The outlook for Adelaide

Contact

The outlook for Adelaide

While some of Adelaide’s fundamentals are solid a big question mark hangs over an important industry sector, writes Simon Pressley.

The average annual growth in median property values in Adelaide over the past 15 years has been 8.1% for houses and 8.3% for apartments, which compares to Australia’s capital city average of 8.4% and 7.6% respectively. The best performing Adelaide areas over the last 15 years were Port Adelaide Enfield (9.2%), Salisbury (9.0%), Campbelltown (8.8%), Marion (8.8%), Onkaparinga and Playford (both 8.5%).

With median house and apartment values of $533,000 and $333,000 respectively, accommodation in Adelaide is the second most affordable of all Australian capital cities after Hobart. This low entry price and the controlled rates of new housing supply meet two important investment fundamentals.

As strange as this may sound, the opening of the redeveloped Adelaide Oval in early 2014 played a significant role in creating an ‘energy’ which has improved Adelaide’s general sentiment. Fundamentals like these plus a low interest rate environment has been the catalyst for growth in 2014 median property values of 6.1% (houses) and 4.0% (apartments). Adelaide’s 1.22 million people represents 72% of the entire state’s population. There are approximately 530,000 dwellings in Greater-Adelaide.

The future for Adelaide’s property market rests in the fate of its economy. South Australia’s key industries are manufacturing, agriculture, mining, and tourism. It also has a significant representation of defence force personnel.

Significant concerns beckon for manufacturing in the state. According to a report produced by University of Adelaide, 24,000 jobs will be lost in South Australia as a result of closures of car manufacturing plants by Ford (2016), Holden and Toyota (both 2017). A cloud also hangs over the careers of thousands of employees at Defence Material Organisation (DMO) and Australian Submarine Corporation (ASC) which play a major role in the manufacturing and maintenance of Australia’s military fleet.

A federal government white paper on Australia’s defence force published in 2011 flagged unprecedented levels of investment in military fleet expansion plus an increase in personnel; Adelaide was to be the primary beneficiary. Subsequent federal budget pressures and Australia’s obvious inability to compete on price with international manufacturers of equipment such as submarines means that neither of these bold targets would come close to being realised.

A significant economic boost is needed to increase demand for goods and services in South Australia. While there is an abundance of opportunities to leverage its agriculture and tourism industries off the Asian Century there is nothing tangible at present to suggest that prosperity is just around the corner.

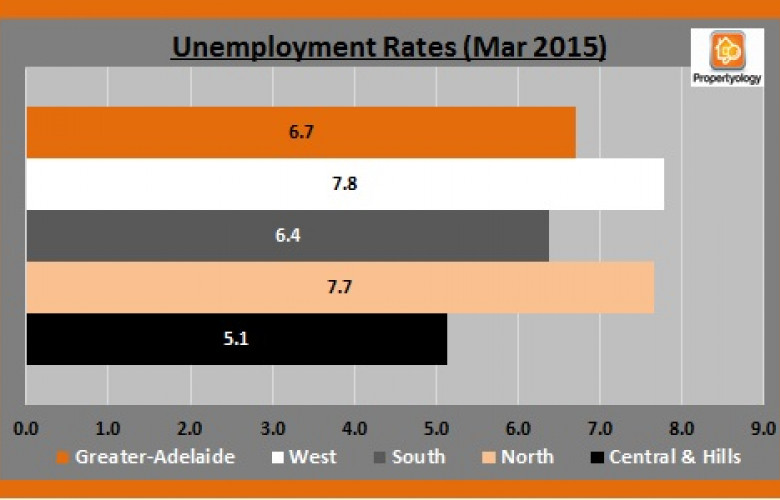

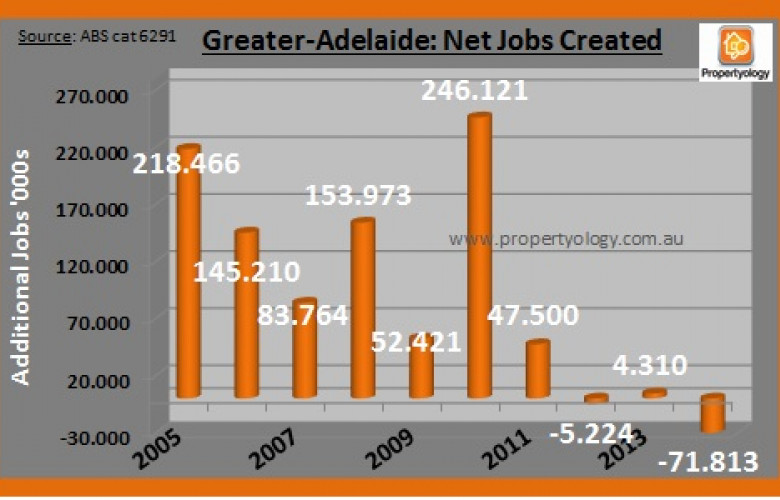

South Australia’s unemployment figures have consistently been trending above the national average for some time. The job creation data for Greater-Adelaide contrasts the impressive 246,121 jobs created in 2011 to a net jobs loss of 71,813 in 2014. The north and west of Adelaide have the highest unemployment rates. Adelaide’s largest infrastructure project is the $2.1 billion Royal Adelaide Hospital. Once completed in 2016, an estimated 14,000 people will occupy the new medical precinct and adjoining university in the north-west corner of the CBD.

