How to Increase Your Home Equity (today)

Contact

How to Increase Your Home Equity (today)

Nathan Vecchio, Mortgage Broker at Hunter Galloway's, goes through his six tips for increasing home equity today.

Buying a home is often not the same as owning a home. The difference comes in the form of home equity - a sum calculated as the total value of your home minus your home loan.

Home equity can increase with the payment of a home loan, or as the property's value rises.

There are also several ways an owner can take charge of the equity in their home.

Get another bank valuation

Often overlooked, this is one of the simplest ways of creating equity.

A bank valuation is different from a market valuation in the sense it helps the lender determine their overall risk on the property, whereas the market valuation which can be provided by a real estate agent can help determine the property’s price on the market.

If you are looking at borrowing your home equity, you are going to need to rely on a bank valuation – but the good news is different banks use different valuers.

Nathan has seen increases as high as $130,000 in home equity in a single valuation, “I have recently had a client whose property was valued at $640,000 on one day and then the very next day a second valuer thought it was worth $770,000!”.

That’s over $130,000 in equity gained in one day.

Book your appointment with a home loan specialist

Source: Hunter Galloway

Get a shorter term loan

Most banks will provide a 30-year loan and calculate repayments based on the idea it will take that long for you to pay it back.

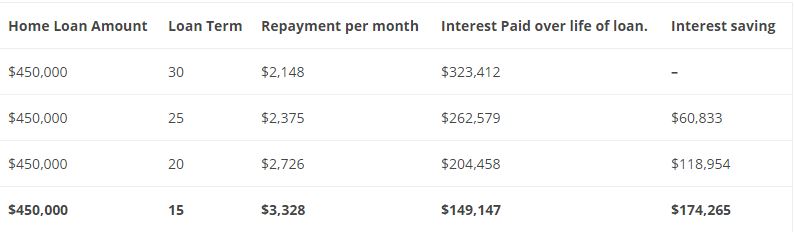

Reducing a loan term to 25 or even 20 years not only allows you to pay off the loan quicker and create more equity, but it also means you will pay much less interest across the life of the loan.

Let’s look at a quick example, assuming you are paying 3.69% interest rate on your home.

Working through this example, simply by reducing your loan term you can save $105,400 in interest and build your equity much faster by paying out your loan in half the time.

Source: Hunter Galloway

Fix up your property

While some simple cosmetic renovations can have a significant impact on a home’s equity position, spending money doesn’t necessarily equate to increased value.

According to Nathan Vecchio, features around the property that tend to have a negative impact on property’s value includes poor landscaping, additions that don’t match the original building, creating dark rooms, over renovating, appealing to the wrong crowd and not getting the appropriate council approvals and can even impact your bank valuation.

Paying more on repayments

Smaller additional payments to the loan allow for it to be paid off quicker without reducing the terms. Some of the easiest ways to do this, according to Nathan these include:

- Adding a small extra amount to your monthly payment, start small and increase over time.

- For example, if your monthly repayment is $2,148 round it up to $2,200 being $52 extra and try to increase over time.

- Switching from monthly to fortnightly payment, so instead of $2,148 per month make it $1074 per fortnight.

- As there are 26 fortnight’s per year and only 12 months you will end up making 2 additional fortnightly repayments cutting years off your loan.

- Trying to schedule extra repayments automatically from your bank to your home loan account at regular intervals, like just after your payment has gone in.

- Look at reducing your home loan’s interest rate. Refinancing your home loan can cut years from your loan term, and build equity much faster.

Using bonuses and tax refunds

The sizeable financial commitment required for reducing the terms of a loan or making additional repayments means some may be more comfortable to use lump sums such as bonuses and tax refunds to increase equity. The sale of material gifts could also contribute to equity.

Using one partner’s income

Couples that want to get their home loan paid off quicker can dedicate one person’s income entirely to paying down the home loan, and live off the second income.

You might need to cut back on the smashed avo, and late night pizza, but it will help build that home equity faster.

The next steps

The team at Hunter Galloway is available to help you take control of your home equity. For more information, email or phone Nathan Vecchio via the details below.

Click here to book your appointment with a home loan specialist

This is a sponsored post

Similar to this:

These are the 12 steps to take to research a home before you buy