Tasmania market hits 13-year high: REIT

Contact

Tasmania market hits 13-year high: REIT

In the first three months of 2017, the Tasmanian real estate market recorded its highest number of sales since 2004, according to new data from the REIT.

Real Estate Institute of Tasmania's March quarterly results confirm that over the first 3 months of 2017 the Tasmanian real estate market has continued to strengthen. The state recorded its highest number of sales since 2004.

Over the period, there were 2,886 sales amounting to a total of $955,721,525, a 29.6 per cent increase on the same time last year.

Launceston outperformed all other regions. The city recorded 440 sales, an increase of 34.6% over last year. Launceston was the only region to record a decrease in median sale price but this came about as a result of more than 60% of its transactions occurring at the mid to lower end of the market.

Hobart sales increased 20.2%, and the North West 20.9%.

REIT President, Tony Collidge said, “Everything had pointed towards the March quarter being one of the most active we have seen for some time. I believe this market still has a way to run. What is pleasing is that increased levels of activity appear to be finally spreading state wide with all regions participating in the improved market conditions. Launceston was a stand out performer."

Significant movement in unit/townhouse sales was also a highlight of the quarter that recorded its highest number of transactions (385 sales) for many years. Unit/townhouse transactions were up 27% in Hobart, 22% in Launceston and 4% on the North West Coast.

Twenty five sales above $1 million were recorded during the period: 23 of these were in Hobart, and two were in Launceston.

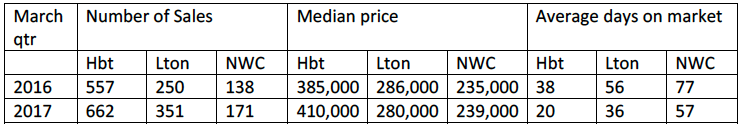

The table below shows the changes in the market during the March quarter over the past 12 months.

Source: REIT.

First home buyers are finding it increasingly difficult to get into the market. Most are looking to buy established dwellings that are not eligible for Government Assistance (First Home Buyers Grant) and have to compete against investors to secure a home.

First home buyers represented just 11.0 % of sales for the quarter, a 15.4% decrease on the same period last year.

State Revenue Office figures show that in 2013/14 financial year, the state government paid out 2,560 FHB Grants worth $25,126,000. For the first eight months of 2016/17, the office has paid just 310 FHB Grants amounting to only $6,051,000.

Tasmania’s rental market continues to offer strong investment returns on the back of high demand and historically low vacancy rates. Investor activity grew by 50% over the same time last year increasing from 14% of total sales in 2016 to 21% in the March quarter.

In Launceston, 32% of sales were made to investors, 26% on the North West Coast, and 23% in Hobart.

Interstate buyers acquired 214 rental properties during the quarter at a median price of $260,000. Interstate buyers grew from 16% of all sales in 2016 to 22% over the March 2017 quarterly period.

Foreign buyers have had little impact on our residential market making only 12 purchases (less than 1%) in the quarter.

REIT research revealed that interstate buyers acquired 465 properties during the quarter. Of these, 214 were for investment purposes and the remaining 251 were for people moving here to live.

On a municipal basis

- Launceston Municipality recorded the highest number of sales (393) up 44% on last year at an accumulated value of $120,821,027;

- Hobart up 36% with 290 sales worth $167,335,543;

- Clarence up 24% with 285 sales worth $116,471,588;

- Glenorchy up 59% with 273 sales worth $81,767,931 and

- Kingborough up 16% with 189 sales worth $80,316,094.

Collidge said, "There continues to be a dire shortage of properties for sale and for rent that is placing real pressure on our markets."

He said he expects the market will remain strong in the medium term. "The last boom had a lifespan of 9 years and we only appear to be 3 years into this new cycle. The rapid improvement in our economic conditions has brought many benefits to this state but it has also created unforeseen situations that are proving difficult to resolve; in particular the market's inability to meet buyer and renter demand."

Collidge said there are opportunities for increased levels of private investment into the housing sector. "I firmly believe that the climate is right to attract increased development, particularly with infill housing, into our marketplaces.”

Read more about Tasmania:

Tasmanian real estate on a high

Hobart leads price gains, but is still the nation's most affordable city