Housing finance numbers continue to dive: REIA

Contact

Housing finance numbers continue to dive: REIA

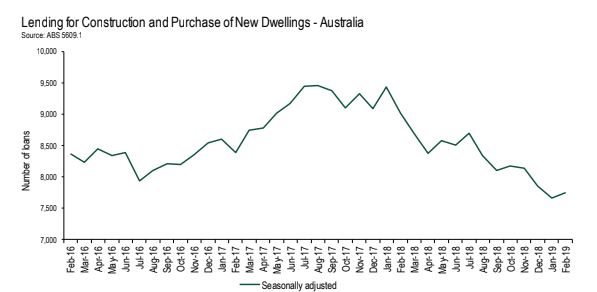

The Australian Bureau of Statistics has released its Lending to Households and Businesses for February 2019, presenting statistics on housing finance commitments including for the purchase or construction of new dwellings.

The February 2019 Lending to Households and Business figures released on Tuesday by the Australian Bureau of Statistics show the number of loans for housing, excluding refinancing, continues to decline, according to the Real Estate Institute of Australia (REIA).

The figures show, in trend terms, that the number of owner-occupied finance commitments, excluding refinancing, decreased by 1.4 per cent – the seventeenth consecutive month of decreases and the lowest since January 2013.

According to the REIA, decreases were recorded in all states and territories except Tasmania which had a modest increase of 0.6 per cent. The largest decrease of 3.2 per cent was in the Northern Territory.

At a glance:

- February 2019 Lending to Households and Business figures released by the Australian Bureau of Statistics show the number of loans for housing, excluding refinancing, continues to decline.

- Decreases were recorded in all states except Tasmania, which had a modest increase of 0.6 per cent.

- According to the Real Estate Institute of Australia, the value of investment housing commitments is 41 per cent of the June 2015 peak.

REIA President Adrian Kelly said the value of investment housing commitments, excluding refinancing, increased by 3.9 per cent in February, in trend terms, but is 41 per cent of the June 2015 peak.

“The proportion of first home buyers, as part of the total owner-occupied housing finance commitments decreased in February to 17.7 per cent from 17.9 per cent in January," he said.

Source: ABS

“There are a number of reasons for the continued decline in housing finance one of which is the concern about changes to property taxation and its impact should there be a change in government.

“There is a clear risk that the decline in activity in the residential property market will become a major drag on the economy."

Related Reading: Housing finance tumbles again, building industry calls for government to act

Housing Industry Association Chief Economist Tim Reardon said the pipeline of building work which had expanded over recent years has shrunk over the past 6 months as the volume of work entering the pipeline has fallen away.

“Our expectation is that the credit squeeze will ease over the course of 2019 and we are hopeful that this is an early sign that the fall in lending will be modest by historical standards," he said.

“The home building industry has driven economic growth in Australia since the end of the resources boom.

"As the housing boom cools the industry will be reliant on a strong national economy to ensure that this is a relatively shallow downturn."

Click here to view the February 2019 Lending to Households and Business figures.

Similar to this:

"No good news" in latest housing finance figures

Industry body warns housing finance figures are on a "slippery slope"