The $1.5 billion Adelaide Riverbank project is likely to commence in 2016. This major urban renewal project will further position the inner-north as a world class entertainment precinct with an expanded Festival Centre, an upgrade of Adelaide’s casino, new hotel, restaurants, and parking.

The only other large project is the $1 billion expansion of the Adelaide Airport. In January 2015, the federal government signed off on funding for the project which includes increased terminal capacity, a 250-room hotel, and office complexes. 8,500 people already work in the airport precinct (the state’s largest employer); the expansion is expected to increase this to 17,500 by 2020.

Aside from these major infrastructure projects, the only thing currently on the horizon to stimulate Adelaide’s economy is the possible expansion of the Olympic Dam mine. Only time will tell whether BHP, the world’s biggest mining company, will finally bite the bullet after 30 years of planning and give the green light to the Olympic Dam mining expansion to create the World’s biggest mine. If this ever did occur there is potential for more than 10,000 new jobs to be based in Adelaide, directly working for BHP and indirectly providing support services.

The long term subdued nature of Adelaide’s economy is directly reflected in South Australia’s modest population growth figures – an average of 1.0 % per annum over the last decade compared to a 1.7% national average.

When Propertyology zoomed the microscope in for a closer look at population figures of the eighteen (18) individual LGA’s which make up Greater-Adelaide, it became apparent that the highest growth is in the LGA of Adelaide City (3.8%).

Building approval data also shows that the extra demand for accommodation in Adelaide City is being adequately supplied by a big spike in apartments (1,306 apartments approved during the eight months from July 2014 to February 2015). Hindmarsh and Woodville are two other locations with a notable increase in apartment approvals. The next biggest increases in population growth have been further out in Playford LGA (2.2%), Port Adelaide (1.7%), Gawler (1.7%), and Salisbury (1.6%).

Population growth is one thing however, employment opportunities is the biggest piece of the property investment puzzle. 9,000 of the job losses from the car manufacturing sector will be to residents of the northern Adelaide LGAs of Salisbury, Playford, Tee Tree Gully, and Port Adelaide Enfield. Residents of the Onkaparinga LGA in the south of Adelaide are also expected to lose 3,000 jobs from the demise of the car manufacturing industry. The DMO and ASC defence force factories are located in the suburb of Osborne.

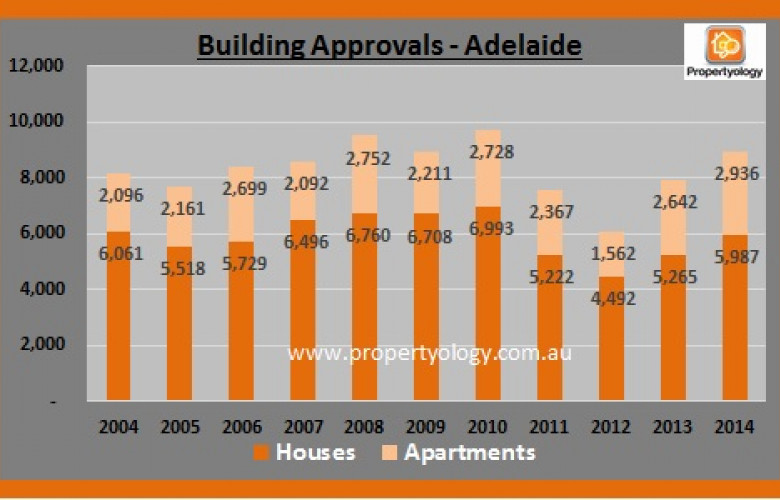

While Adelaide’s uninspiring economy is likely to continue to limit housing demand, building approval data shows that housing supply has been kept in check. There are approximately 530,000 existing dwellings in Greater-Adelaide. Generally speaking, between 6,000 and 8,000 new dwellings are approved each year. The highest volume of new housing stock are in Paradise, Gawler South, Craigmore, Davoren, Angle Vale, Enfield, Northgate, Windsor Gardens, Parafield Gardens, Salisbury North, Aldinga, and Seaford.

With housing affordability as the pillar of Adelaide’s property market, and provided housing supply remains in check, Propertyology expects the Adelaide market to produce steady growth again in 2015.

Unfortunately, the Adelaide market beyond 2016 looks somewhat gloomy. The pending challenges with Adelaide’s manufacturing sector are significant; government intervention is required. Propertyology’s current expectations is that employment opportunities are likely to significantly diminish and pressure on property values will go with it.

This article was written by Simon Pressley, Managing Director of Propertyology, a REIA Hall Of fame Inductee, property market analyst, accredited property investment adviser, and Buyer’s Agent. Propertyology works exclusively with property investors to purchase properties in strategically chosen locations all over Australia.