30 per cent drop forecast for Sydney and Melbourne, but Hobart outlook is strong: SQM Research

Contact

30 per cent drop forecast for Sydney and Melbourne, but Hobart outlook is strong: SQM Research

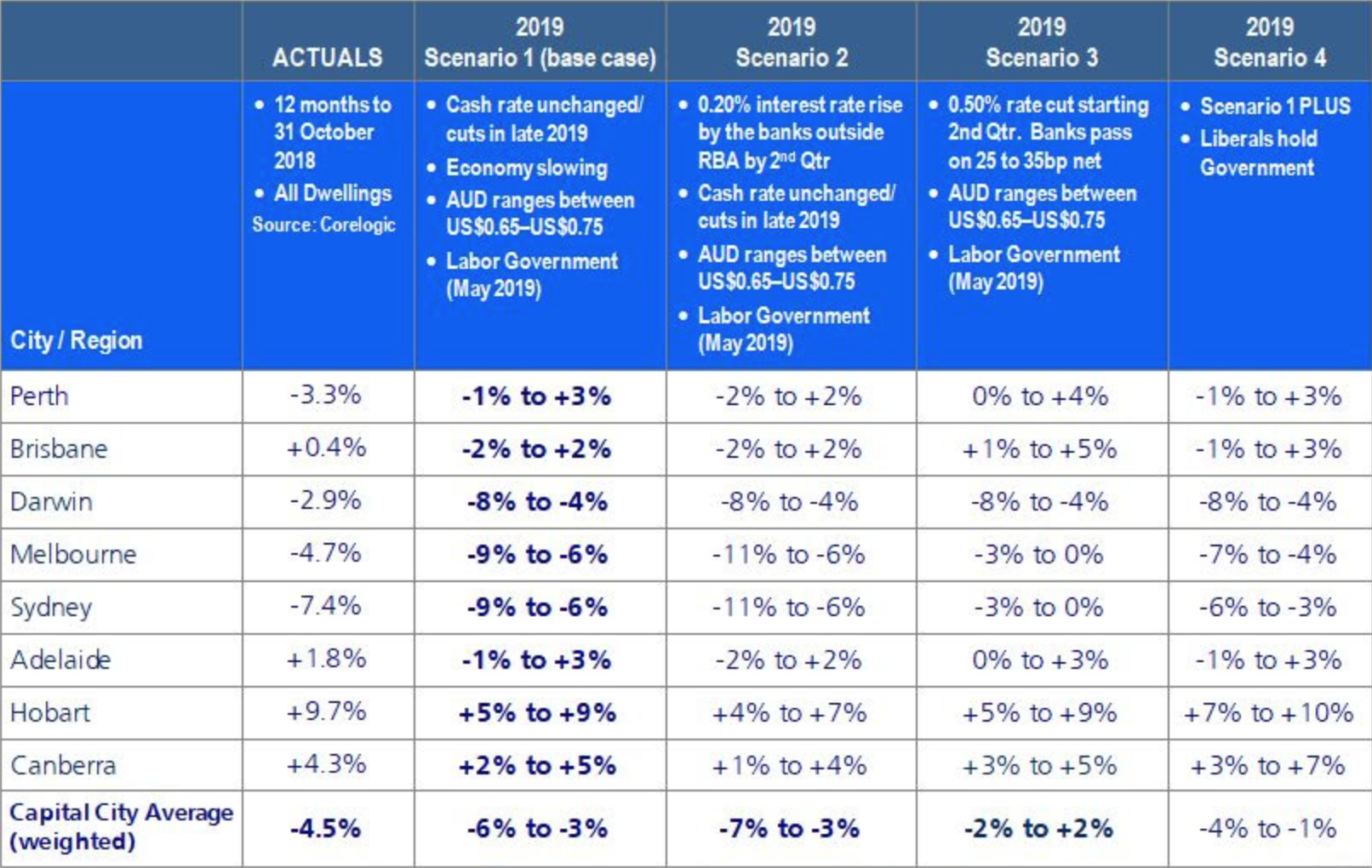

Sydney and Melbourne house prices could fall by as much as 30 per cent, while Hobart house prices could rise by 5 per cent, according to SQM Research Louis Christopher's Boom and Bust Report.

Hobart house prices could rise by nine per cent next year, bucking the national trend if interest rates are cut in response to rapidly falling house prices in Sydney and Melbourne.

That's according to leading property analyst SQM Research's annual Boom and Bust Report, who have warned falling house prices and changes to negative gearing could spark a recession.

The report forecasts big price falls for Australia's housing market next year, led by Sydney and Melbourne. Peak to trough price falls of 12 per cent to 17 per cent have been predicted for the country's two biggest housing markets.

Source: SQM Research

But if negative gearing is repealed (a firmly stated Labor party objective) that number may rise to 30 per cent by 2020.

