Australia ranked second in Global RE Transparency Index

Contact

Australia ranked second in Global RE Transparency Index

Foreign investors accounted for a record 42% of investment into Australian commercial property in 2015.

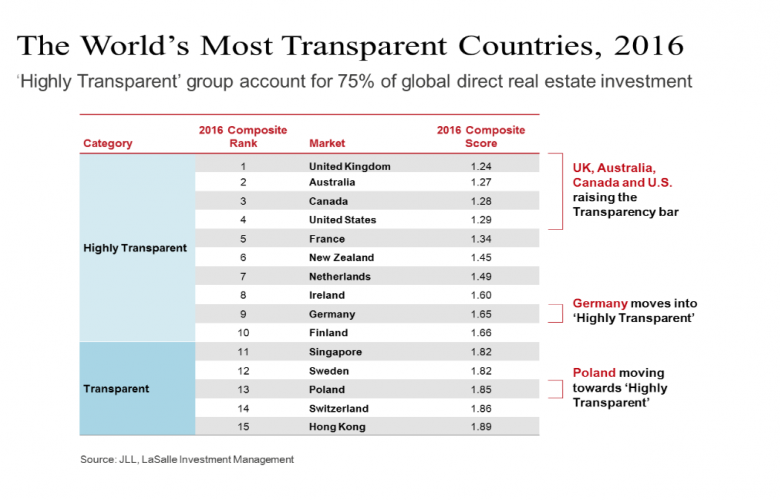

Australia has ranked second in the world for real estate market transparency in the JLL Global Real Estate Transparency Index 2016, up from third place in 2014. JLL’s ninth Global Real Estate Transparency Index covers 109 markets worldwide, and shows continued progress in the transparency of commercial real estate around the world.

JLL says transparency is very high in Australia because we have a strong legal framework to define and protect property rights and an open and established bidding process.

Australia continues to hold the top spot as Asia Pacific’s most transparent real estate market, while New Zealand ranks second in the region. Globally, the United Kingdom ranks first, followed by Australia second, Canada third and the United States fourth.

The Index, compiled every two years, measures transparency by looking at factors including market data availability, governance, transaction processes, property rights, and the regulatory and legal environment.

"As capital allocations to real estate grow, investors are demanding further improvements in transparency. Technology is allowing a more forensic assessment of real estate market patterns, allowing for greater analysis of transparency levels across markets while the rapid growth of cross-border investment means that investors place a big premium on accurate and timely information," said JLL’s Head of Australasian Research, Dr. David Rees.

There has been a steady improvement in market transparency over the twelve years since the Index was lunched, JLL reports, with progress in Taiwan, South Korea, Indonesia and Japan within the Asia Pacific region.

Rees says Australia's market has a long history of transactional and time series data/information across all the major metrics, and data is easily accessible to most participants. "In addition, governance and the regulatory environment are high by international standards. Improvements in the coverage of alternative property sectors, such as student housing, contributed to the improvement in Australia’s ranking in this year’s survey," he said.

Record foreign investment was recorded into Australian commercial property in 2015, with offshore investors accounting for 42% of total transaction volumes. This is around double the ten year annual average.

Read more: