New home sales show signs of stabilising - HIA

Contact

New home sales show signs of stabilising - HIA

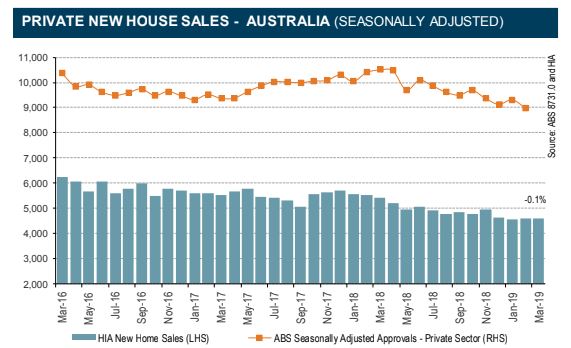

New research by HIA has revealed that new home sales appear to have stabilised in the first quarter of 2019.

A stabilisation in new home sales in the first quarter of 2019 indicates the credit squeeze may be beginning to ease, according to a Housing Industry Association Senior Economist.

The HIA released its New Home Sales report for March this week, showing a significant increase in growth for three of the five mainland states.

New South Wales (4.8 per cent), South Australia (8.6 per cent) and Western Australia (2.3 per cent) all experienced an increase in new home sales compared to the previous month, while Queensland experience a decrease of 4.7 per cent and Victoria was down by 2.9 per cent on the month of February.

HIA Senior Economist Geordan Murray said the figures reflected a market "adjusting to the new lending norms".

"After falling by 8.5 per cent in 2018 new home sales appear to have stabilised in the first quarter of 2019,” he said.

“Given the rapid decline in new home sales throughout 2018, this moderation in the fall in new home sales suggests that the credit squeeze is easing.

Source: HIA

“The credit squeeze impacted the market at a time when the natural housing cycle was already beginning to cool.

"Banks reduced the amount of money they were willing to lend and the time it took to get a loan approved blew out."

Lending will be in the spotlight this month as the Reserve Bank of Australia meets next week ahead of the Federal election on May 18.

Mr Murray said while there should be a clearer picture of the market's immediate future following the election, policies could dictate whether there is a rise in sales following the poll.

“There is uncertainty surrounding the federal election, which typically subdues new home sales and approvals as investors and owner occupiers put decisions on hold until after the election," he said.

"The election result will rectify this uncertainty but the potential for higher taxes on housing means a post-election rebound in sales may not eventuate,” he said.

More from Geordan Murray:

Victoria still tops the Housing Scorecard...for now