A bank vs non-bank case study

Contact

HoldenCAPITAL is a specialist construction finance group, and is recognized as a market leader in deal structuring, and sourcing debt and equity solutions. Packages are carefully tailored through a consultative approach to each client’s financial position and risk appetite.

HoldenCAPITAL delivered $224 million of debt and equity loans in the 2015 financial year. While 64% of this volume was with the major banks, most of the balance was HoldenCAPITAL’s own construction loan product. A number of loans were also provided through HoldenCAPITAL’S QSI equity fund.

The case study

With interest rates at historic lows, the property market is booming. With record numbers of projects coming on line, there is strong competition for project funding. Conditions are ripe for alternative approaches. While most construction debt is still sourced from the major banks, the following case study, prepared by HoldenCAPITAL, examines a situation where returns are significantly boosted by non-bank funding. In this case study we look at a project’s specific requirements and market conditions, to determine the best funding choice.

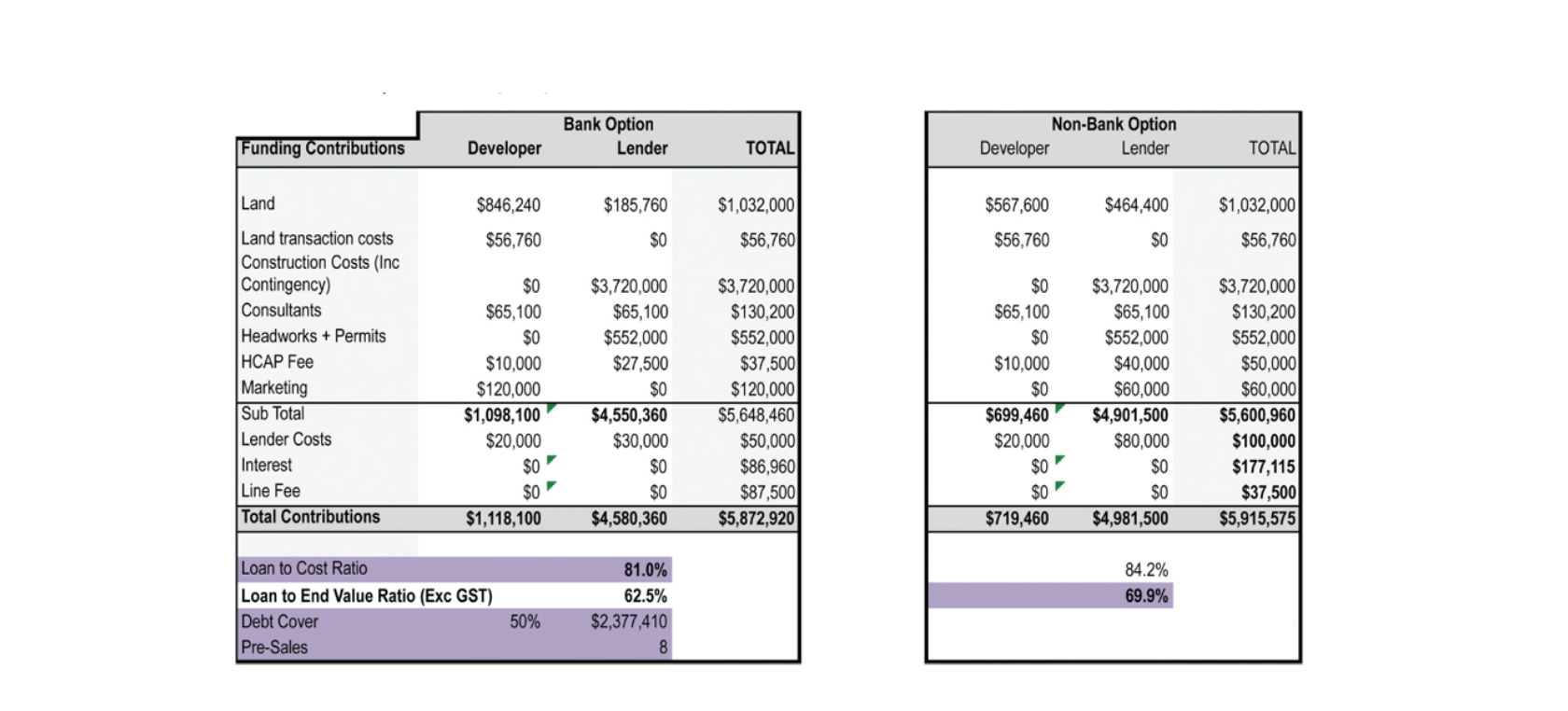

Both the bank and the non-bank lender have a Loan to Valuation Ratio of 65%.

