Is it really a case of "buyer beware" in Tasmania?

Contact

Is it really a case of "buyer beware" in Tasmania?

While some experts are warning buyers to be careful in Tasmania, as the island state's booming housing market is reportedly headed for a slow deceleration, agents from Knight Frank Hobart say the 'human side' of the market is being overlooked in favour of statistics.

RiskWise Property Research CEO, Doron Peleg, has said that while the outlook has been good for the short term, and currently there is still strong activity, there is a risk associated with the Tasmanian property market, and buyers should do their research before proceeding.

“Things have certainly been good, however, the market has started to show some decelerated price growth and there has been a marked reduction in enquiries," Peleg said.

But Pam Corkhill, an agent with Knight Frank Hobart, told WILLIAMS MEDIA that Peleg isn't taking the 'human side' into consideration.

"I know he's (Peleg) looking at all the statistics, but what he isn't taking into account is the human side of the changes in Tasmania, and that is the fact that people are discovering it is a fabulous climate, it isn't polluted, we have wonderful schools, and transport in and out of the island has significantly improved in comparison to what it was years ago.

"All of these things are contributing factors in terms of the increasing prices, in my opinion," Corkhill said.

So what are the statistics saying?

CoreLogic’s latest figures show dwelling values in Hobart increased by 12.7 per cent over the past 12 months. They also show Hobart had the strongest capital gains trend amongst the capital cities, with dwelling values rising a further 2.3 per cent over the past three months.

However, while housing market trends remained positive, the quarterly pace eased relative to the March quarter when values were up 3.4 per cent.

Source: RiskWisePeleg said one factor influencing the market was that Tasmania was less affordable than five of the states and territories, in terms of price-to-income-ratio.

“This means that while the median house price in Hobart is only $425,000, dwellings in Tasmania are less affordable in terms of price-to-income ratio than all states and territories, except South Australia, New South Wales and Victoria, due to the low annual household income,” Peleg said.

"A significant increase in dwelling prices in recent years, less affordable housing, decelerated price growth, fewer people turning up to open home inspections and fewer inquiries on listings, indicate that housing affordability has an impact on dwelling prices and that the current growth rate is unsustainable.”

Hobart's median house price rose by 7.2 per cent over the March quarter reflecting a significant 20 per cent rise on the previous year, according to Real Estate Institute of Australia figures released last month.

However, Peleg noted Tasmania's economic growth is the second lowest in Australia, and also has the lowest median weekly wage and wage growth.

"The annual median income is only $57,200 per household, the lowest in Australia," Peleg said.

“This means that a large proportion of the jobs are low salary ones. The annual salary growth is also the lowest in the country.”

24 Clarke Avenue, Battery Point for sale through Pam Corkhill of Knight Frank Hobart as featured on Luxury List.With just 210,000 dwellings in the island state, Peleg notes housing affordability remains an issue high on the agenda of the Liberal Government, which has promised to spend $125 million over five years on more affordable housing, stamp duty cuts for first-home buyers, a $20,000 first-home builders grant, tax relief for downsizing retirees and three-year land tax breaks for properties being rented out.

“Any major government policy to increase housing supply to address the issue of housing prices, could have a strong adverse impact on the property market, in the medium to long-term, particularly on units,” Peleg said.

