Bradley Beer

Contact

Bradley Beer

Bradley Beer is the Chief Executive Officer of BMT Tax Depreciation. He joined BMT in 1998 and, as such, he has substantial property investment knowledge supported by expertise in depreciation and the construction industry. Bradley is a regular keynote speaker and presenter covering depreciation services on television, radio, at conferences and exhibitions Australia-wide.

By This Author

Good news – new depreciation rules only apply to properties purchased after 9 May 2017.

BMT Tax Depreciation believes that many investors pursuing a strategy of ‘rentvesting’ may be leaving thousands of dollars of tax savings on the table by not using tax depreciation.

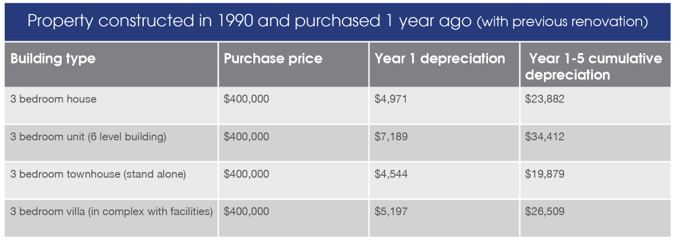

Investors often ask, "Which type of property will earn me greater deductions?"

Bradley Beer, CEO of BMT Tax Depreciation, lists the top five tax mistakes made by investors that can result in missing out on thousands of dollars in deductions each year.

Claim depreciation on outdoor structures and save.

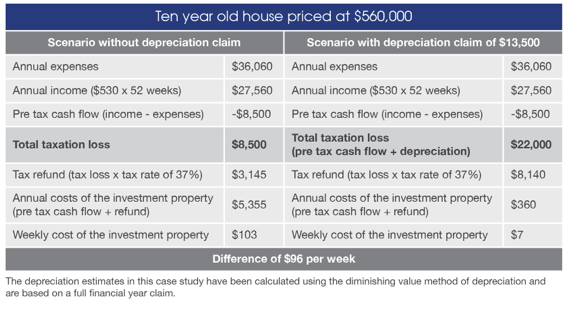

This could equate to an extra $50 per week in the investor’s pocket, showing the value of claiming depreciation correctly.

Outdoor areas in investment properties contain a number of structures and assets which are worth thousands of dollars for their owners. These items also experience wear and tear over time.

According to estimates provided by BMT Tax Depreciation, Dean and Shay’s penthouse apartment has the highest amount of depreciation deductions available, with a minimum of $62,735 that could be claimed in the first year and $1,621,688 over the specified lifetime of the property.

Tax deadline is looming. Property investors should take care to ensure deductions are claimed correctly.

Pages

Latest from our contributors

Williams Media Network

Williams Media Network

- The Business Page

Australia - The Business Conversation

Australia - The Hotel Page

Australia, New Zealand and South Pacific - The Hotel Conversation

Australia, New Zealand and South Pacific - The Real Estate Conversation

Australia - The Home Page

Australia - Luxury List

Australia - The Canberra Voice

Australia - The Industrialist

Australia - Gapura Bali

Indonesia - Gapura Jakarta

Indonesia - Mingalar Real Estate Conversation

Yangon, Myanmar - Recon jobs

Australia - RETalk Asia

Asia - RETalk Mena

Middle East and North Africa - RETalk Malaysia

Malaysia - REthink Tokyo

Japan - The ASEAN Developer

Association of Southeast Asian Nations - Exotiq

Thailand - Suay Phuket

Thailand - COMMO

Australia