"It's disappointing": New report finds housing affordability is down

Contact

"It's disappointing": New report finds housing affordability is down

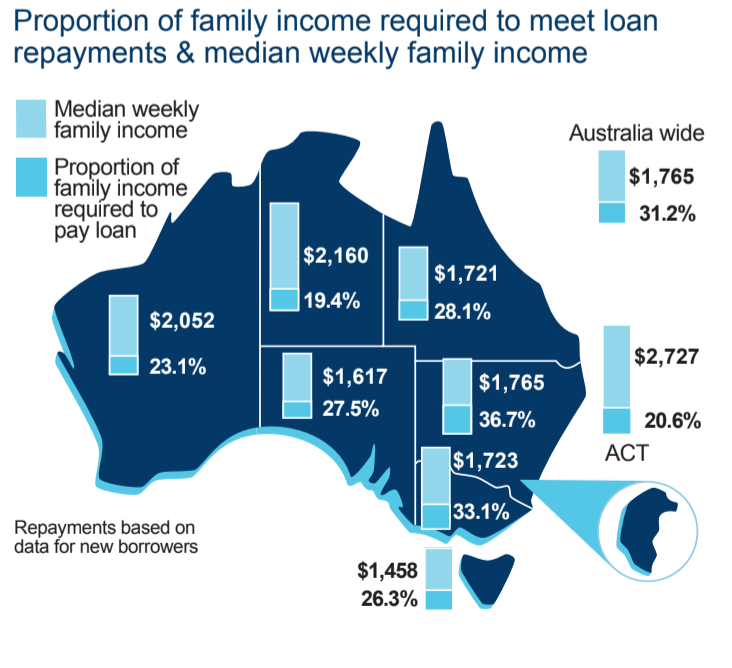

Tasmania was the hardest hit as housing affordability declined across the country, according to research from the Real Estate Institute of Australia (REIA) and Adelaide Bank.

Housing affordability declined in all states and territories, with the exception of Victoria and the Northern Territory, according to the December quarter 2018 edition of the Adelaide Bank/REIA Housing Affordability Report.

“The slight downtick in housing affordability nationally for the quarter is disappointing," Darren Kasehagen, Head of Third Party Banking, Adelaide Bank said.

But compared to the corresponding quarter of 2017, housing affordability has actually improved over the past year with the proportion of income required to meet monthly loan repayments decreasing by 0.4 percentage points.

Adelaide Bank/REIA Housing Affordability Report at a glance:

- Victoria leads first home buyer numbers

- Australian Capital Territory first home buyers up 34 per cent

- New South Wales shows the biggest improvement for renters

- Queensland shows the largest decrease in new loans

- South Australia had the largest increase in loan size

- Western Australia rents up 0.5 per cent (but still nations most affordable at 16.6 per cent of family income)

- Tasmania had the largest rise in monthly loan repayments

- Northern Territory housing affordability improves by 1.5 per cent

Mr Kasehagen said the decline in affordability in the quarter is attributable to an increase in average mortgage payments through increases in interest rates.

"These negated the drop in house prices and an increase in household payments."

The largest decline was in Tasmania, with the proportion of income required to meet loan repayments increasing to 26.3 per cent.

Source: Adelaide Bank

It comes after the Reserve Bank of Australia (RBA) kept the cash rate on hold yesterday at 1.5 per cent - again.

"No doubt the RBA are tracking housing market conditions very closely, watching for any further deterioration that might signal a dent to consumer spirits, resulting in less spending, more saving and a further pullback in residential construction activity," CoreLogic Head of Research Tim Lawless said.

"CoreLogic reported another broad-based decline in dwelling values in February, down 0.7 per cent nationally, however, the good news was that the rate of decline has eased over the past two months and housing affordability is showing a consistent improvement across most housing markets."

Number of loans to first home buyers up, but number of first home buyers down

REIA President Adrian Kelly said the number of loans to first home buyers has increased in all states and territories.

"The number of loans to first home buyers as a proportion of all loans has also increased over the quarter," Mr Kelly said.

"Tasmania, the Northern Territory, and the Australian Capital Territory all had relatively large increases in loans to first home buyers."

Mr Kasehagen said there was a 3.3 per cent increase nationally in the number of loans over the December period.

"To be honest, it was a bit of a surprise over a traditionally quiet period and this activity also kept our back office busier than usual over the Christmas break.

"Despite this quarterly increase, we are still looking at a decrease of 9.4 per cent compared with the same quarter last year.

"I suggested in the last edition that the reduction in the total number of new loans had the potential to be a continuing trend and that appears to have been borne out by these numbers. No surprise either was the decrease in average loan size to first home buyers to $337,500.

While the number of first home buyers was up 3.8 per cent during the December 2018 quarter, the number has actually decreased when compared to the December 2017 quarter.

"We are actually looking at a longer-term decrease in first home buyers of 5.8 per cent," Mr Kasehagen said.

Related reading:

Most renters don't believe they will ever own their own home, survey says

Changes to negative gearing "won't stimulate housing demand"