Rental market strong: SQM Research

Contact

Rental market strong: SQM Research

Vacancy rates fell and rents rose around the country in January, particularly in mining towns, according to new data from SQM Research.

Increased housing supply does not appear to be dampening rents or vacancy rates, even in Sydney and Melbourne where construction has been strongest, according to the latest data from SQM Research.

Rents continued to rise at about 2.0 per cent per annum across the nation, with variability reflecting the strength of different markets.

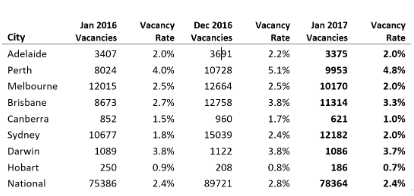

Source: SQM Research.

Residential vacancy rates were lower around the country in January 2017, with 78,364 rental homes vacant and available for rent, making a national vacancy rate of 2.4 per cent, according to SQM Research. The January vacancy rate was a significant decline on the 2.8 per cent recorded in December.

All capital cities recorded falls in January.

Sydney's vacancy rate fell to 2.0 per cent from 2.4 per cent in December, and Melbourne's vacancy rate fell to 2.0 per cent from 2.5 per cent. The declines in vacancy rates could push rents higher in both cities, according to SQM Research.

Perth continued to record the highest vacancy rate for any capital city in January, recording a rate of 4.8 per cent, down from 5.1 per cent.

Hobart's rental market is extremely tight, with a vacancy rate of a mere 0.7 per cent. Launceston's market is also tight, with a rate of 1.6 per cent.

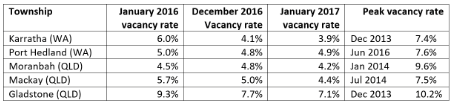

Source: SQM Research.

Rental market conditions continued to improve in mining towns, suggesting the housing correction could be coming to an end.

Source: SQM Research.

See also:

Mining town Karratha has turned the corner

Low numbers of property listings likely to keep prices high for now