Loyal bank customers exploited: Productivity Commission draft report

Contact

Loyal bank customers exploited: Productivity Commission draft report

Competition for home loans in the Australian banking sector is "less than desirable" says the Productivity Commission's draft report, and loyal customers are often exploited.

The Productivity Commission's draft report into competition in the Australian financial system delivers a damning verdict.

The report says barriers to switching financial institutions, especially for home loans, made "loyal customers ripe for exploitation".

"One in two people still bank with their first-ever bank," the report says.

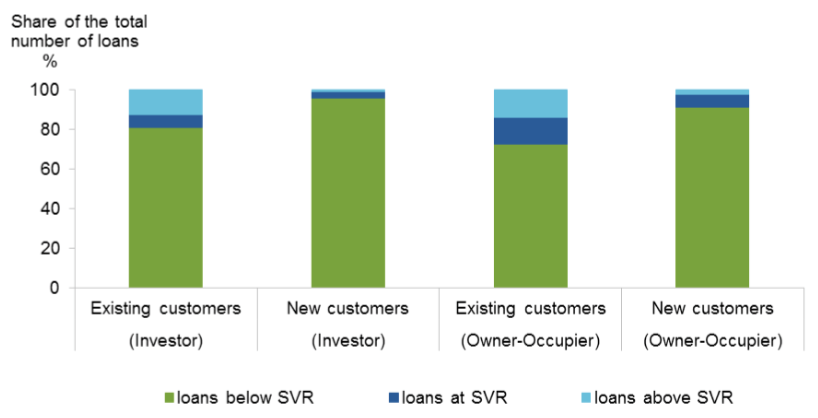

The Reserve Bank has found that existing home loan customers pay 0.3 per cent to 0.4 per cent higher on mortgage rates than those obtaining new home loans.

“These higher rates are paid by around 15 per cent of existing customers and equate to an extra $66 to $87 per month on the average home loan balance," the report says.

New home loan customers pay lower interest rates (compared with standard variable rate)

Souce: Productivity Commission, Competition in the Australian Financial System.

Mortgage brokers not providing sufficient price competition

The growth in the number of mortgage brokers does not appear to have increased price competition, the report says.

"Engagement with mortgage brokers now makes up over 50% of the way people obtain home loans and around 70% of broker mortgages are written by aggregators that are owned by lenders," the report states.

With many brokers now working for large banks, and lack of transparency "clear conflicts of interest created by ownership are inherent."

Source: Productivity Commission.

According to the report, mortgage brokers “are not obliged by law to act in the best interests of the customer”.

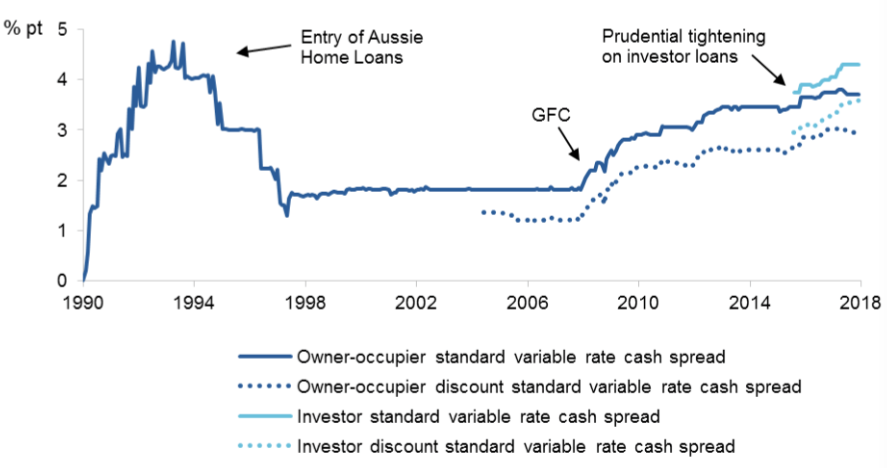

The report says that lending curbs imposed by APRA have cost Australian taxpayers $500 million a year, increased bank profits and reduced competition.

Home loan interest rate spread

Souce: Productivity Commission, Competition in the Australian Financial System.

“APRA’s actions to slow new lending in what it determined are higher-risk areas resulted in higher interest rates on both new and existing investment loans, boosted lenders’ profit on home loans, and saw a decline in competition from some smaller lenders in the home loan market," the Productivity Commission report said.

The report indicated that most of the banks’ increase in profit was paid for by taxpayers through negative gearing arrangements.

“Up to half of the increase in lenders’ profit was in effect paid for by taxpayers, as interest on investment loans is tax deductible.”

Source: Productivity Commission.

Read more about the Australian banking system:

What will the banking Royal Commission mean for real estate?