But notice that the Loan to Total Development Cost Ratio for the bank is 80%. There is no such limit for the non-bank loan.

A major consideration is that banks generally require 75 - 100% debt cover by way of pre-sales. Non-bank loans have no pre-sales requirements.

Because of the difference in the Loan to Development Cost ratio, the developer would be able to borrow more by choosing the non-bank option. The equity requirement for the non-bank loan of $603,240 is significantly lower than the $1.1 million equity requirement for the bank loan.

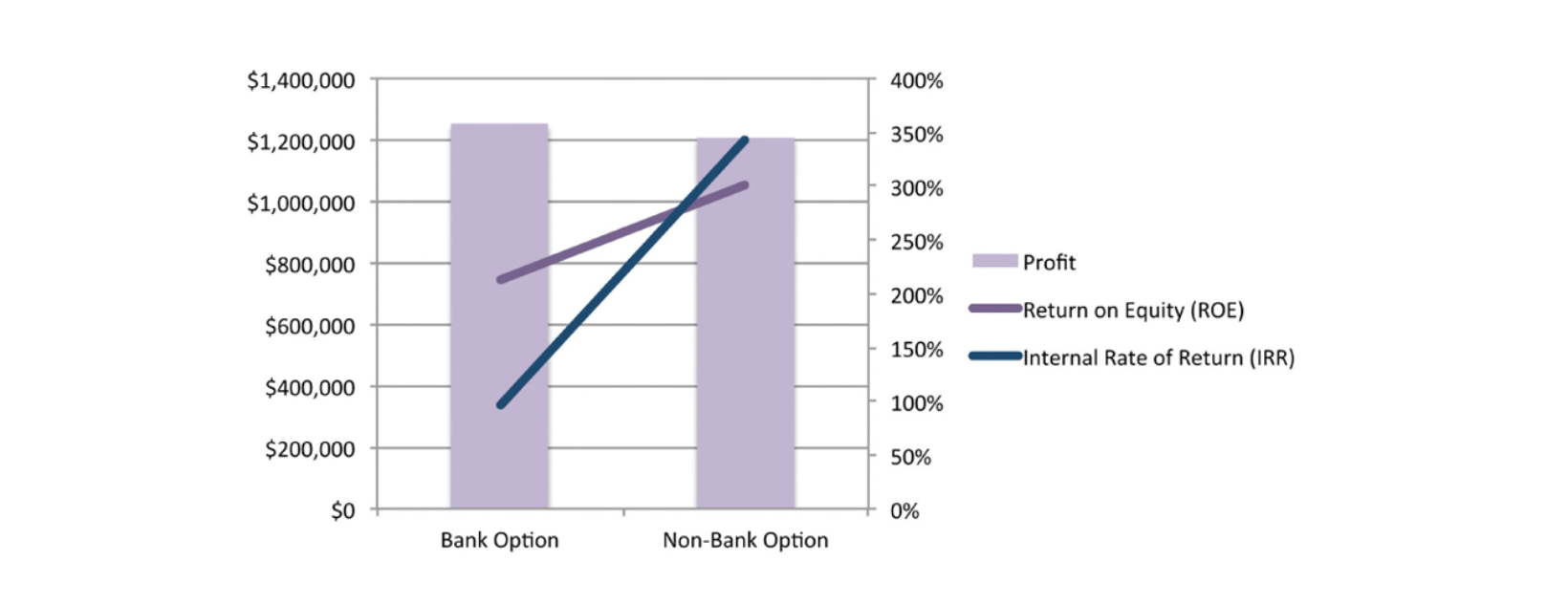

Rates of Return

The internal rate of return on a project is the annualized effective compounded return rate. It is commonly used to evaluate projects, and provide a return that can be compared to the annual cost of capital.

The above chart shows that, because of the lower requirement for equity, the non-bank option delivers a significantly higher return on equity. And the internal rate of return is more than double that delivered by the bank option.

Managing project timing

The non-bank option doesn’t require the three to six-month delay associated with the pre-sales requirement. Therefore, the non-bank option could allow the project to be completed more quickly. A shorter time frame can reduce the possibility of a change in market conditions, which could impact a project’s viability.

Summary

While every project has its own risks and merits, the case study provides a realistic summary of some of the differences between bank and non-bank funding.