Wealth report reveals where you can get more for a million

Contact

Wealth report reveals where you can get more for a million

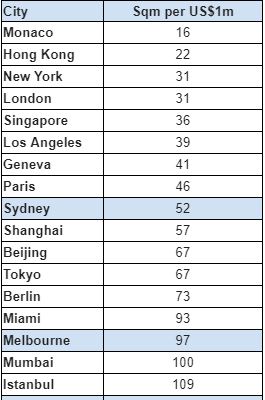

As part of its 2019 Wealth Report, Knight Frank has revealed how much US$1 million can buy around the world

Knight Frank has answered the million dollar question in The Wealth Report 2019, revealing how much US$1 million buys around the world.

The study compares how many square metres of luxury internal floor space can be purchased with the sum as of 31 December 2018 to establish relative values for prime residential property globally

According to the report, Monaco remains the most expensive city in the world, with US$1 million buying 16 sqm of accommodation – the equivalent of a bedroom in a luxury home.

Hong Kong came in second, with US$1 million buying 22 sqm, while New York and London tied third at 31 sqm for US$1 million.

Related reading: Sydney is still number one for the ultra-wealthy

In Australia, US $1 million will buy you 52 square metres in Sydney and 97 square metres in Melbourne.

Source: Knight Frank

Knight Frank’s Head of Residential Research Australia, Michelle Ciesielski said currency fluctuations across the past 12 months had made Australian prime property more attractive to foreign buyers.

“Over the course of 2018 Sydney prime properties rose 3.1%, but with a stronger US dollar, overall, the impact of the currency shift saw prices decline 7% for someone buying a Sydney prime residential property with US dollars," she said.

“Looking at the impact of currency fluctuations on prime residential prices across the major Australian cities over 2018, the end of the year saw a price discount of 7 to 8% for those purchasing with the US dollar, 9 to 10% for those purchasing with Japanese Yen, whilst those purchasing with Renminbi currency saw a reduction of 2 to 3% over the same time," she said.

“When currency is factored into the sale price, we can often see a significant variance in the sale price for those purchasing residential property in Australia.

"When the US dollar appreciates rapidly against the Australian dollar we have increased enquiries from high-net-worth expat clients taking advantage of how much more luxury residential property can be purchased."

The ABS Residential Property Price Indexes, released this month, revealed a 2.4% fall in the national residential price index for December 2018 quarter.

This has been coupled with concern about global markets, sparking fears of a possible recession.

Knight Frank’s Partner and Head of Prestige Residential Australia, Deborah Cullen, said it was worth noting what US$1 million could buy ten years ago during the GFC.

“Ten years ago marked the collapse of Lehman Brothers in the Global Financial Crisis when you could buy 86 sqm of prime residential property in Sydney with your US$1 million, 34 sqm more than what you could at the end of 2018 – the equivalent to a prestige-sized kitchen," she said.

“In 2008 US$1 million could buy you 155 sqm of space in Melbourne, in comparison with 97 sqm as at December 2018, and 90 sqm at the end of 2017.

“Continuing along the eastern seaboard, US$1 million could buy 123 sqm in Brisbane, down from 160 sqm in 2008, while on the Gold Coast, US$1 million would get you 136 sqm at the end of 2018, compared to 173 sqm in 2008.

“Perth, on the other hand, has seen an increase in the amount of space US$1 million can buy from 109 sqm in 2008 to 116 sqm as at December 2018."

Click here to download the report.

Similar to this:

Knight Frank Wealth Report shows Australia still mixing it with the best

Sydney, Melbourne make top 20 for Knight Frank Prime Residential Index