Collective sales up 600% in last five years, says Knight Frank

Contact

Collective sales up 600% in last five years, says Knight Frank

Collective-site sales are booming, particularly in NSW, with foreign buyers making up 62 per cent of collective sales nation-wide last financial year.

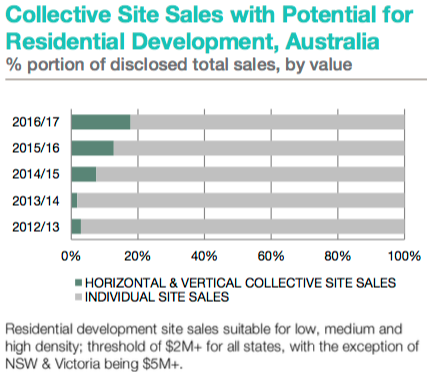

Sales of collectively owned sites suitable for low, medium and high-density residential development have increased six-fold over the last five years, and were 17.8 per cent of total sales by value in 2016-17, according to new research from Knight Frank.

Knight Frank’s report, 'Collective Sales for Residential Development – Market Insight: September 2017', finds collective sales have been both horizontal, with homeowners grouping together to form residential super-lots, and vertical, with owners of individual apartments and offices in a single building selling together.

Source: Knight Frank.

Foreign buyers accounted for 62 per cent of group sales in 2016-17

In 2012-13, foreign buyers accounted for 21 per cent of collective sales, however by 2016-17, foreign buyers had purchased 62 per cent of collective sales, according to Michelle Ciesielski, Knight Frank’s head of residential research, Australia.

“Within these collective sales purchased by foreign buyers in the last year, 53.6% were for horizontal sites and 8.4% for vertical sales," she said.

NSW legislation changes driving increase in collective apartment sales

“Vertical site sales have been more prevalent in New South Wales since new legislation for strata properties came into operation," said Ciesielski.

From 30 November 2016, new legislation requires that only 75 per cent of owners need to agree for a collective sale for it to go ahead. Previously, 100 per cent of owners had to agree.

Visit Fair Trading to find out more about the 'collective sale and renewal' process.

No other state or territories have introduced similar legislation.

The share of NSW vertical collective-site sales suitable for higher density development grew to $228.3 million, or 8.1% of high-density residential development site sales, in 2016-17, up from 2.3 per cent the previous year, before the new legislation came in.

Collective vertical sales in Victoria were only 1 per cent of total sales in 2016-17, for a value of $18.5 million. That rate was down from the previous year, when a 2.5 per cent share was recorded, with a value of $39.7 million.

Strong demand for development sites on Sydney's upper north shore

Earlier this week, Savills Australia revealed it has sold nine homes at 130-138 Archer Road and 10a, 12, and 14 Boundary Street, Roseville, to local developer Mayrin Group for more than $35 million. The selling agents were Stuart Cox and Neil Cooke of Savills Residential Site Sales. Together, Cox and Cooke have sold $1.7 billion worth of residential development sites.

"We continue to see strong developer demand for a variety of sites across the North Shore and Northern District," said Cox.

Cooke said, “In 2017, the amount of DA approved sites for circa 100 apartments has completely dried up particularly in blue chip areas such as Pymble on Sydney’s North Shore."

Cooke and Cox have a 7,879sqm site at 2-8 Pymble Avenue and 2-4 Everton Street, Pymble, for sale. The site is DA approved for 98 residential apartments, a downstairs shop, and parking, and is within 100 metres of Pymble railway station and the bus stop.

Read more about combined sales:

Little Bay development site for sale

Futuristic Chinese developer snaps up 363 hectares in outer Melbourne

Seven-hectare Brisbane site sold to Singapore-based developer for $20m