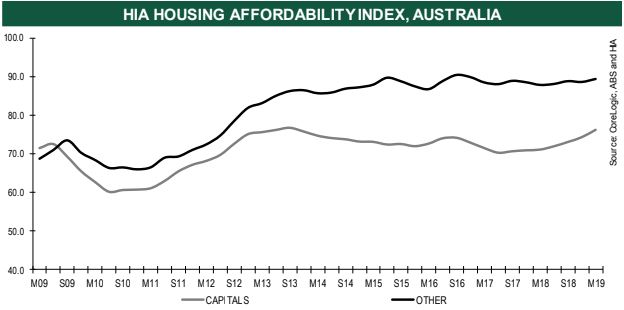

The HIA Affordability Index rose by 2.2 per cent in the March 2019 quarter to post the most significant improvement in affordability since September 2013.

The sharpest rise in housing affordability since 2013 is a result of the "pent up" demand experienced in Sydney and Melbourne throughout the past two decades finally being met, according to the Housing Industry Association.

The HIA Affordability Index rose by 2.2 per cent in the March 2019 quarter to post the most significant improvement in affordability for nearly six years.

The index is calculated for each of the eight capital cities and regional areas on a quarterly basis and takes into account the latest dwelling prices, mortgage interest rates and wage developments.

At a glance:

- The HIA Affordability Index rose by 2.2 per cent in the March 2019 quarter, representing the sharpest increase since September, 2013.

- According to HIA, the improvement was most significant in the east coast cities.

- The boom in home building across the past five years is believed to have been a factor in the trend.

HIA Chief Economist Tim Reardon told WILLIAMS MEDIA the rise had come from the supply of new homes finally catching up with demand.

"We had 20 years of mismanagement when it came to the supply of new homes, which meant there weren't enough homes to satisfy demand, and house prices went up as a result," he said.

"Now we are seeing a sufficient number of homes being built to meet demand, meaning that new home building has declined significantly."

In its quarterly economic and industry outlook released last week, HIA's preliminary data suggested that the housing market has adjusted from a strong annualised rate of home building of around 220,000 homes per year this time last year, to around 183,000 at the start of 2019.

Mr Reardon said while the correction had occurred much quicker than they had anticipated, the historical context of the data had to be taken into account.

"What we've found is that consumers are very poor at picking the bottom of the housing price cycle," he said.

"We usually only know what the bottom was three to six months after we have been there.

"For home builders, the correction occurring in the market is quite painful, but from a national policy perspective, this is the sharpest downturn we have seen in 20 years to what will be the shallowest drop.

"It's been a sharp rate of decline, but we will probably end up where we were in 2012/13 which, at the time, were fairly reasonable years.

Source: HIA

Rapid east coast improvement

According to the HIA Affordability Index, improvement in housing affordability has been experienced across the country, with the exception only of Tasmania and the ACT, where ongoing house price growth has seen affordability remain static.

Mr Reardon was most significant in the east coast capital cities.

"Affordability in Sydney deteriorated to an extent that in June 2017 it required two average Sydney incomes to be able to afford repayments on an average Sydney home," he said.

"In just over a year this has improved to only requiring 1.8 standard incomes to purchase the same home.

“Similarly, in Melbourne, the Affordability Index has improved by almost 10 per cent in a year."

Five of the eight capital cities saw improved affordability over the year to March 2019. Sydney continues to be home to the greatest improvements, its index is up by 12.4 per cent.

This was followed by Melbourne (+9.6 per cent), Perth (+7.7 per cent), Darwin (+5.9 per cent) and Brisbane (+2.5 per cent). Affordability deteriorated in Hobart (-5.1 per cent), Canberra (-5.1 per cent) and Adelaide (-1.1 per cent).

Similar to this:

New home sales show signs of stabilising - HIA

Skilled migration crucial to housing - HIA

Australia must maintain record rate of housing supply: HIA report