Interest rates on hold until 2019: REINSW

Contact

Interest rates on hold until 2019: REINSW

Leanne Pilkington, president of the REINSW, says the institute doesn't expect rates to begin rising until 2019.

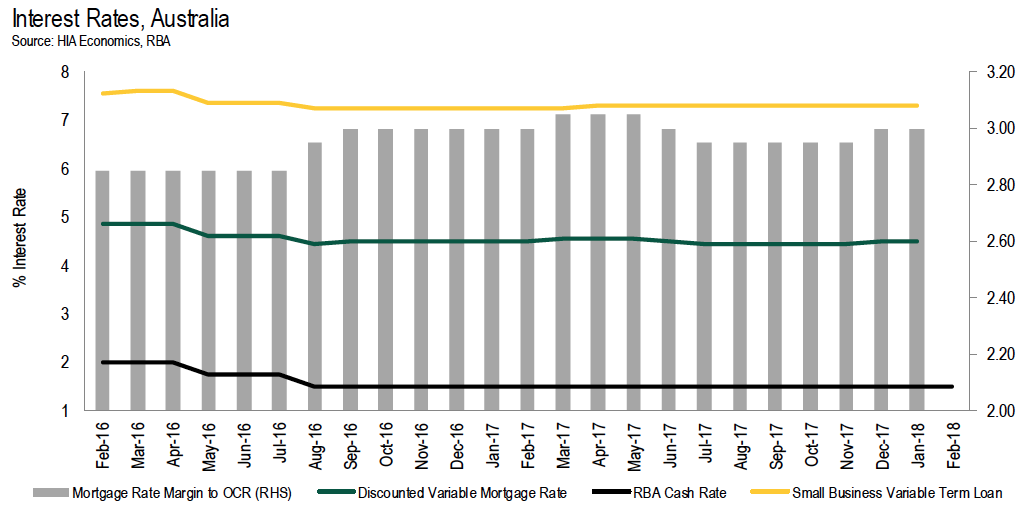

The Reserve Bank of Australia has left the official cash rate at 1.50 per cent, where is has stood since August 2016.

REINSW President Leanne Pilkington welcomed the decision.

“The most recent data indicates house price growth has slowed in the major capital city markets, reinforcing a wait-and-see approach from the RBA,” she said.

“The regulator’s efforts to dampen activity appear to be working, with tighter lending criteria having the desired effect," she said.

Source: HIA.

Though Pilkington cautioned that any significant decline in house prices would impact consumer confidence. "The situation is delicate," she warned.

In the Monetary Policy Decision statement, Governor Philip Lowe wrote:

"Nationwide measures of housing prices are little changed over the past six months, with prices having recorded falls in some areas. In the eastern capital cities, a considerable additional supply of apartments is scheduled to come on stream over the next couple of years. To address the medium-term risks associated with high and rising household indebtedness, APRA introduced a number of supervisory measures. Tighter credit standards have also been helpful in containing the build-up of risk in household balance sheets."

Click here to read the 6 February, 2018, RBA Monetary Policy Decision statement in full.

Rates on hold until 2019: REINSW

Pilkington said the REINSW doesn't expect rates to rise until next year.

“Based on current conditions, we expect there won’t be a rise in interest rates until next year,” she said.

The meeting of the RBA board will be on Tuesday, 6 March 2018.

Low interest rates good news for renters: HIA

“The continued environment of remarkably low interest rates is very beneficial for renters,” said Shane Garrett, Senior Economist for the HIA.

Last week’s ABS inflation data showed rents rose a mere 0.6 per cent in 2017, the slowest pace of growth since 1993 - or 24 years.

The slow growth in rents is attributable to the large volume of new homes built in recent years, and record-low mortgage rates, said Garrett.

“The fact that interest rates have been so low and so stable over the past two years has taken the pressure off rents," he said.

Read more about interest rates:

Rates set to remain at historic lows into 2018

What does the RBA interest rate really mean?

Interest rates on hold: what does it mean for the property market?