As loan squeeze takes toll on clearance rates, experts call for six-week auction campaigns

Contact

As loan squeeze takes toll on clearance rates, experts call for six-week auction campaigns

SQM Research Louis Christopher is calling for the typical four-week sales campaign to be extended, as the tightening loan approvals process takes its toll on clearance rates.

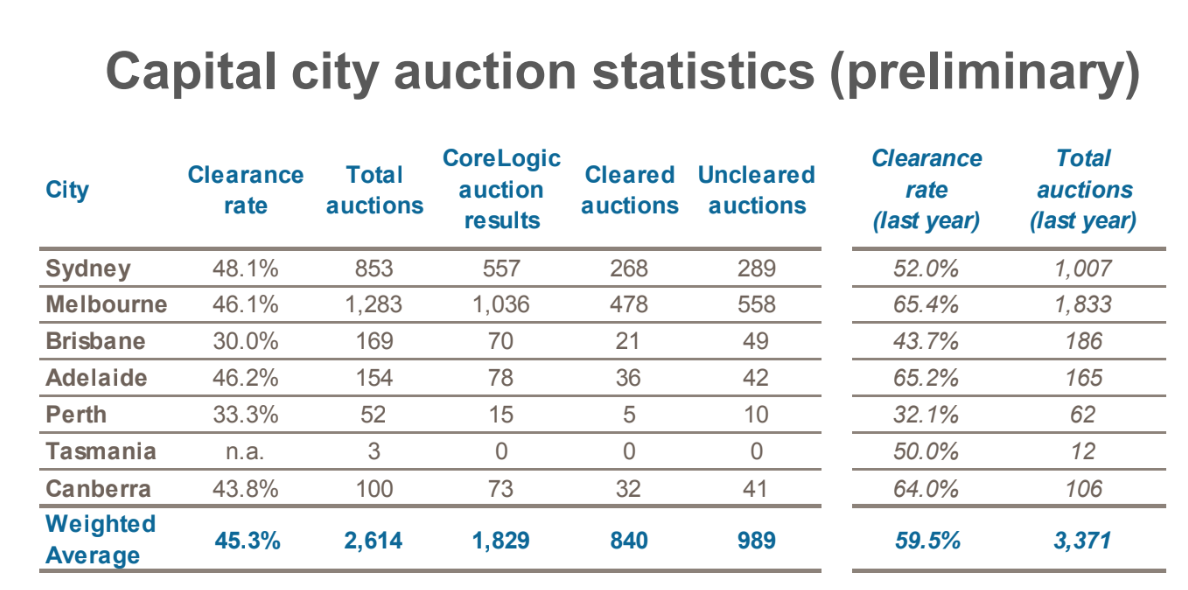

The loan squeeze is hitting auction clearance rates hard, as preliminary clearance rates are expected to be revised below 45 per cent for the sixth week in a row, according to CoreLogic data.

With less than half the number of listed auctions reported, Sydney's clearance rate was at 48.1 on preliminary results from CoreLogic.

Melbourne was at 46.1 per cent. Last week, Sydney's final clearance rate came in at 35.8 per cent, while Melbourne ended with a 40.6 per cent clearance.

Source: CoreLogicVeteran property analyst Louis Christopher, from SQM Research, says agents and vendors need to consider extending the normal four-week marketing period before an auction to account for the loan squeeze.

"With the increased scrutiny on expenses by the banks, they are taking longer to process loan applications. They are taking four weeks or more to process a loan application from a good loan applicant. The average auction period has been typically around four weeks.

"Agents and vendors need to consider, as part of the strategy in the market now, to extend the auction campaign to up to six weeks."

Mr Christopher's statement comes after reports mortgage brokers are pulling up loan applicant's on expenses like UberEats and Afterpay.

CEO of The Agency, Matt Lahood says buyers should get their finances in order over the Christmas break.

Pictured: Matt Lahood, CEO of The Agency. Image supplied by The Agency.

"For buyers, getting your finances in order over the break and investigating your mortgage options with a broker will assist you in tackling the stricter lending conditions. Given variable interest rates have been increased by the major banks, irrespective of the cash rate inertia, don’t rest on your laurels when it comes to comparing the various products on offer," Mr Lahood said in The Agency's Summer Report 2018/2019.

He told WILLIAMS MEDIA sellers should get their properties on the market now.

"We predict an early start to 2019 with a high rate of listings scheduled for January. If you are looking to sell, it is a good idea to get your property online sooner rather than later. On New Year’s Day, there is a spike in search activity on the property portals in response to New Year’s resolutions."

But despite falling clearance rates, there were a number of successful sales, including the $3.5 million sale of a five-bedroom home at 9 Pyrl Road in Sydney's Artarmon.

The Californian bungalow was sold at auction by agents Peter Chauncey and Brigitte Crawford of McGrath.

Another big ticket sale included a five-bedroom house with sweeping views at 20 Dunois Street, Longueville. The 765-square-metre property sold for $4.885 million through agents Brent Courtney and Sam Lloyd of McGrath Lane Cove.

Meanwhile, in Melbourne's Brunswick, this modern craftsman townhouse was passed in at auction with a vendor bid of $1.075 million. The seller had hoped to get at least $1,125 million.

Part of the luxurious Halliard complex, the brand new four-bedroom townhouse was designed by Franze developments.

Real Estate Institute of Victoria (REIV) President Gil King told WILLIAMS MEDIA the suburb of Reservoir continues to lead the way.

“Reservoir once again led the market with 12 auction sales while Glen Iris was the top performer with 12 auctions resulting in a clearance rate of 83 per cent," Mr King said.

“There was a new record set in Diamond Creek with 13-19 Old Aqueduct Rd selling under the hammer for $4.225 million, the highest sale price for a house in the suburb.”

In Brisbane, the preliminary clearance rate was at a meagre 30 per cent from a reported 169 auctions.

Auctioneer Justin Nickerson told WILLIAMS MEDIA the brakes were well and truly hit, with clearance rates diving below 50 per cent for the first time in many weeks.

"Although the buyer registration and bidding participation levels stayed consistent, there was a noticeable gap between buyers and sellers. Perhaps this is born out of different viewpoints of where the market is currently sitting."

He says it will be interesting to see if activity picks up in the lead up to Christmas.

"Attendance at auctions was stronger than the previous week and it will be interesting to see if this is maintained in the last big auction weekend prior to Christmas."

Despite Brisbane's low clearance rate, there were some successes such as the sale of 20 Eric Road in Holland Park.

The four-bedroom home sold under the hammer for $745,000 through agents Shane Hicks and Dion Tolley of Place Bulimba.

Related reading:

Housing affordability improving, but number of first home buyers down, report finds

Western Australia most affordable housing market in the country, report reveals

A third of first home buyers opting for investment property over first home, report reveals