SQM Research's Louis Christopher says the range is entirely dependent on:

- When, if and how the RBA responds to the downturn;

- How the economy responds to the downturn;

- Will the banks be required to lift rates out of cycle;

- Will negative gearing and capital gains tax concessions be repealed as per the Labor Party’s policy.

"If the RBA does not respond and/or the bank lift interest rates again in 2019, it is possible the peak to trough falls in Sydney and Melbourne could be even more than this negative range. But we do take the view that the downturn in Sydney and Melbourne will be a significant negative for the overall economy, and so the central bank will eventually respond at some point and cut interest rates," Mr Christopher said.

“The looming changes of Negative Gearing and Capital Gains Tax are increasingly weighing on investor sentiment. Quite frankly implementing these changes during a housing downtown is very risky and may trip the economy into a recession,” Mr Christopher added.

Pictured: Sydney. Image by Tom Rumble via Unsplash.

Head of Research at Propertyology, Simon Pressley agrees with Mr Christopher's concerns about the risk of recession.

“Australia already had responsible lending policies. Clearly, we needed better policing of those existing policies. Instead, what we’ve seen from APRA is radical and unreasonable reform that, unless stopped, poses a real risk of a road to recession," Mr Pressley told WILLIAMS MEDIA.

“If someone doesn’t intercept quickly, that snowball of financial woe that has started rolling down the hill will have built up a significant head of steam that may ultimately cause considerable economic destruction," Mr Pressley said.

President of the Real Estate Institute of Australia (REIA) Malcolm Gunning says the government needs to be mindful of the impacts on the economy.

“Government and regulators should be very mindful of the impact that a lack of confidence in the housing market can have on the economy. The continued decline in housing finance reflect the slowing market, APRA restrictions which with hindsight were probably excessive, the fallout from the Royal Commission into Banking and concerns about changes to property taxation and its impact should there be a change in Government," Mr Gunning told WILLIAMS MEDIA.

Pictured: Melbourne suburbs. Image by Tom Rumble via Unsplash.

Housing Industry Association (HIA) Acting Principal Economist, Geordan Murray says because the effects of APRA's measures are untested in a market downturn, it's not overly surprising that house prices are declining.

"The role that APRA’s interventions in the mortgage market are having is a unique aspect of this cycle. The tighter lending environment is an additional contributing factor to the softer housing finance figures. APRA’s measures are untested in a market downturn and the effect needs to monitored closely. The housing price cycle still has time to run and throughout the phase where prices are easing we should expect to see fewer property transactions and soft housing finance numbers," Mr Murray told WILLIAMS MEDIA.

Real Estate Institute of New South Wales (REINSW) CEO, Tim McKibbin says stamp duty is having a huge effect on the NSW property market.

“People no longer want to transact property because of taxation. Families would expand and move into a house after owning a unit, but now they are electing to stay where they are and renovate rather than finding a new property," Mr McKibbin told WILLIAMS MEDIA.

Pictured: Sydney. Image via Pixabay.

Mr McKibbin said if the Government is serious about Stamp Duty reform it must adjust the brackets to reflect today’s median house price, and then index it from there.

Real Estate Institute of Victoria President, Robyn Waters says median prices are actually rising in Melbourne.

“We’ve all heard the ‘doom and gloom’ commentary about a downturn in Melbourne’s property market but the median house price has actually increased five per cent in the past 12 months. The property boom of 2017 could not be sustained and a levelling or correction of the market is a good thing in the context of housing affordability already being a pressing issue in Melbourne," Ms Waters told WILLIAMS MEDIA.

Hobart to buck the national trend, while Darwin will struggle on

According to SQM Research, Hobart will be the best performing city in 2019 in what will be the second year in a row for robust price and rental gains.

Real Estate Institute of Tasmania (REIT) President, Tony Collidge is optimistic about the market.

“Tasmania’s popularity as a lifestyle destination coupled with strong economic conditions are establishing an environment for positive population growth. This growth has and will continue to impact our real estate markets across all sections of the state," he told WILLIAMS MEDIA.

Pictured: 269 Channel Highway, Taroona in Hobart, where the outlook is strong for the local market. For sale by Leigh Patrick of Hobart Sotheby's, as seen on Luxury List.

"There is still a strong buyer presence in the market and such demand will minimise any impact on future prices over coming months. I do not foresee prices falling away as they have in some of the mainland centres," Mr Collidge added.

Perth and Brisbane rental markets are also expected to recover, while SQM Reseach predicts Canberra should record solid rental increases.

The report forecasts Darwin will continue to struggle, as real estate sales plummet after the height of the LNG boom, and the population declines.

Real Estate Institute of Northern Territory CEO, Quentin Kilian says the government needs to address the issue.

"We've been calling on the government for the last two years to produce a comprehensive population policy, (and they have had the opportunity many times) but the reality is that they need to instigate some long-term employment strategies, and not just project by project, which is what they tend to do," Mr Kilian told WILLIAMS MEDIA.

Related reading:

"No bright spot" in latest housing finance figures

Louis Christopher: "Crash territory"? Low clearance rates prompt questions over state of market