"Buyers frustrated with lack of stock" in Melbourne market

Contact

"Buyers frustrated with lack of stock" in Melbourne market

Auction volumes are picking up the pace, as frustrated buyers keen to close a deal make their move in the lead up to the end of the year.

With spring selling season kicking off next weekend, more homes are flying 'under the radar' and either selling before auction, or in off-market deals as buyers become frustrated with a lack of stock on the market.

"In Melbourne, there has really been no stock on the market to start the season off, so I think there are a lot of frustrated buyers who are thinking, "well if I don't do it now, it's getting close to Christmas anyway, so I might as well go". Buyers are just buying whatever is available in the marketplace," Jeremy Fox, director of RT Edgar Toorak told WILLIAMS MEDIA.

Source: CoreLogic

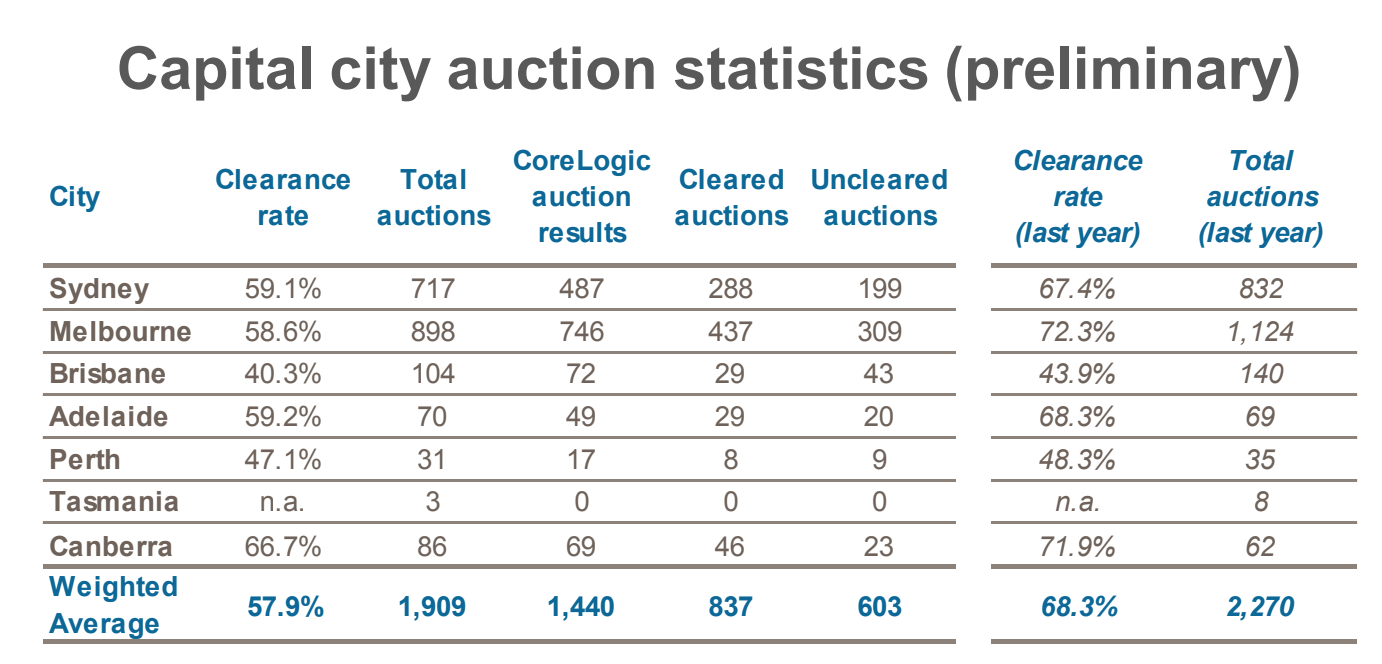

Auction volumes continue to pick up the pace, with 1,909 homes taken to auction across the combined capital cities over the weekend.

While most agents attribute the cooler market conditions to the 'winter lull', Corelogic says winter auctions were about 20 per cent lower than last year, "highlighting a substantial weakening in vendor confidence driven by the softer housing market conditions and consistently lower clearance rates".

Preliminary results show a clearance rate of 57.9 per cent this week, increasing from last week’s final clearance rate of 53.3 per cent, although this will revise as the remaining results are collected.

Sydney

There were 717 auctions reported to CoreLogic over the weekend with a preliminary clearance rate of 59.1 per cent.

