Western Sydney hot with first-home buyers

Contact

Western Sydney hot with first-home buyers

The strongest uptake of the Berejiklian government's first-home buyer stamp duty assistance was in Western Sydney.

Terry Gordon, agent with Inglis Real Estate & Property Camden, told SCHWARTZWILLIAMS there is an "enormous amount of demand with first-home buyers for the new developments" in Sydney's west.

Gordon said first-home buyers are happy to purchase homes on smaller blocks of land.

"Younger people, to get into the market, are both working. They are happy to have a lawn they can cut with a pair of scissors," he said.

Prices have softened, but not to a worrying degree, said Gordon.

"Certainly the heat's gone out of the market. I don't think there's any great drop," he said.

"Badgery's Creek has created a lot of interest and will help with this area," he said.

"There was a lot of interest from investors, but the returns are going down a bit."

Gordon said that with share markets "skittish", returns in property could still be better than a share market investment.

Western Sydney sees strongest uptake of Berejiklian government's first-home buyer stamp duty assistance

Gordon's comments come as premier Gladys Berejiklian headed to western Sydney on Sunday to reveal first-home buyer numbers.

Berejiklian said that more than 19,000 people have bought their first homes since the NSW government introduced stamp duty concessions in July 2017. The number compared with 5,400 over the same period the previous year.

In Western Sydney, more than 7,200 first-home buyers saved on their stamp duty under the new scheme.

Western Sydney focused on direct sales; not a strong auction market

This week's auction clearance rate in Sydney was 68.7, down from the same period last year.

Despite strong demand for property in Western Sydney, the sub-region does not generally record high auction clearance rates. Auction is not the most common method of sale in Western Sydney, private treaty is.

The Eastern Suburbs (85.2 per cent), Northern Beaches (79.1 per cent) and Inner West (75.0 per cent) sub-regions had the highest clearance rates in Sydney last week.

“I made helping first homebuyers one of my first priorities as premier," said Berejiklian, "so I’m thrilled that our stamp duty reforms are driving real outcomes for people in NSW."

Last year, the NSW Government eliminated stamp duty for first homebuyers purchasing a new or existing property valued up to $650,000 and provided stamp duty savings for purchases of homes valued between $650,000 and $800,000.

The data revealed there was strong take‑up in regional NSW as well as the Greater Sydney area.

Regional towns with high numbers of first-home buyers saving on stamp duty include Gosford (316) and Wyong (224) on the Central Coast, and Wagga Wagga (251), Orange (230), Queanbeyan (222), Dubbo (182) and Wollongong (158).

REINSW president Leanne Pilkington told SCHWARTZWILLIAMS, "Compared to same time last year both numbers and clearance was down (80.7 per cent), but the results are consistent with what we were seeing towards the end of last year.

"We are expecting auction numbers to continue to increase for the next couple of weeks which will provide a better indication of what 2018 holds for the market," she said.

Melbourne auction market

REIV President Richard Simpson told SCHWARTZWILLIAMS, there were 457 auctions held last weekend with a preliminary clearance rate of 74 per cent.

Volumes were up considerably on the same period last year when only 248 auctions were held," he said.

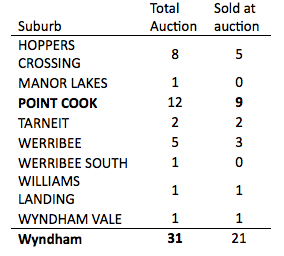

Wyndham was the top performing municipality last weekend with 31 auctions held and 21 sales under the hammer, according to the REIV.

Auction sales in Wyndham were boosted by Point Cook, where nine homes sold at auction – the highest of any suburb

“Melbourne’s outer ring accounted for the highest proportion of auction volumes and sales last weekend, with strong competition encouraging more vendors to sell their homes under the hammer.”

“Vendors in the outer suburbs experienced solid results at auction this weekend, with a preliminary clearance rate of 76 per cent recorded from 151 auctions.”

Read more about first-home buyers:

First-home buyer share of market keeps rising: REIA

Affordability is improving, and first-home buyers are back in the market