McGrath floats

Contact

McGrath floats

McGrath has today lodged a prospectus with ASIC in relation to listing on the ASX.

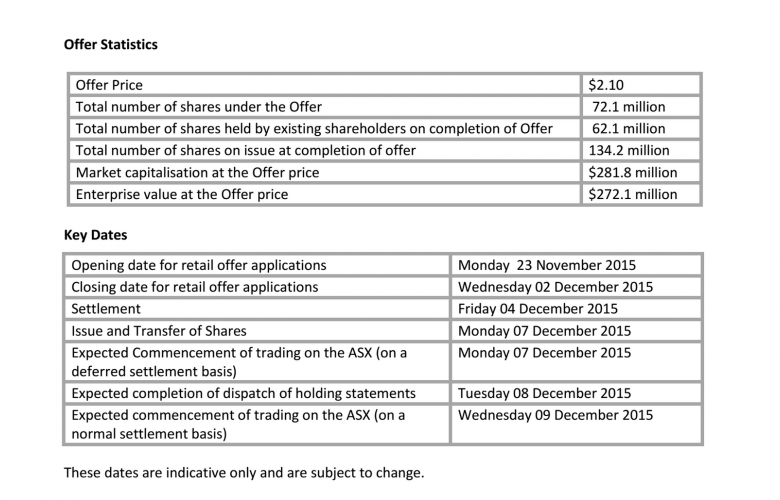

The real estate empire started by John McGrath in 1988, McGrath Holding Company Limited, has today lodged a prospectus with the Australian Securities and Investment Commission to list on the Australian Securities Exchange. The company will have a market capitalisation of $281.8 million, based on 134.2 million shares at an offer price of $2.10 per share. Retail applications will open on November 23 and close on December 2, with settlement scheduled for December 4. McGrath is inviting investors to subscribe for 61.7 million shares. McGrath operates a diverse business model consisting of five business units covering residential property sales, property management, franchise services, mortgage broking, auction services and real estate training. McGrath generates revenue primarily through commissions and franchise fees. Once the acquisition of McGrath’s largest franchisee, the Smollen Group, is complete, the firm will have 22 Company Owned Offices and 53 Franchise Offices. As a whole, the McGrath Network was responsible for sales turnover of approximately $11.6 billion in FY2015 from approximately 11,000 sales and manages approximately 21,900 properties valued at over $16.2 billion. Its mortgage broking business, Oxygen Home Loans, has total loans under management of approximately $2.0 billion. “John McGrath has methodically and successfully built this business from a one man operation into one of the leading residential real estate providers in Australia," said McGrath Chairman David Mackay. “I started this business with a vision of building a world class residential real estate business and an IPO is an important step in that direction," said founder and Chief Executive Officer John McGrath. "Today our footprint spans Sydney, regional NSW, the ACT, South East Queensland and regional Queensland. However our plans are much more expansive, with immediate plans to enter Victoria, focusing initially on select key Melbourne suburbs, as well as expanding further in our existing markets." The company will be renamed McGrath Limited and existing Shareholders will own approximately 46.3 percent of McGrath, of which John McGrath will remain McGrath’s largest shareholder with a holding of 27 percent. Luminis Partners is advising the McGrath Board on the IPO, and Bell Potter and JP Morgan are Joint Lead Managers. Legal advice is being provided by Allen and Overy.