Queensland projects could power property market

Contact

Queensland projects could power property market

An unprecedented level of major projects in the pipeline has the potential to produce significant growth in Queensland property markets.

An unprecedented level of major projects in the pipeline has the potential to produce significant growth in Queensland property markets, although there are some unanswered questions with a new government now in office.

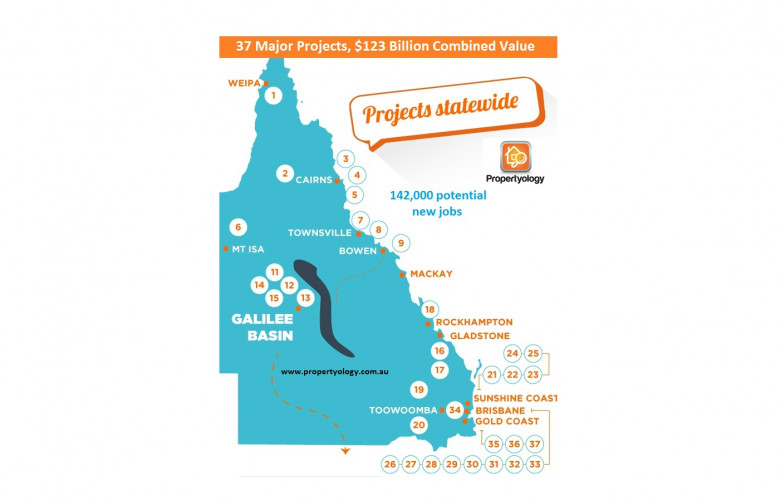

According to Propertyology’s research, there are thirty seven major infrastructure projects with a combined project value of a staggering $123 billion. If they were all to proceed they would create 142,900 new direct jobs. There’s been a lot of hype over the last couple of years about the end of the mining construction boom and very little else coming through Australia’s infrastructure pipeline. What has been unfolding behind the scenes in Queensland is quite exciting although few people realise it. I doubt whether any state at any time in Australia’s history has ever had such a big pipeline of projects.

Throughout 2014 there were a lot of approvals of major projects along with various new proposals. Queensland’s jobs growth trend began to show green shoots. By the back end of 2014, Propertyology had become quite bullish in regards to property market outlooks throughout parts of the state.

We place a heavy emphasis on job growth potential with our property market forecasting because wherever there is a new job, there is demand for accommodation.

Official statistics from Australian Bureau of Statistics shows that Queensland created a total of 11,048 new jobs over the entire last three full calendar years. This puts the 142,900 job potential from Queensland’s project pipeline in to perspective. Jobs growth has been the biggest driver of Sydney’s remarkable property boom over the last two years. The evidence is in the ABS data. Australia created an additional 134,408 jobs in 2014. 52,975 of these were in Sydney.

Propertyology flags Brisbane, Gold Coast, Toowoomba, and Cairns as property markets with very promising outlooks. The Abbott Point expansion at Bowen and rail infrastructure must be built in order to open up the biggest coal province in the world, Galilee Basin. High rollers such as Indian billionaires Adani and GVK, Gina Rinehart, Clive Palmer, and Chinese miner Macmines collectively have projects in the pipeline worth $53 billion.

Over the last two years, the city of Mackay has struggled under falling coal prices and property over-supply. But Mackay was placed back on Propertyology’s radar due to the potential 31,500 direct jobs which would be created if the Galilee Basin was officially opened up. Brisbane will benefit from the thousands of CBD administration new jobs that will be created. To a lesser extent, Townsville’s property market would also benefit through the supply of goods and services at the coal face and at Abbott Point.

During the January state election campaign, the Queensland Labor government made it known that they were opposed to expanding port facilities, even though, under former Premier Anna Bligh, Labor had initially approved the port expansion before the Newman government scaled it back to a more sustainable size. In May, Labor flagged a new proposal for the port dredging. The new government has officially scrapped the $5.2 billion BaT Brisbane transport infrastructure project. The $3 billion Queens Wharf project – comparable in size and quality to the new Barangaroo precinct in Sydney and the Crown Casino precinct in Melbourne – was approved in July.

Propertyology is still investing in Brisbane however we now place a couple of other locations ahead of Brisbane. The 18,000 extra jobs from the BaT project would have been very positive for Brisbane so too would have been the Herston medical precinct proposed by the Newman government. Job creation prospects in Brisbane are sound however they wont reach Sydney and Melbourne proportions in the near term. The Gold Coast property market has been described by Propertyology as having potential to be the best performing market in Australia over the next two years. When the Gold Coast Mayor first made mention that the proposed $7.5 billion ASF Resort project had potential for as many as 35,000 new (direct and indirect) jobs our ears certainly pricked up. Upon being elected in to office, the new state government has scrapped the project although they have since softened and a revised project is now back on the cards. There’s already a lot of job creating infrastructure projects under way on the Gold Coast.

And our outlook for the Australian tourism industry is off the Richter scale. Despite several major projects being declared ‘dead’ or doubtful’ over recent months, the job creation potential from within the long list of ‘likely to proceed’ projects is still very exciting. Queensland property markets have suffered over recent times from low confidence after the infamous 2011 floods, falling coal prices, and cut backs in the public sector. Pre-GFC, Queensland had previously created around 60,000 new jobs each year however there was actually a net loss of jobs in 2012 and 2013.

This article was written by Simon Pressley, Managing Director of Propertyology.