Revised auction clearance rate one of the lowest this year

Contact

Revised auction clearance rate one of the lowest this year

But Gil King, the CEO of the REIV, told SCHWARTZWILLIAMS that last week auction volumes and sales in Victoria were ahead of those for the same period last year.

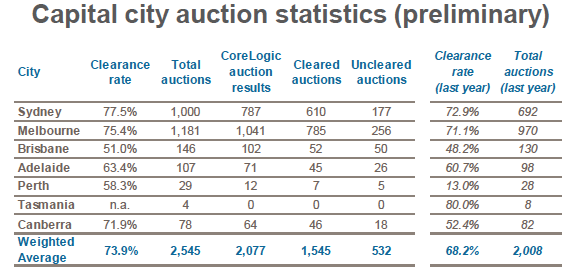

The preliminary clearance rate for the combined capital cities rose to 73.9 per cent last week, up from the previous week’s final result of 71.3 per cent, the third-lowest clearance rate so far this year, according to data from CoreLogic.

Since final clearance rates are generally revised lower, the preliminary result for last week, described above, could actually end up lower than the previous week's result, cautioned CoreLogic.

The number of properties going to auction was lower last week than the previous week. Auction volumes fell to 2,545 last week - the first week of winter - compared to 2,885 the previous week.

At this time last year, both the combined capital city clearance rate and the number of auctions were lower, with 2,008 auctions held and a 68.2 per clearance rate.

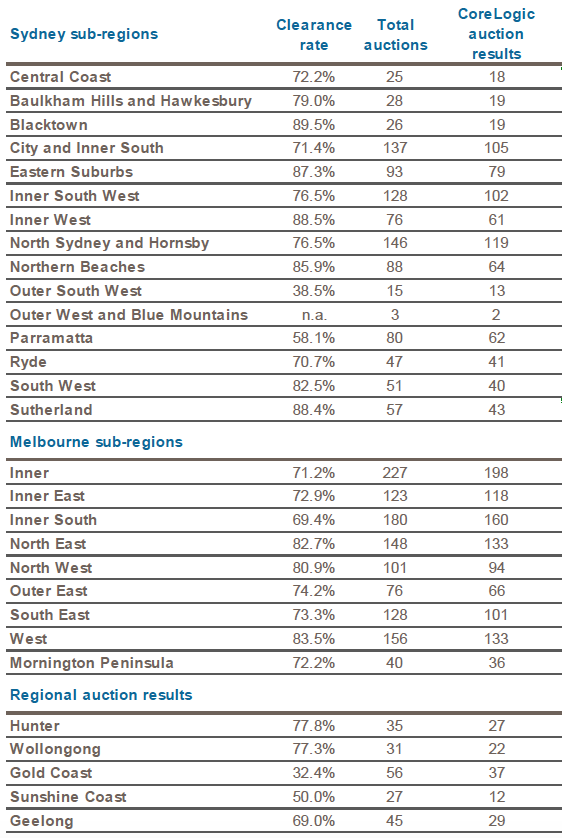

Clearance rates in the nation's largest auction markets rose. Melbourne achieved a clearance rate of 75.4 per cent, while Sydney's preliminary clearance rate was 77.5 per cent last week.

Source: CoreLogic.

Gil King, the CEO of the REIV, told SCHWARTZWILLIAMS that volumes and sales were up on the same period last year.

The city’s northern suburbs had the highest number of sales under the hammer, led by Preston with 15 sales and Craigieburn and Reservoir with 13 sales in each.

“Vendors in Melbourne’s north experienced strong results under the hammer this weekend with high auction sales in Preston, Craigieburn and Reservoir.

“Outer west suburbs Hoppers Crossing and Werribee recorded 100 per cent clearance rates this weekend, from 10 and nine auctions respectively," said King.

King said the last two weeks of June are lining up to see bumper volumes go under the hammer.

“The upcoming long weekend will see auction volumes reduce significantly before the market bounces back with two consecutive Super Saturdays before the end of June," he said.

Source: CoreLogic.

John Cunningham, president of the REINSW, told SCHWARTZWILLIAMS, the market was strong, despite first-home buyers holding off until 1 July to take advantage of new stamp duty concessions.

"Despite the expected delaying tactics by the sub $800,000 first-home buyers waiting until 1 July to make their moves to take advantage of the new stamp duty concessions, the market behaved very strongly on the weekend," he said.

"Clearance rates jumped up again above 75%," he said.

Cunningham said the market is entering a more stable "plateau" phase.

"Reports from both auctioneers and agents indicate that, despite a clear stabilising of the market, there were plenty of sales prior to auction and ample bidders on auction day. Anecdotal evidence is showing many sales are either selling just below reserve price or just creeping over reserves, showing the market is not slowing down but just adapting to the plateau phase."

Cunningham said top properties, as usual, were attracting top dollar.

"There were, of course, the usual highly sought after properties that smashed their reserve prices, and this is why we will not see the market go into decline due to the underlying high demand and short supply," he said.

Scott Kennedy-Green, chief auctioneer for McGrath, told SCHWARTZWILLIAMS that the auction market is still strong, and that McGrath has seen auction records fall throughout the year.

"Solid pre-Easter and holiday results saw the largest weekend on record for the McGrath network on 8 April with 243 auctions scheduled, of which the Sydney Metro region achieved a clearance rate of 81 per cent from 172 auctions," he said.

And things aren't slowing down, he said.

“Following on from these healthy clearance rates, we are seeing a steady increase in overall listing numbers for the winter months," said Kennedy-Green.

In June, McGrath took 584 auctions to market, with 381 in the Sydney metropolitan region.

Last weekend, McGrath had 113 properties scheduled for auction, and achieved a clearance rate of 71 per cent. Demand was strong across the city. Sydney’s eastern suburbs remained active with a 75 per cent clearance from 20 properties, the Lower North Shore saw a 78 per cent clearance from 23 properties, while the North West saw a 70% clearance from 20 properties.

"The overall feeling is that while this market cycle is close to its peak in some areas and price brackets, there have been some standout results that demonstrate buyer demand remains robust," said Kennedy-Green.

Kennedy-Green pointed to 3 Wood Street, Waverton, selling for $3,010,000 through agent Donovan Murphy as a standout result.

“Vendors are continuing to capitalise on this demand whilst sentiment remains consistent," he said.

Kennedy-Green said "now through to the spring selling season will be as good a time as any to consider buying or selling, keeping in mind that the key to success in Australian real estate is to take a long-term view where possible."

Read more about the real estate auction market:

Auction volumes up, clearance rates hold steady