"There was a higher clearance rate and more auctions compared to last week," REINSW President, Leanne Pilkington told WILLIAMS MEDIA.

"Agents are expecting numbers of properties coming onto the market to continue increase as we head into spring."

24 Ernest Street, Balgowlah Heights was sold at auction over the weekend for $3.2m by Matt Brady and Ryan Spence of Belle Property Seaforth, as seen on Luxury List.

Christie's International Real Estate's Darren Curtis told WILLIAMS MEDIA buyers are smartly considering suburbs which have seen exponential growth.

“People are now considering areas like Castlecrag, Castle Cove, Hunters Hill, Woolwich, and the Upper North Shore where there have been some astonishing results in the last year," Mr Curtis said.

Mr Curtis says growth will continue in areas like the Upper North Shore, which have excellent schooling and infrastructure.

“There is a future perception that these areas offer better value for money. These suburbs are undervalued compared to others only 15 minutes away.”

Melbourne

CoreLogic reported a preliminary clearance rate of 58.6 per cent across 898 auctions, compared with a far higher 72.3 per cent across 1,124 auctions at the same time last year.

Of the 649 auctions reported to the Real Estate Institute of Victoria (REIV), 390 sold at auction, and 259 were passed in - 147 of those on a vendor bid.

“There was close competition between Melbourne’s inner and middle ring suburbs over the weekend with both areas recording almost 140 auction sales," REIV CEO, Gil King told WILLIAMS MEDIA.

“Kew led the market with nine sales leading to a 75 per cent clearance rate while Glenroy cleared all eight of its auction listings.

“Mount Waverley also performed well with eight homes selling under the hammer from nine listings.”

6a Peters Street, Airport West, which was sold at auction over the weekend for $1.1m by Mark Giardina and Joseph Stilo of Nelson Alexander Keilor East, as featured on Luxury List.

Mr Fox spoke to WILLIAMS MEDIA about a property he sold prior to auction - 23 Airlie Street, South Yarra.

"The owners decided to sell it beforehand. The buyers were a local family, with one kid, who wanted a bigger backyard," Mr Fox said.

23 Airlie Street, South Yarra which sold prior to auction by Jeremy Fox and Anthony Grimwade of RT Edgar Toorak, as seen on Luxury List.

Mr Fox says buyers are increasingly going for well positioned properties on a decent amount of land.

"The theme that is coming out at the moment is properties with a bit of land that are in a good position - our agency has sold a lot of properties like that recently.

Related reading: Get to know Jeremy Fox, Director of RT Edgar

"There is also a bit more price matching going on right now. Prices are coming down a bit, and so buyers are starting to get their confidence again," Mr Fox said.

Brisbane

There were 104 homes taken to auction over the weekend, returning a preliminary clearance rate of 40.3 per cent - compared with 43.9 per cent across 140 auctions at the same time last year.

Tightened lending restrictions are continuing to have an impact on clearance rates, says agent Hamish Bowman of Ray White New Farm.

"It's very important for buyers to get their financing in order before they get involved with the buying process.

"Our number one question to buyers isn't 'what are you looking for', it is 'are you pre-approved' - without being pre approved buyers are unsure whether or not they can participate in the process, particularly if they want to go after a property they like.

"They may not realise it will actually take a month to get their finances in order," Mr Bowman told WILLIAMS MEDIA.

7 Culbara Street, Mooloolaba which was sold by Craig Morrison of Property Today at auction over the weekend for $2.06m as featured on Luxury List.

Across the smaller auction markets, the country's highest preliminary clearance rate was recorded in Canberra (66.7 per cent), while Adelaide (59.2 per cent) and Perth (47.1 per cent) followed suit.

Earlier in the year, Adelaide was reported to be Australia's most affordable capital city.

Agent at Ouwens Casserly, Nathan Casserly told WILLIAMS MEDIA buyers are flocking in from Sydney and Melbourne to get more bang for their buck.

"The proximity to the CBD really surprises interstate buyers. What they perceive as being value for money in terms of accommodation and land size is appealing, as is the amount of time they end up saving on their daily commute by being able to live close to the city," Mr Casserly said.

Related reading:

Auction volumes down but preliminary clearance rate up in first week of August

Sluggish weekend as two high profile properties fail to sell at auction

Houses outperform unit market, while unit market consistently better performer