Related reading: Hobart housing demand higher than anywhere in Australia

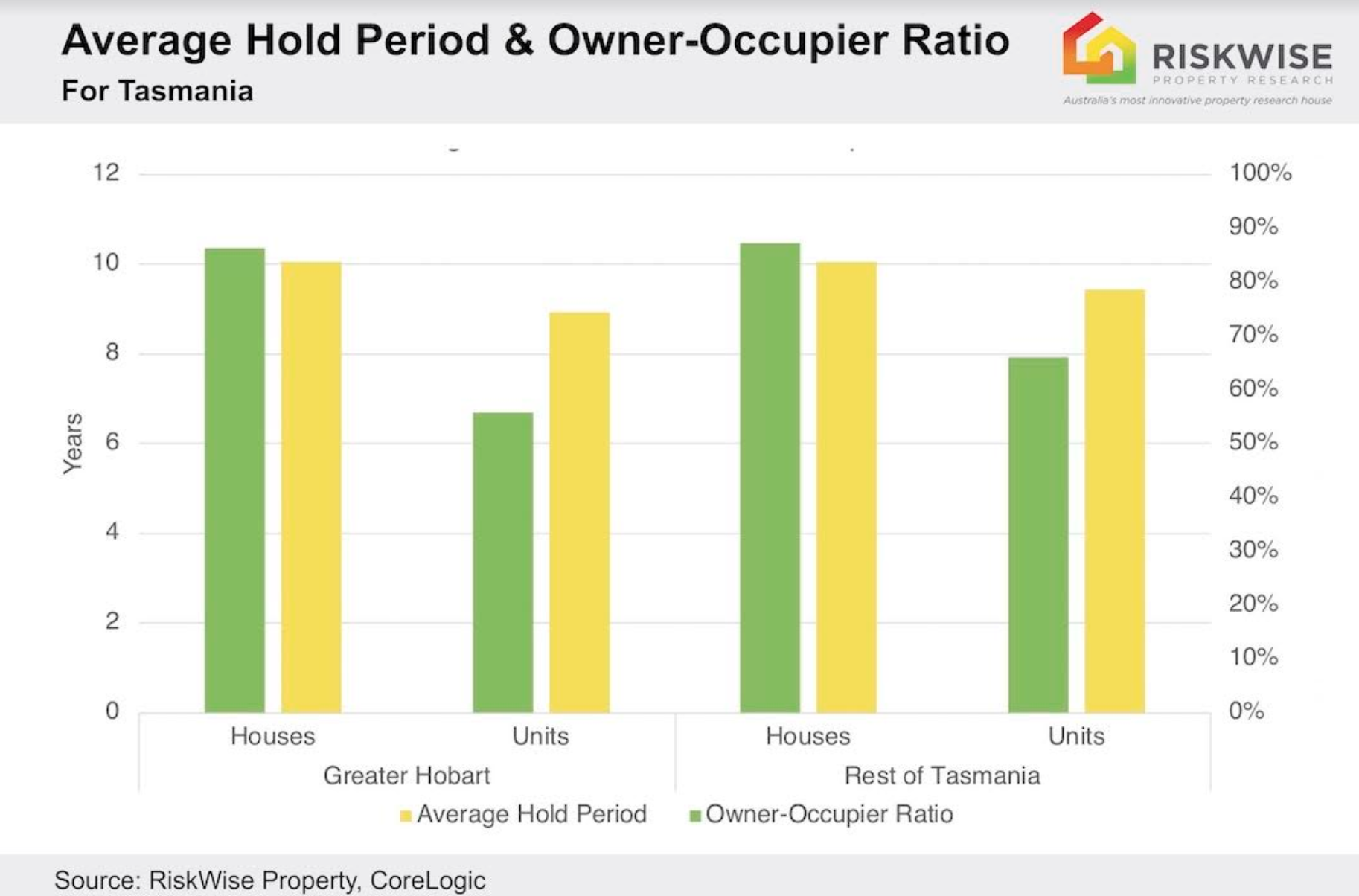

“Houses enjoy far stronger demand from owner-occupiers and are held for a longer period of time, particularly in Hobart, where the average is 10.1 years, as opposed to units that are held for an average of 9.0 years.

62 Napoleon Street, Battery Point, sold by Pam Corkhill of Knight Frank Hobart, as featured on Luxury List.“The unit market is mainly driven by investors, of which intra-state buyers make up a relatively high proportion, and if there are better opportunities in, say, Melbourne, Sydney or Brisbane, there could be a huge shift, and this could have a significant impact on the market.

“Tasmania is an extremely small market which means it is much more exposed to external events that reduce intra-state investors demand for housing," Peleg said.

What does this all mean for buyers?

Peleg said as interest in the Tasmanian property eased, those entering the market should take a long-term, risk-based approach before departing from hundreds of thousands of dollars.

"Buyers should always be careful, they should always do their due diligence, and at the end of the day they should feel comfortable with their investment," agreed Corkhill.

Lynne Page, an agent also with Knight Frank Hobart, told WILLIAMS MEDIA buyers who are worried should invest in gentrified, or up-and-coming suburbs.

"I would suggest buying in up-and-coming, and gentrified locations, adding value. They are all tried-and-true methods.

"I'm not just talking about the elite purchases, more the middle of the road ones. Perhaps buying a block of land, sub-divide or strata," Page said.

33 Woodcutters Road, Tolmans Hill, for sale through Pam Corkhill of Knight Frank Hobart as featured on Luxury List.Corkhill told WILLIAMS MEDIA she doesn't think the drop predicted for the Tasmanian housing market will be as "tremendous" as people are saying.

"For generations, the property market has gone in peaks and troughs and it always will. We have never, ever experienced the peaks and troughs the mainland capital cities have. It has always been gentle; we have not gone down a lot, perhaps apart from when interest rates went to 18 per cent some years ago. But things like interest rates are completely out of our control," she said.

"The market will slow down, but at the moment it is still very strong. If it does drop, it won't drop tremendously.

"None of us have a crystal ball. You can only speak for what you are finding at the moment, and that is that Tasmania is in a very lovely, strong place," she told WILLIAMS MEDIA.

It certainly is, says Page, who recently closed the deal on a property that received eight offers, while Corkhill has buyers flying in from interstate to inspect a property she listed only yesterday.

While the markets going up and down certainly isn't anything new, it will be interesting to see what happens with the Tasmanian market.

Watch this space.

Related reading:

Hobart housing demand higher than anywhere in Australia

Adelaide is now Australia's most affordable capital city: REIA

Hobart likely to lead price gains in 2018: SQM Boom and Bust Report