REIV launches Residential Market Index

Contact

REIV launches Residential Market Index

The Real Estate Institute of Victoria has unveiled a new tool to measure property price trends.

Data on property price trends in Victoria is set to be made more readily available through the Real Estate Institute of Victoria's Residential Market Index.

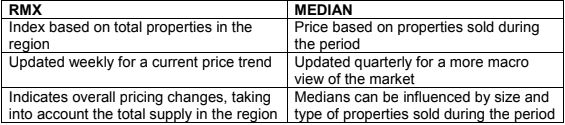

Launched on Thursday, April 18, the RMX is designed to give sellers and buyers a more accurate and up to date reflection on current price trends by taking into account the total properties in Victoria.

The index was developed in consultation with experts from the Reserve Bank of Australia and Deakin University and uses a similar methodology to the Australian Bureau of Statistics (ABS) Residential Property Price Index

REIV President Robyn Waters said the research tool builds on the REIV’s quarterly median price reports.

“The REIV Residential Market Index is, like any other index, a number," she said.

"Just as the ASX200 index allows investors to understand the strength of the Australian stock market, the RMX allows us to understand the residential property market in Victoria.

Source: REIV

"The REIV will continue to report on median prices quarterly but medians are determined by the type of properties that sell during a particular quarter: if a large number of prestige properties sell in a quarter, the median will go up even if the local market is stable.”

“The RMX sets a new standard in the availability of information that is truly reflective of the housing market right now."

The current RMX Index reference period is 2016 = 100.0 to match prices with the most recent ABS census data.

This means that the weighted average of property prices in 2016 was given a value of 100.0 and price movements over time are relative to this ‘base’ reference period.

Ms Waters said the RMX was quite volatile over 2018, ranging from 118.2 to 132.6 and it is currently recovering from the usual early year drop in price, although the drop has been more severe than in recent years and currently stands at 114.1.

“In simple terms, the current RMX value of 114.1 means that properties in Victoria at the moment are worth 14.1 per cent more than they were in 2016," she said.

“The REIV collects its data directly from our members, it is not subject to assumption or internet research.

"The REIV collates more than 90 per cent of all auction data each week and we believe we have the most reliable real estate reporting in Victoria."

Similar to this:

Days on Market data shows increasing buyer interest in Melbourne’s south west