House prices Australia wide are rising, but don't expect a strong recovery: Macquarie

Contact

House prices Australia wide are rising, but don't expect a strong recovery: Macquarie

"It is now looking very likely that housing prices at the national level are again rising modestly," said Macquarie in a note to clients.

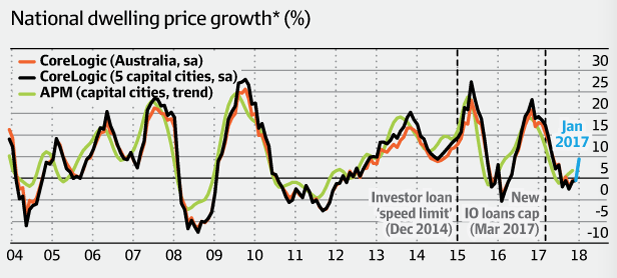

Macquarie Bank analysis of CoreLogic and Domain data suggests that nation-wide property prices have stopped falling and are now in fact beginning to rise again.

The findings were revealed in a note to clients, and reported in The Australian Financial Review.

"It is now looking very likely that housing prices at the national level are again rising modestly," said the note.

* Annualised monthly.

Source: Macquarie Group.

Data from both Domain's APM and CoreLogic's RP Data showed prices have begun rising modestly, albeit on thin volumes.

But Macquarie cautioned that it does not expect a strong rebound in property markets.

"We do not expect a repeat of the 2016 bounce back in housing price growth," the note said.

The analysts, Justin Fabo and Ric Deverell, said prices would remain contained because of speculation about interest rate rises, because banks are being more cautious with their lending following intervention from Australian Prudential Regulation Authority, and because low yields were making property investment less attractive.

Read more about property prices:

Property prices down across Australia: REIA

Sydney, Darwin, Perth property prices down for the quarter: CoreLogic

Regional property markets outpacing capital cities: CoreLogic